Market Data

December 22, 2016

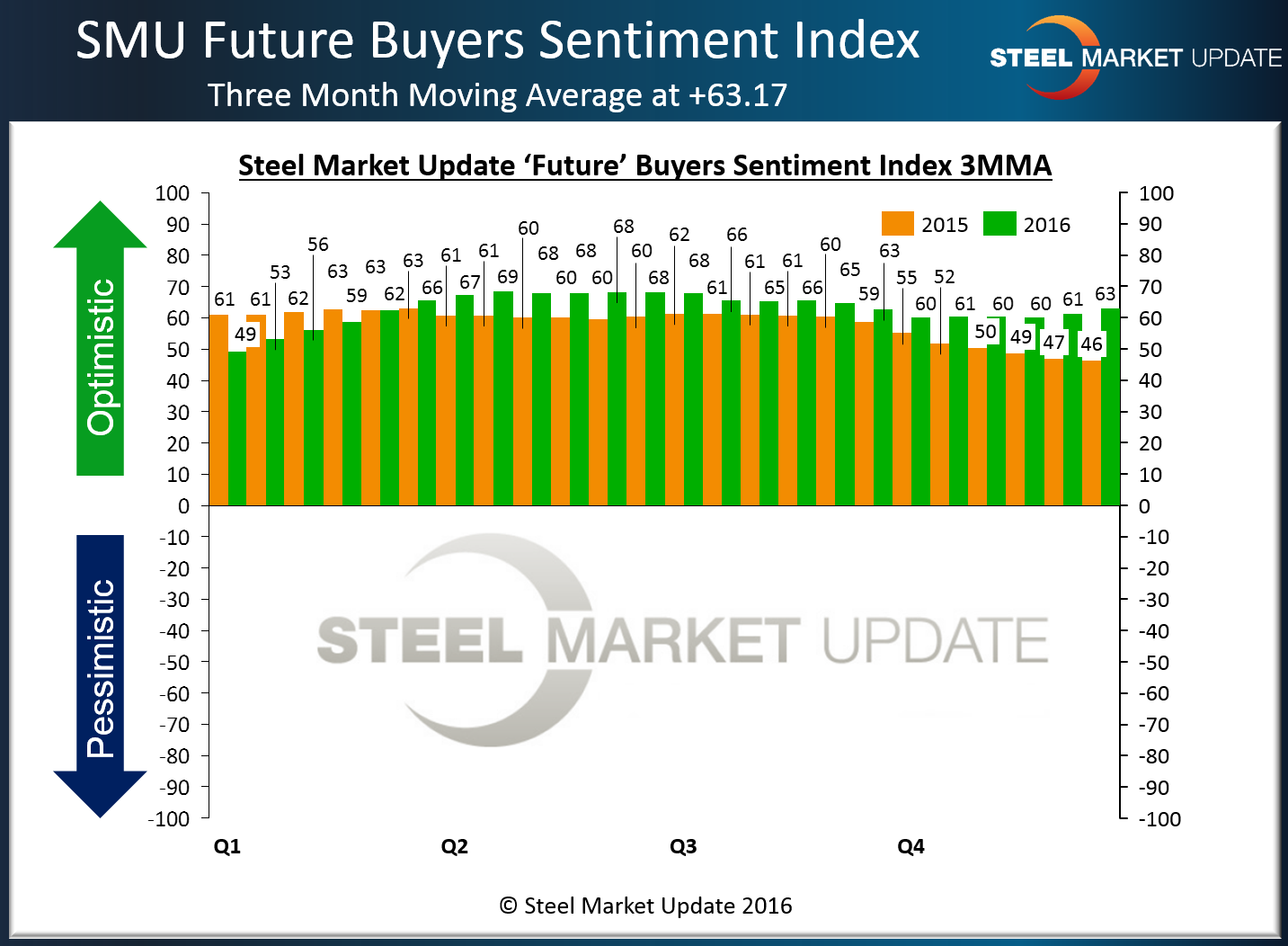

SMU Sentiment Index is Making a Strong Move into the New Year

Written by John Packard

SMU Steel Buyers Sentiment Index has reversed trend and is rising (getting more optimistic) as we prepare to move into the New Year. On Monday of this week Steel Market Update (SMU) began conducting our mid-December flat rolled steel market trends analysis. We completed our inquiries earlier today (Thursday, December 22, 2016) and we are reporting both our Current Index and Futures Index as improving.

Buyers and sellers of flat rolled steel are becoming more optimistic regarding their company’s ability to be successful both now, in the current market environment, as well as three to six months into the future. The Steel Market Update (SMU) Steel Buyers Sentiment Index rose +5 points to +70 and our three month moving average for Current Sentiment improved dramatically to +57.00. One year ago our single data point for mid-December was +43 and our three month moving average (3MMA) was +36.50. Our new results can be considered net positives for the steel industry as we move into the New Year.

What our Respondents are Saying

A service center reported to Steel Market Update that he felt “good” about his company’s ability to be successful with the following notation, “Could be artificial feeling as people are buying currently to beat larger price increases coming for February.” He went on to say, “Concerned with interest rate hike and large price increases by steel mills they will instill a recession or stall in the construction market until people feel pricing will hold at those levels for 6 months or more!”

A second distributor had a similar response (“good”) but added, “Low cost imported steel has finally arrived.”

A third distributor was also in the “good” camp but had this to add, “If the mills raise price again not to sure on good may slide to poor.”

A large number of service centers as well as manufacturing companies pointed out that many customers were actively trying to “beat the price increases.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 42 percent were manufacturing and 43 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.