Market Data

December 8, 2016

Steel Mill Lead Times Extend YOY

Written by John Packard

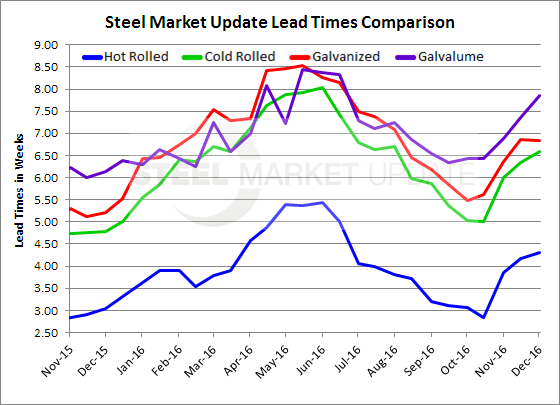

Over the past four days Steel Market Update has been conducting one of our market trends surveys. The respondents to our queries have provided data indicating slightly longer lead times on hot rolled, cold rolled and Galvalume while galvanized lead times remained steady at mid-November levels.

The lead times reported in this article are the average of the responses collected from all of our steel survey respondents for each flat rolled product. The averages do not reflect the lead time at any one supplier. As an average you can expect to find steel mill lead times at domestic steel producers that may be longer or shorter than what we are reporting below.

The purpose of our survey is to identify any changes in the trend. In this case are lead times moving in one direction or another?

Average hot rolled lead times are closing in on four and a half weeks (4.31 weeks) which is an improvement over the 4.18 weeks we reported in mid-November and much higher than the 2.84 weeks we saw not that long ago in the middle of October 2016. One year ago HRC lead times averaged 3.05 weeks.

Cold rolled lead times, which averaged less than five weeks (4.78 weeks) one year ago are now averaging six and a half weeks (6.58 weeks) up from 6.35 weeks in mid-November and much improved over the five (5.0) weeks reported in the middle of October 2016.

Galvanized lead times were unchanged at 6.84 weeks. This is one week further extended than what we were reporting in the middle of October. One year ago GI lead times were closer to five weeks (5.20).

Galvalume lead times moved out and are closing in on eight weeks (7.85 weeks). This is slightly longer than the 7.36 weeks reported at the middle of November and is about 1.25 weeks longer than what we saw in the middle of October 2016. One year ago AZ lead times averaged 6.13 weeks.

The longer the lead times the more support given to price increases and the pricing power of the domestic steel mills.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.