Prices

December 19, 2016

Global Steel Production in November and Forecast through 2017

Written by Peter Wright

The following analysis was done by Steel Market Update for our Premium level customers. We are sharing the article with everyone (as well as our Apparent Excess article), well, because we would like all of our readers to upgrade to Premium…

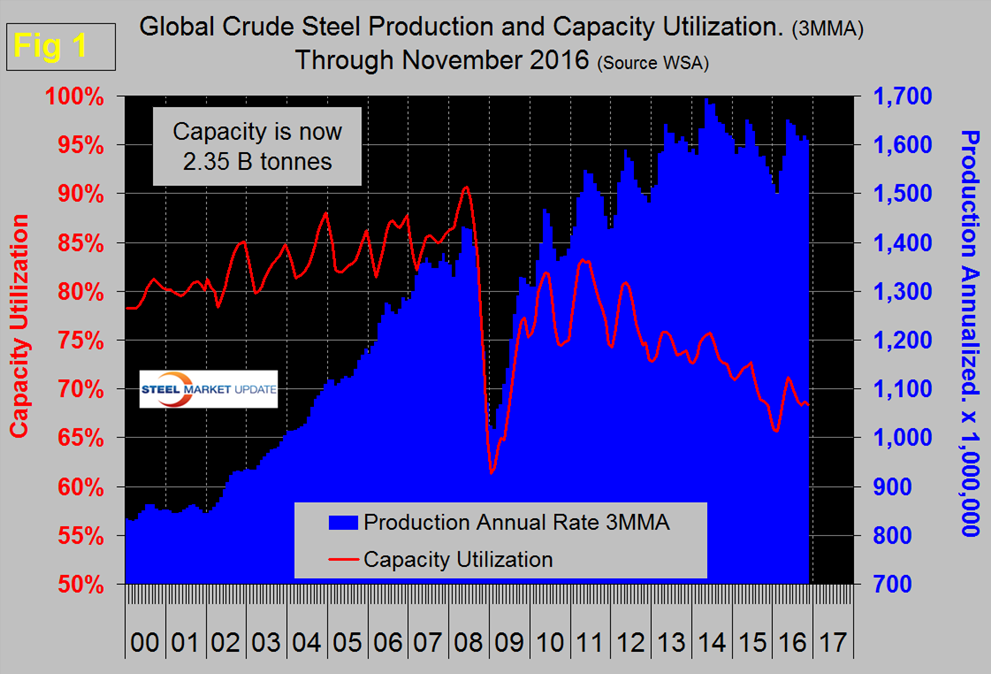

The WSA released their November update of global steel production on Tuesday. Production in the month of November at 132,402,000 metric tons was down by 3.3 percent from October which was entirely a result of one less day in the month. The three month moving average (3MMA) that we prefer as a measure was down by 0.5 percent from October. Capacity is 2.35 billion tonnes per year and the 3MMA of capacity utilization in November was 68.4 percent. Figure 1 shows monthly production and capacity utilization since January 2000.

On a tons per day basis, production in November was 4.413 million tonnes with a 3MMA of 4.424, up by 0.6 percent from October. Since 2011, capacity utilization has been on a steadily downward trajectory with a leveling out in the last three months. On October 9th the OECD’s steel committee reported that global capacity is expected to increase by almost 58 million tonnes per year between 2016 and 2018 bringing the total to 2.43 billion tonnes.

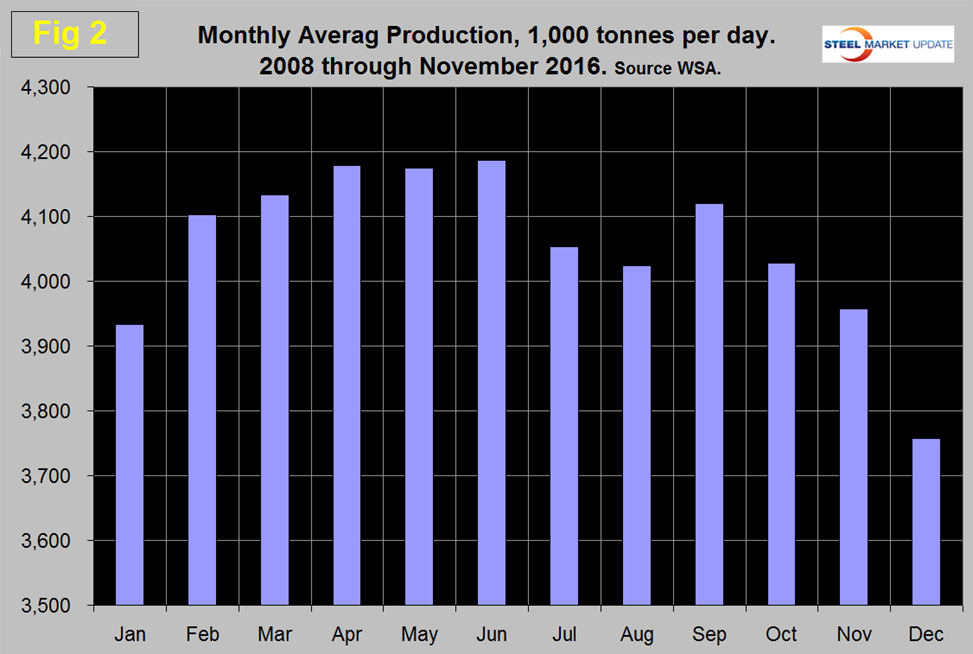

As we dig deeper into what is going on we start with seasonality. Global production has peaked in the summer for the last seven years including 2016. Figure 2 shows the average tons per day monthly production since 2008.

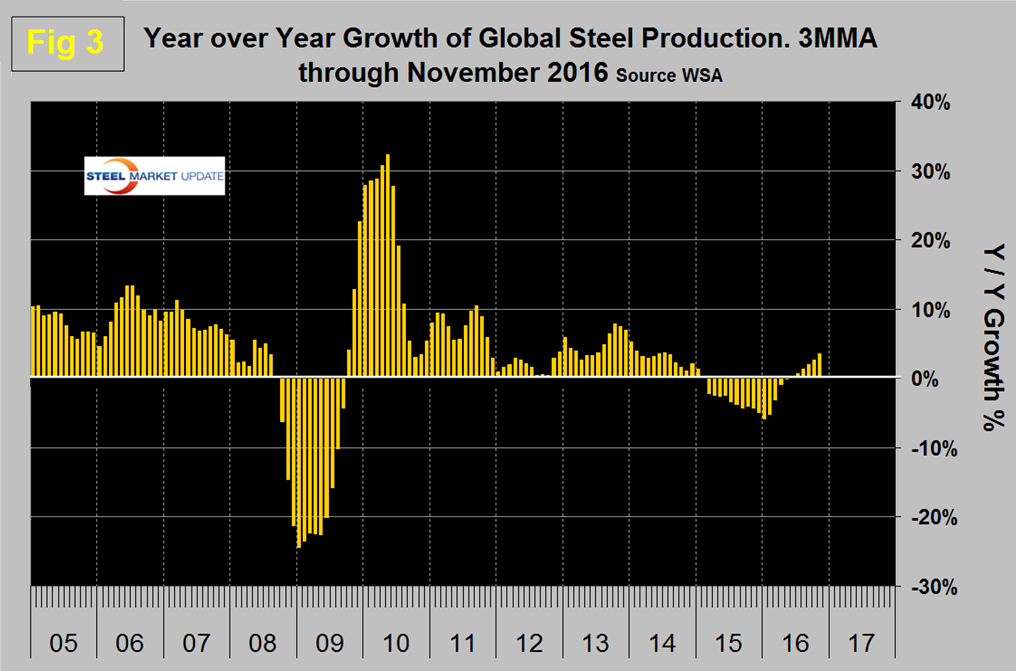

In those nine years on average, November has declined by 1.8 percent, this year November was almost unchanged with an expansion of 0.01 percent. On average during the last eight years tons/day production in December has been down by 5.0 percent. We believe it’s necessary to look at the year over year change in the three month moving average to eliminate seasonality and on this basis November was disappointing in that tons per day production did not decline as normal. Figure 3 shows the change in growth rate since January 2005.

Production began to contract in March last year and the contraction accelerated through January this year when it reached 5.8 percent. In the next four months contraction slowed and in May and June was zero. July, August, September, October and November have had year/year increases in the 3MMA of 0.8 percent, 1.4 percent, 2.0 percent, 2.7 percent, and 3.6 percent. The much desired slowdown in global steel production has reversed course on a year over year basis and is accelerating. China has been the main driver.

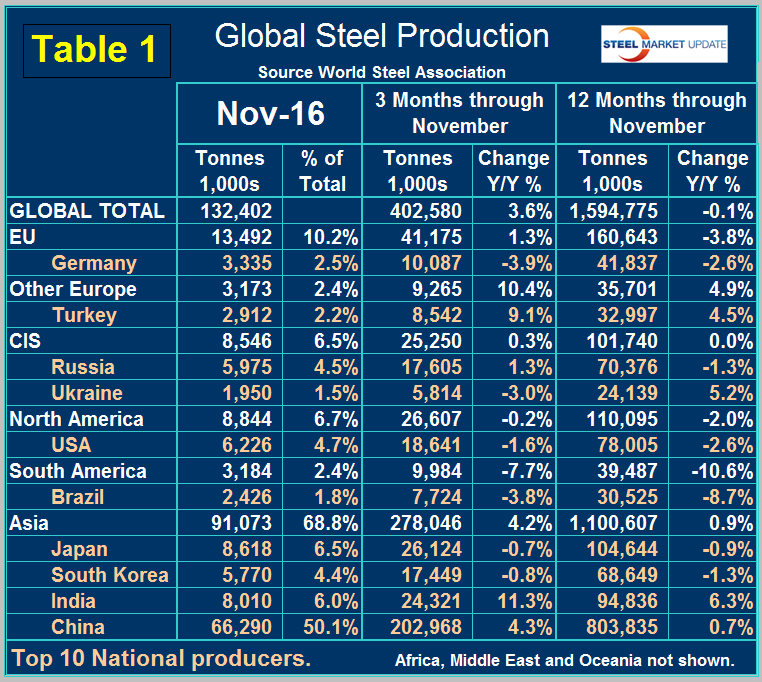

Table 1 shows global production broken down into regions and also the production of the top ten nations in the single month of November and their share of the global total. It also shows the latest three months and twelve months production through November with year over year growth rates for each period. Regions are shown in white font and individual nations in beige.

The world as a whole had positive growth of 3.6 percent in 3 months and negative 0.1 percent in 12 months through November. If the three month growth rate exceeds the twelve month we interpret this to be a sign of positive momentum which has been the case for the last ten months.

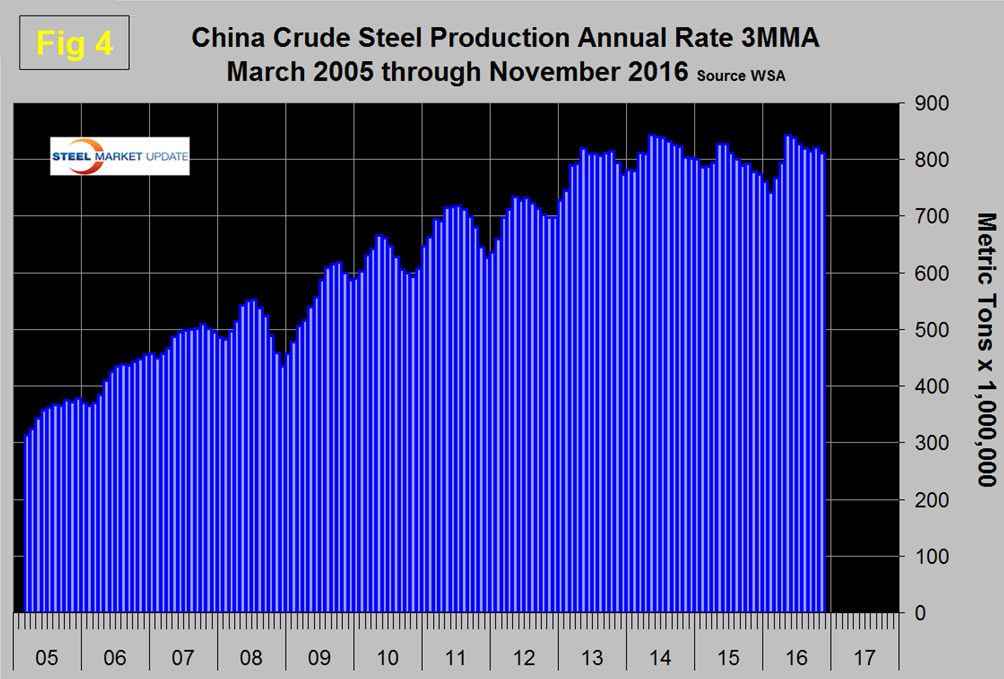

Figure 4 shows China’s production since 2005 and Figure 5 shows the y/y growth.

China’s production after slowing for 13 straight months on a 3MMA basis year over year returned to positive growth each month in the May through November time frame had a growth rate of 4.3 percent in November on a 3MMA year over year basis. China accounted for 50.1 percent of global production in November. The slowdown in Chinese steel production that the rest of the world has demanded is NOT happening and is in fact accelerating.

On a regional basis in 3 months through November year over year, North and South America contracted, all other regions had positive growth. Asia as a whole was up by 4.2 percent with India up by 11.3 percent. Other Europe (mainly Turkey), was up by 10.4 percent and North America was down by 0.2 percent. Within North America the US was down by 1.6 percent, Canada was down by 0.4 percent and Mexico up by 11.4 percent.

The November 2016 version of the World Steel Association Short Range Outlook (SRO) for apparent steel consumption in 2016 and 2017 forecast a global growth of 0.2 percent this year and 0.5 percent next. Note this forecast is steel consumption, not crude steel production which is the main thrust of what you are reading now. Based on this forecast, NAFTA will contract by 0.1 percent this year and grow by 2.9 percent next. China’s demand will decline by 1.0 percent this year and 2.0 percent in 2017 therefore if their production doesn’t decline by at least that amount the flood of exports will only increase. The WSA forecast for the top 10 steel producing nations has the US down by 1.2 percent in 2016 and up by 3.0 percent next year.

SMU Comment: Global production returned to positive year/year growth in July and since then growth has accelerated to 3.6 percent. On the same basis China has accelerated to a 4.3 percent growth rate. This will absorb a small proportion of the overcapacity but an acceleration of plant closures will be necessary to make a real dent. At the same time new construction is coming on stream, the net result of closures and startups according to the OECD will be an additional 58 million tons of capacity by the end of 2018. To make matters worse, global economic growth is slowing and the Chinese currency is weakening.

Source: World Steel Association with analysis by SMU

SMU Note: If you are interested in learning more about our Premium newsletters and website access please contact John Packard at: John@SteelMarketUpdate.com or by phone at 800-432-3475. There are also details on our website. Please be advise, however, we will be raising our subscription rates modestly on February 1, 2017.