Prices

November 29, 2016

SMU Price Ranges & Indices: Prices Up Before AM Announcement

Written by John Packard

Steel Market Update (SMU) spend the last 24 hours researching the flat rolled steel markets in an effort to come to a resolution on what the price spread is on hot rolled, cold rolled, galvanized and Galvalume steels. We found about 90-95 percent of the buyers reporting the domestic steel mills as “firm” in their pricing with most offers being referenced as being $540-$580 on hot rolled and $740-$780 on cold rolled with a little higher top end on coated products. As one large service center coined it, “They aren’t at the ‘full Monty’ yet” but they are getting close. The ArcelorMittal flat rolled price increase announcement came in after most of our steel buyers had reported their offers and buys to us earlier this morning and afternoon.

We do expect prices to move higher from here and our Price Momentum Indicator continues to point toward higher spot prices over the next 30 to 60 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $520-$580 per ton ($26.00/cwt- $29.00/cwt) with an average of $550 per ton ($27.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton over one week ago while the upper end remained the same. Our overall average is up $5 per ton compared to last week. Our price momentum on hot rolled steel continues to be pointing toward Higher which means that prices are expected to move up over the next 30-60 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $740-$780 per ton ($37.00/cwt- $39.00/cwt) with an average of $760 per ton ($38.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton over last week while the upper end remained the same. Our overall average is up $15 per ton over one week ago. Our price momentum on cold rolled steel continues to point toward Higher which means that prices are expected to move up over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU Base Price Range is $37.50/cwt-$39.00/cwt ($750-$780 per ton) with an average of $38.25/cwt ($765 per ton) FOB mill, east of the Rockies. The lower end of our range rose $10 per ton over one week ago while the upper end decreased $10 per ton. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel continues to point Higher which means that prices are expected to move up over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU Range is $819-$849 per net ton with an average of $834 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU Base Price Range is $38.00/cwt-$39.50/cwt ($760-$790 per ton) with an average of $38.75/cwt ($775 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton over last week while the upper end remained the same. Our overall average is up $10 per ton over one week ago. Our price momentum on Galvalume steel continues to point Higher which means that prices are expected to move up over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1051-$1081 per net ton with an average of $1066 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-7 weeks

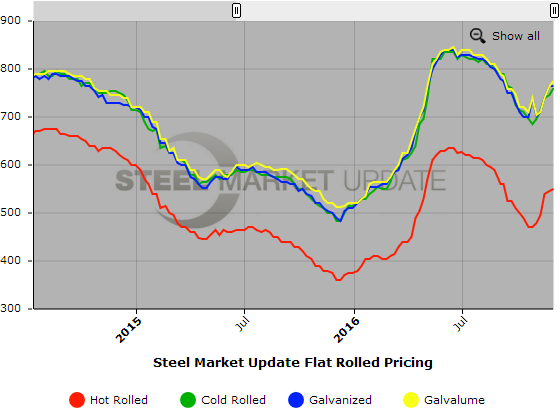

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.