Analysis

January 5, 2017

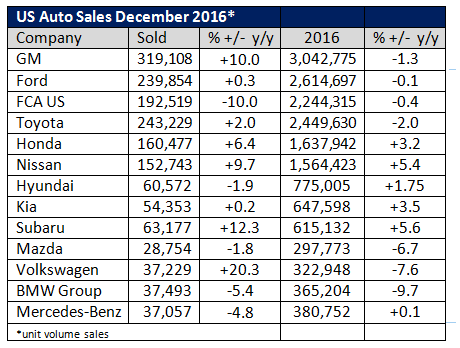

Another Record Year for US Automakers

Written by Sandy Williams

US automakers set a new record for annual sales with a total of 17.465 million light vehicles in 2016, a 0.4 percent increase from 2015’s record year, according to WardsAuto.

Sales in December reached 1.68 million units as consumers were attracted by manufacturer discounts. Incentives of 10 percent off sticker price were offered in December said JD Power, an average of $3,542 per vehicle.

Manufacturers indicate 2016 may have been the peak year for sales and 2017, although strong, will be more moderate.

“Key economic indicators, especially consumer confidence, continue to reflect optimism about the U.S. economy and strong customer demand continues to drive a very healthy U.S. auto industry,” said Mustafa Mohatarem, GM’s chief economist. “We believe the U.S. auto industry remains well-positioned for sales to continue at or near record levels in 2017.”

Political uncertainty looms for the industry as President-elect Trump vows to punish US automakers with a 35 percent tariff for vehicles produced in Mexico and exported to the U.S. On the other hand, if infrastructure spending takes off as expected, pickup truck sales could increase.