Prices

January 3, 2017

SMU Price Ranges & Indices: Gentlemen Start Your Engines

Written by John Packard

The engines are warming up and the expectation is for a better 2017 than 2016. The data we collected today was not significantly different than what we were seeing one week ago. Many mills are telling their customers they are on an “inquire only” basis when it comes to new spot orders. We are also hearing of mills advising their contract customers they need to book their February orders or they may lose their spot in February production.

The expectation has been for ferrous scrap prices to increase for the month of January. We have heard numbers bantered about ranging from +$20-$30 to as high as +$50 per gross ton. In SMU opinion, the higher scrap goes the more likely buyers will see larger increases than what have come out previously. Of course steel buyers are protesting and hoping that the steel mills will slow the pace of the increases so the buyers have more time to absorb the new numbers into their inventories and have a better chance of being able to pass the increases along to their customers.

In any case the engines are warming up as the cars head for the starting line.

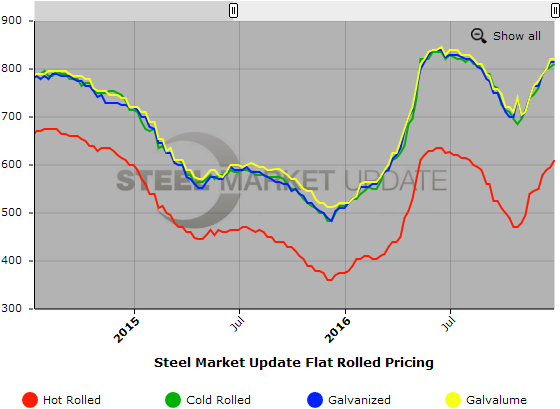

Here is how we see prices this the first week of January 2017:

Hot Rolled Coil: SMU Range is $590-$630 per ton ($29.50/cwt-$31.50/cwt) with an average of $610 per ton ($30.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago while the upper end increased $10 per ton. Our overall average is unchanged compared to last week. Our price momentum on hot rolled steel continues to be pointing toward Higher which means that prices are expected to move up over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU Range is $800-$830 per ton ($40.00/cwt-$41.50/cwt) with an average of $815 per ton ($40.75/cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged over last week while the upper end increased $10 per ton. Our overall average is up $5 per ton over one week ago. Our price momentum on cold rolled steel continues to point toward Higher which means that prices are expected to move up over the next 30-60 days.

Cold Rolled Lead Times: 4-10 weeks

Galvanized Coil: SMU Base Price Range is $40.00/cwt-$41.50/cwt ($800-$830 per ton) with an average of $40.75/cwt ($815 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago while the upper end decreased $10 per ton. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel continues to point Higher which means that prices are expected to move up over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU Range is $869-$899 per net ton with an average of $884 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks

Galvalume Coil: SMU Base Price Range is $40.00/cwt-$42.00/cwt ($800-$840 per ton) with an average of $41.00/cwt ($820 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged over one week ago. Our price momentum on Galvalume steel continues to point Higher which means that prices are expected to move up over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1091-$1131 per net ton with an average of $1111 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-12 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.