Prices

December 18, 2016

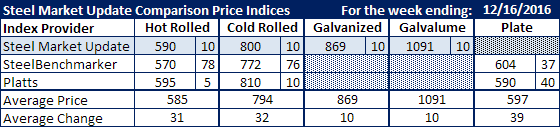

Comparison Price Indices: Pace Slows as Prices Approach Announced Levels

Written by John Packard

Flat rolled prices continued their march toward $600 per ton hot rolled ($30.00/cwt) and $820 per ton base prices on cold rolled and coated ($41.00/cwt).

Based on the steel indices followed by Steel Market Update (SMU), hot rolled, cold rolled and coated all increased their averages compared to one week earlier. SteelBenchmarker did report prices this week but they appear to be running a week to two weeks behind the Platts and SMU averages.

Hot rolled was $570 per ton on SteelBenchmarker while SMU at $590 and Platts at $595. Both indices were up for the week with SMU up $10 and Platts up $5. SteelBenchmarker, which only produces their index twice during each month, was up $78 per ton over the past few weeks. Even so, SteelBenchmarker is $20-$25 per ton below the other two indexes.

Cold rolled saw both SMU and Platts up $10 for the week and, like HRC, closing in on the base price suggested by the mills in the last announcement ($820 per ton). SteelBenchmarker was up $76 per ton and settled in at $772 per ton.

Both Galvanized and Galvalume were up $10 per ton. Galvanized .060” G90 at $869 per ton was only $20 per ton away from the $820 base suggested by the mills in their last announcement.

Plate prices also rose with SteelBenchmarker up $37 and Platts up $40.

SMU Note: Galvanized prices include $69 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.