Analysis

December 10, 2016

Final Thoughts

Written by John Packard

Last week Steel Market Update conducted one of our flat rolled steel market trends analysis. We invited just under 600 people to participate in our early December survey and we had 100+ responses. Based on these responses we derive our lead times, negotiations, Sentiment and many other trends that impact the flat rolled steel industry. Our Premium level members will be able to find the results from last week’s survey in a Power Point presentation that we put online which takes last week’s data and puts it into a historical perspective. Executive level members who are interested in learning more about our Premium product please send me an email: John@SteelMarketUpdate.com.

We will be publishing a Premium supplemental issue of Steel Market Update on Monday afternoon.

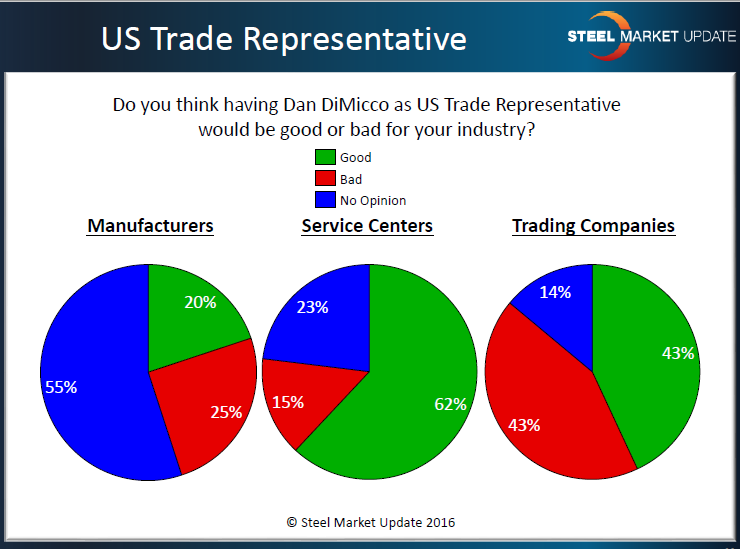

One of the questions asked of each of the major market segments (manufacturing, service centers/wholesalers and trading companies) was about what they thought about Dan DiMicco’s involvement with the Trump Administration as potentially the U.S. Trade Representative. I thought the results were quite interesting.

Manufacturing companies seem to be less enamored with DiMicco as U.S. Trade Representative than service centers, and trading companies seem to be evenly split on whether DiMicco will be good or bad for their business.

We have a wait list for our next Steel 101 workshop. We will try to see if we can clear the people on the wait list by the end of this week. I hope to be able to announce the next Steel 101 training workshop which will be in the early Spring 2017. We expect to produce four Steel 101 workshops during calendar year 2017.

We are coming up on Christmas, Hanukkah and New Year’s. We expect to publish on Thursday, December 22nd. We will not publish on Sunday, December 25th and we will publish our price indices and very little else on Tuesday, December 27th. We will publish our normal issue on Thursday, December 29th and then not again until Tuesday, January 3rd.

If you have any questions please feel free to contact us at 800-432-3475. Brett’s direct line number is 706-216-2140 and Diana/Alison’s direct number is 772-932-7538.

As always your business is truly appreciated by all of us here at Steel Market Update.

John Packard, Publisher