Overseas

January 10, 2017

Chinese Weekly Steel Market Update

Written by John Packard

The following article was provided to Steel Market Update by Beijing Metal Import and Export Company, Ltd. out of China. It is their view of the Chinese steel markets for the week ending at Sunday, January 8th. After the article we will have some independent comments from another Asian steel trading source of ours who saw the note below. Note that SMU has taken the liberty to change some of the words to make the content easier to understand. We show those changes by using brackets [ ]:

Dear our valued friends and customers,

Good Day to you!

Please allow us to update China steel market (Jan 03 – Jan 08, 2017) as usual as following:

In the first week of 2016, China steel market still kept fluctuating up and down. In 5 working days Billets increased [by] RMB70/MT [and then] dropped total RMB50/MT in the weekend.

We reported to you that Shagang released new prices for the first ten days of Jan 2017 on Jan 01, all the prices of De-bar, Wire Rod was made unchanged again but HRC was increased by RMB200/MT (VAT included). Obviously the EXW prices of Billets/WR/De-bar is higher than spot prices. For example, EXW price of Shagang De-bar (HRB400 Ф16-25mm) is RMB3550/MT but spot price now only near RMB3100/MT, that’s the reason that spot market transaction was not active in the whole week.

Many countries already [have filed] anti-dumping actions on China steel, especially EU [which] nearly closed the door for all the China steels. China steel need to make a new ally, on the one hand, steel is a pillar industry for the Chinese economy, government can’t cut down too [much] production in order to keep economic growth + low down unemployment rate; on the other hand, China has to close some heavy polluting enterprises in order to get better weather. In the new year China steel prices will depend on how many tons to be cut down by China government, and RMB exchange rate is also a major factor. I still trust [we believe] market will not drop heavily before Chinese Spring Festival but please note Coke price already had a slight drop, until now only small mills decreased their prices, if main steel mills starts to low down [lower] EXW prices market will go down heavily, at least down to near spot level. Shagang/HBIS will release new prices for 2nd ten day of Jan, I will update you in next report next Monday.

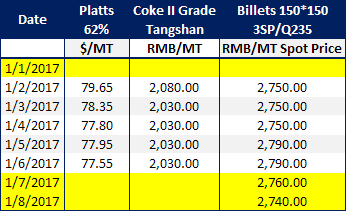

Below price details of Platts 62% index and spot Billets / Coke for your information:

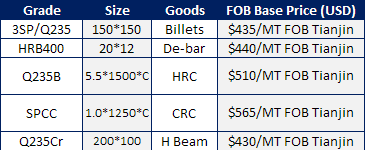

For export, below our offer TODAY just for your reference:

Another Asian trading source advise us with the following note on Monday evening:

This time the report is way off…

Billets are $30/MT lower than they reported. Debars [rebar] $20/MT lower. Others around $5-$10/MT lower.

Coking coal is the biggest gap yesterday at RMB1600/MT not 2050. That is a big difference.

Ore is OK, more or less…