Prices

January 15, 2017

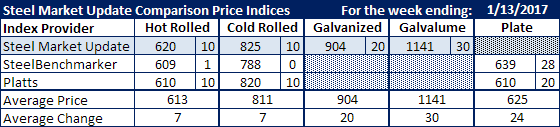

Comparison Price Indices: Steel Prices Moving Higher in New Year

Written by John Packard

Flat rolled steel and plate prices continued their march higher this past week based on the steel price indexes followed by Steel Market Update.

Benchmark hot rolled coil (HRC) which is the base thickness prior to extras being added, is working its way toward the latest “minimums” set out by ArcelorMittal in their recent price announcement earlier this month. ArcelorMittal called for HRC to be sold at a minimum of $640 per ton ($32.00/cwt). SMU index was up $10 per ton to $620 per ton while Platts (up $10) and SteelBenchmarker (up $1) were at, or closer to, $610 per ton.

Cold rolled has a much wider spread between SteelBenchmarker and the other two indexes. SteelBenchmarker, which only produces price averages twice per month, saw cold rolled as averaging $788 per ton this past week. Platts at $820 and SMU at $825 per ton saw the market average as being significantly higher.

Galvanized and Galvalume continue to be the strongest of the flat rolled products with .060” G90 GI up $20 and .0142” AZ50, Grade 80 AZ up $30.

Plate prices also rallied with Platts at $610 and SteelBenchmarker and $639 per ton.

SMU Note: Galvanized prices include $69 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.