Market Data

January 17, 2017

New York Manufacturing Continues to Expand in January

Written by Sandy Williams

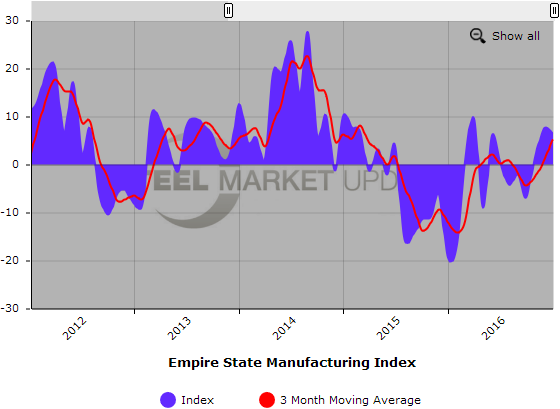

The January Empire State Manufacturing Survey in January declined -1.1 from December to 6.5. The general business index reading was positive for the third consecutive month indicating that business activity continues to expand in New York State.

New orders and shipments remained positive but fell by 7.3 and 1.3 points, respectively. Unfilled orders posted a reading of -1.7 up from -10.4 in December. The delivery time index rose to -2.5. Inventories had their first increase since mid-2015, climbing 16 points to 2.5 on the inventory index.

There was a faster increase in input and selling prices in January, with the indexes advancing by 14 points each. Employment indexes were negative this month for number of employees and average workweek.

Manufacturers expressed strong optimism for the next six months, unwavering from last month’s multiyear high of 49.7. Indexes indicated employment levels and average workweek length are expected to show strong growth in the coming months.

More firms expected to increase capital expenditures and technology spending in the next six months.

Below is a graph showing the history of the Empire State Manufacturing Index. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.