Market Data

November 30, 2016

Service Center Apparent Excess Results & Forecast

Written by John Packard

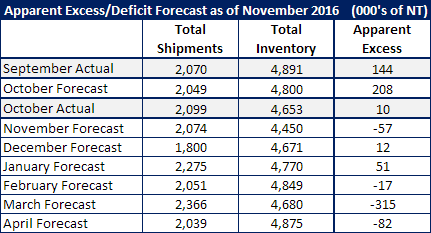

In September Steel Market Update forecast October shipments of flat rolled steel out of the service centers would total 2,049,000 tons. According to the Metal Service Center Institute (MSCI) the actual total came in at 2,099,000 tons.

SMU forecast flat rolled inventories to total 4,800,000 tons at the end of October. The actual number was slightly lower at 4,653,000 tons.

Our forecast was for the U.S. distributors to have a 208,000 ton inventory excess (flat rolled) at the end of October. Based on our model with the 50,000 tons of higher shipments coupled with lower inventories the actual excess was 10,000 tons. Essentially, the service centers are back into a balanced scenario.

We consider anything within +/- 100,000 tons to represent a balanced inventory position at the flat rolled steel service centers in the United States.

With the recent price increase announcements (4 since October 21) we believe distributors will not try to build inventories at these price levels. This will help keep inventories either balanced or moving into a deficit and that is what we are showing in our new forecast for November through April 2017.

SMU Forecast

We expect shipments to come in around 2,074,100 tons during the month of November (21 day shipping month). This would be in line with October’s 2,099,000 tons of shipments. October also had a 21 day shipping month.

We believe December shipments will total 1,800,300 tons which would be a 4.2 percent improvement over the previous December.

From there we believe shipments will be flat against the year-over-year comparables.

Inventories at the end of November are expected to be 4,450,400 tons which would represent a -57,000 deficit. As you can see by the table provided, with the exception of March 2017 we expect inventories to be in the balanced range during this whole time period.