Prices

December 13, 2016

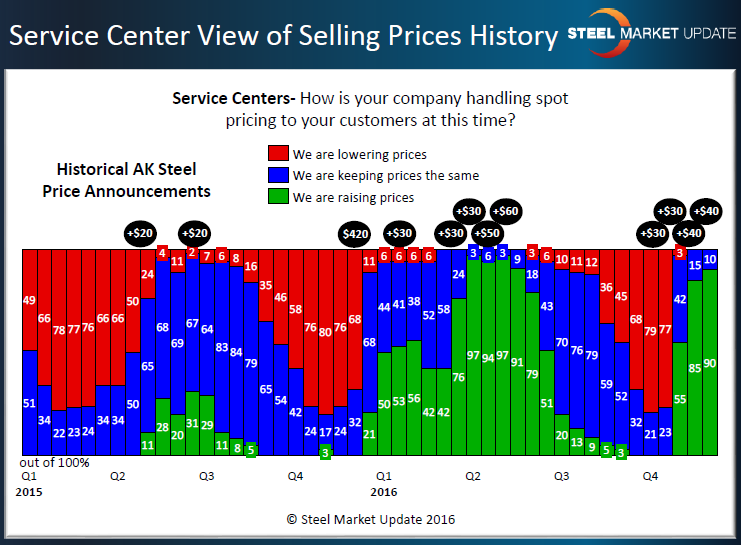

Service Center Spot Prices Supporting Steel Mill Price Increases

Written by John Packard

The flat rolled steel service centers are increasing their spot steel prices to their customers. According to our most recent flat rolled steel market trends survey, 90 percent of the distributors responding reported their company as raising spot prices to their end users or to other steel service centers. The 90 percent number is 5 percentage points higher than what we reported two weeks ago and 35 percentage points higher than what we reported at the beginning of November 2016.

Separately, 69 percent of the manufacturing companies reported their service center suppliers as increasing prices which is 19 percentage points higher than what we saw during the middle of November.

It is Steel Market Update opinion that higher spot prices coming out of the service center segment of the flat rolled steel industry is supportive of price increase movement out of the domestic steel mills. We have seen four price increase announcements since the middle of October (October 21st was the first increase in the current market cycle). At the time of the first announcement service centers had reached the point of capitulation when at least 75 percent of the service centers report their company as lowering spot prices (see below). At the point of capitulation we find the distributors as willing to support mill price increases as a way of protecting the value of their inventories.

As soon as early November more than 50 percent of the distributors were raising their spot prices and this trend has continued through this past week’s survey.

Once price increases are announced the steel mills need the distributors to support the increases by raising their spot prices. The firmer both the service centers and steel mills are regarding the prices taken on new spot orders, the more likely the mills are to collect the increases being announced.

The strength of the support levels by the distributors is also a sign of further support for future price increase announcements. However, SMU will be watching the spread between domestic and foreign pricing to see if foreign orders begin to increase indicating pressure on future mill pricing 2-3 months into the future.

Our Premium level members will be able to evaluate foreign orders through our surveys and the information we are sharing in the Power Point presentation which Premium members have access to in our website.