Market Data

December 27, 2016

SMU Survey Respondents: Steel Mills Have Upper Hand in Spot Negotiations

Written by John Packard

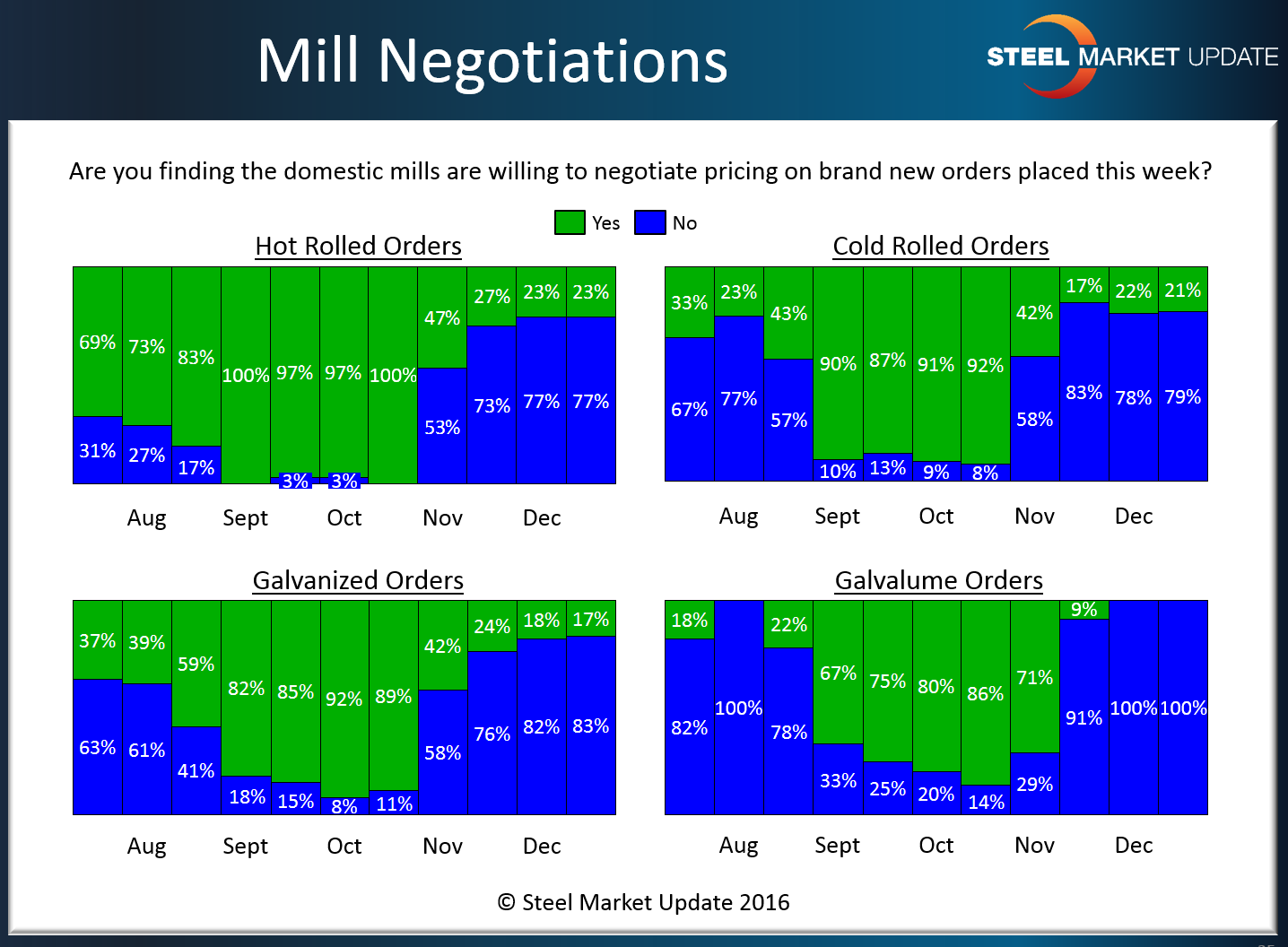

There was little movement in the positions of the domestic steel makers when it came to their willingness to negotiate spot flat rolled steel prices this past week. Respondents to our final flat rolled steel market trends survey reported the steel mills as taking strong stances when it came to negotiating spot pricing on hot rolled, cold rolled, galvanized and Galvalume steels.

Our respondents remained firmly entrenched regarding hot rolled price negotiations with only 23 percent of our respondents reported the mills as willing to negotiate. This is unchanged from the beginning of the month and a long way away from the 47 percent reporting the mills as willing to negotiate HRC spot prices back in early November.

Like hot rolled, cold rolled also remained ensconced at 21 percent reporting the mills as willing to negotiate CRC spot prices. At the beginning of November, 42 percent of our survey respondents were reporting the mills as willing to negotiate CRC spot pricing.

Galvanized remained a tight product with little price movement as only 17 percent of our respondents reported GI spot prices as negotiable at the steel mills this past week. At the beginning of November, 42 percent of our respondents were reporting the domestic mills as willing to negotiate GI spot pricing.

All of the respondents to our survey reported Galvalume as one product where not one mill was negotiating spot prices. This is a far cry from the 71 percent of our respondents who were reporting the domestic mills as willing to negotiate AZ prices at the beginning of November.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.