Market Data

January 5, 2017

2017 Begins with SMU Steel Buyers Sentiment Index at Record High

Written by John Packard

On a single data basis both our Current Steel Buyers Sentiment Index and Future Sentiment Index are at the record highs for our index. Current Sentiment, which is how buyers and sellers of flat rolled steel feel about their company’s ability to be successful in the existing market environment, came in at +71 this week. This is +1 point from what we saw in the middle of December 2015 and tied with the all-time highs set during mid-April 2015 and again at the beginning of July 2015. One year ago, Current Buyers Sentiment was +44. An explanation of our point system follows at the end of this article.

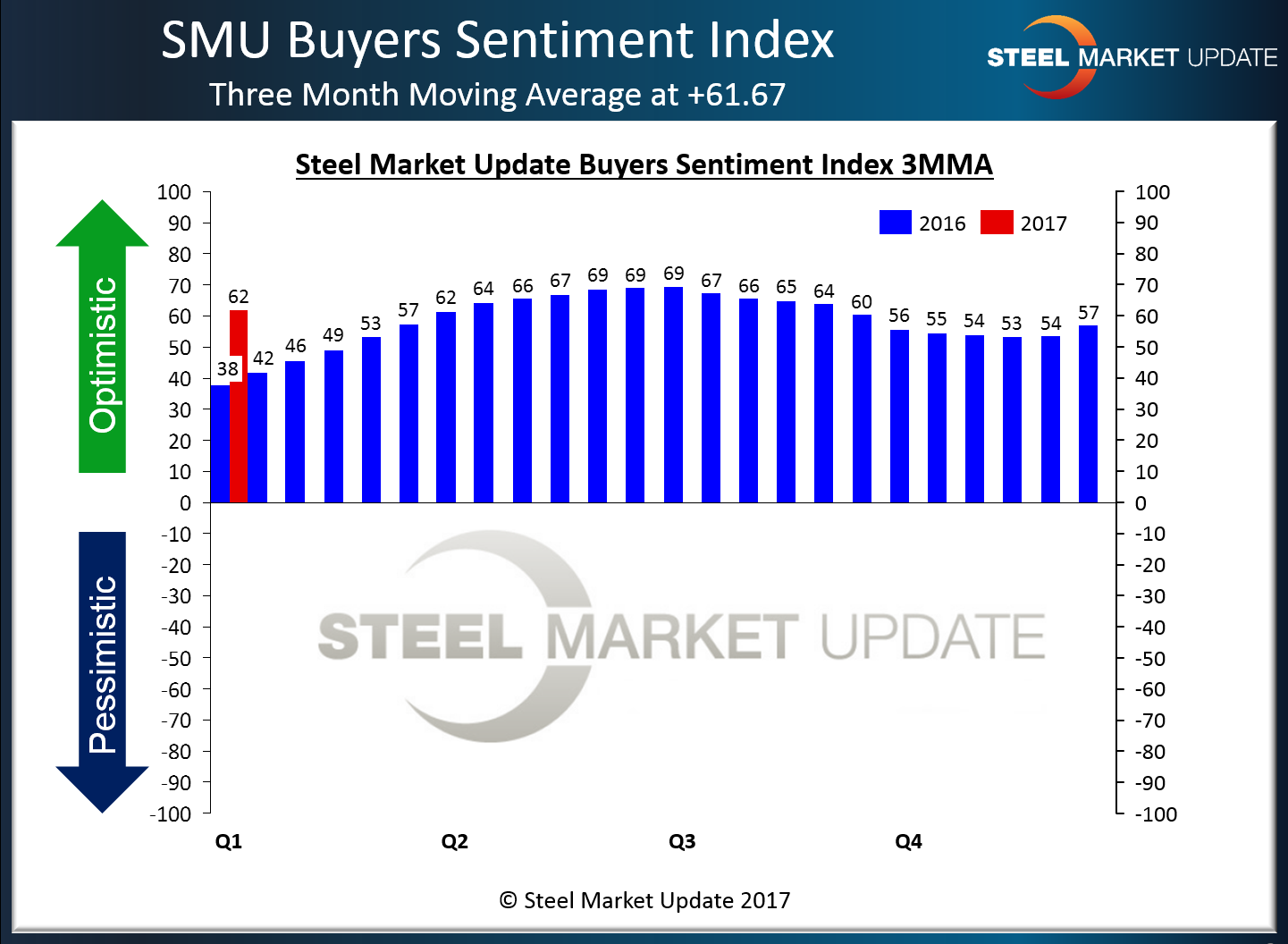

Looking at Current Sentiment from a three-month-moving average (3MMA), which is our preferred method of tracking the trend, Sentiment rose +4.67 to +61.67. The trend for a more optimistic buying and selling community is now two months old after peaking in early July and then tapering off from there.

Don’t get us wrong, Current Sentiment has been firming entrenched as being optimistic during calendar year 2015 and now at the start of 2017. The question has been the direction of the trend and then ultimately if new enthusiasm translates into better sales and/or profits for those involved in the industry.

Future Sentiment, which is how buyers and sellers of steel feel about their company’s ability to be successful looking three to six months out into the distance, is being reported as being +74 this week. This ties a record high set back in mid-July 2014. One year ago Future Sentiment was +61.

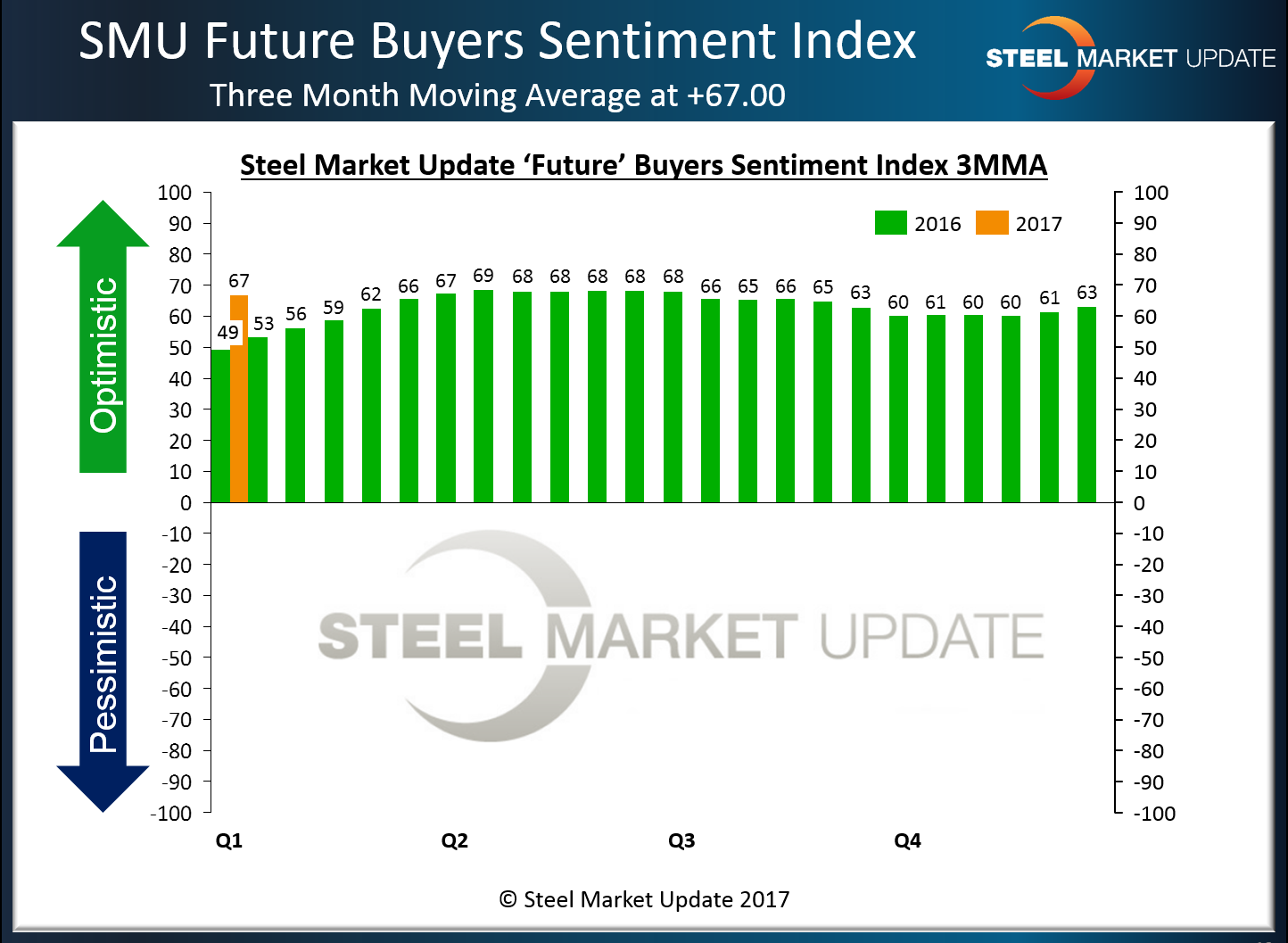

Looking at Future Sentiment from a three-month-moving average (3MMA) we found our average improving by +3.83 points to +67.00. The record high for Future Sentiment 3MMA was set in mid-April 2015 at +68.67 so we are not too far away. One year ago, our 3MMA was +49.33.

What Our Respondents are Saying

We invited 630 individuals representing more than 600 companies to participate in this week’s flat rolled steel market trends analysis. A number of our respondents left behind comments regarding their thoughts about either the existing or future of the flat rolled steel markets they are involved in. Here are some of their thoughts.

“We need a recovery in the oil and gas markets in 2017 for our business to return to the growth side.” Manufacturing company

“Still facing competition selling based on inventory cost and not replacement resulting in margin erosion.” Service center

“Price increases too much too fast making administration of orders and inventory a nightmare!” Service center who went on to say, “People are buying existing inventory/spot ahead of the big prices increases March April could be very slow months as customers have bought ahead!”

“Hot roll demand currently lacking in market, and that will negatively affect company success.” Service center

“Worry about strength of current market being sustainable.” Supplier to the Industry who went on to say, “They need to be careful they do not raise prices to the point where the steel purchasers market will limit purchases to supply definite orders for end user products. Lead times will be critical in this equation.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 42 percent were manufacturing and 43 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.