Market Data

November 28, 2016

China’s Economic Statistics and Steel Production through Q3 2016

Written by Peter Wright

Once each quarter we publish the official statistics for Chinese GDP, industrial production, consumer price inflation and fixed asset investment. Currently available GDP data is through the third quarter, other data included here is through October. Many analysts don’t believe these Party self-serving figures but we include them in our reports because of the importance of China in the global steel scene and these numbers are all there is. Figure 1 shows published data for the growth of GDP, industrial production and consumer prices through the third quarter of 2016.

The GDP and industrial production portions of this graph are three month moving averages. The growth of GDP was 6.7 percent in the third quarter which was the same as in the first and second quarters and down from 6.8 percent in the fourth quarter of 2015. The reported growth rate of GDP has declined steadily since it peaked at 11.9 percent in Q1 2010. Consumer price inflation averaged 1.44 percent in 2015 and so far this year has averaged .97 percent. Industrial production has been little changed since February last year.

Earlier this month economy.com wrote: The Chinese economy is adjusting to the ‘new normal’, featuring slower industrial growth and higher consumption. In the third quarter, small stimulus measures and the housing market recovery drove a cyclical bounce in activity. The economy’s potential growth rate is decelerating as a result of the continued development of the economy and the ageing of the workforce. Overcapacity in heavy industry continues to weigh on the economy, but there are signs of improvement in some key areas. Manufacturing output is rising thanks to the global tech rebound and energy-efficient motor vehicle subsidies. The housing market recovery has also boosted household sentiment and encouraged construction activity in major cities. A decline in overcapacity can be seen in higher input prices (commodity prices have troughed and producer prices are now back in inflation). The government’s commitment to shrinking overcapacity in steel and coal, if it eventuates, will go a long way in cutting excess productive capacity weighing on the economy. Crude steel output rose 3.9 percent after a 3 percent increase previously. Coal output fell 12.3 percent, and natural gas output ticked up 0.1 percent. Cement output rose 2.9 percent y/y, slightly stronger than the 1 percent y/y rise in August.

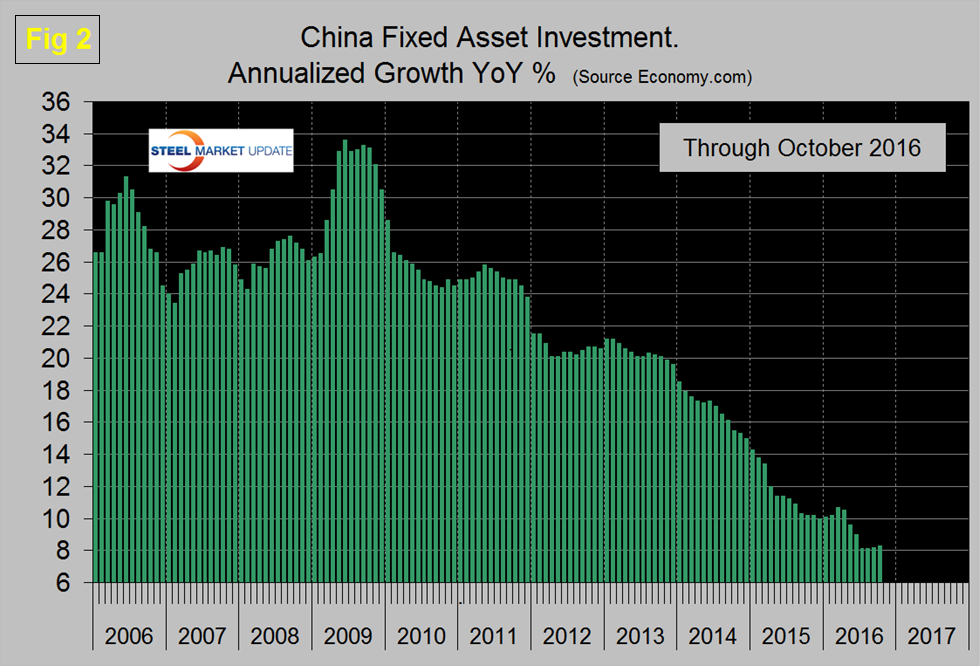

Figure 2 shows the growth of fixed asset investment y/y.

The growth slowdown experienced in 2013 accelerated through all of 2014 through August of 2015. Growth leveled off in Q4 2015 and Q1 2016, dropped sharply in Q2 2016 and leveled off again in Q3 2016. In October FAI grew at 8.3 percent y/y which means it is still doubling every 104 months. The lower growth rate is being propped up by public investment as private investment dwindles. Economy.com wrote: the main weakness in fixed asset investment activity continues to come from the mining sector. Profitability of mining companies has fallen sharply amidst low commodity prices and chronic overcapacity. The government has been attempting resolve these persistent issues by pledging to reduce steel production capacity by 100 million tonnes, to 150 million tonnes, by 2020. This will keep a lid on investment activity for the foreseeable future.

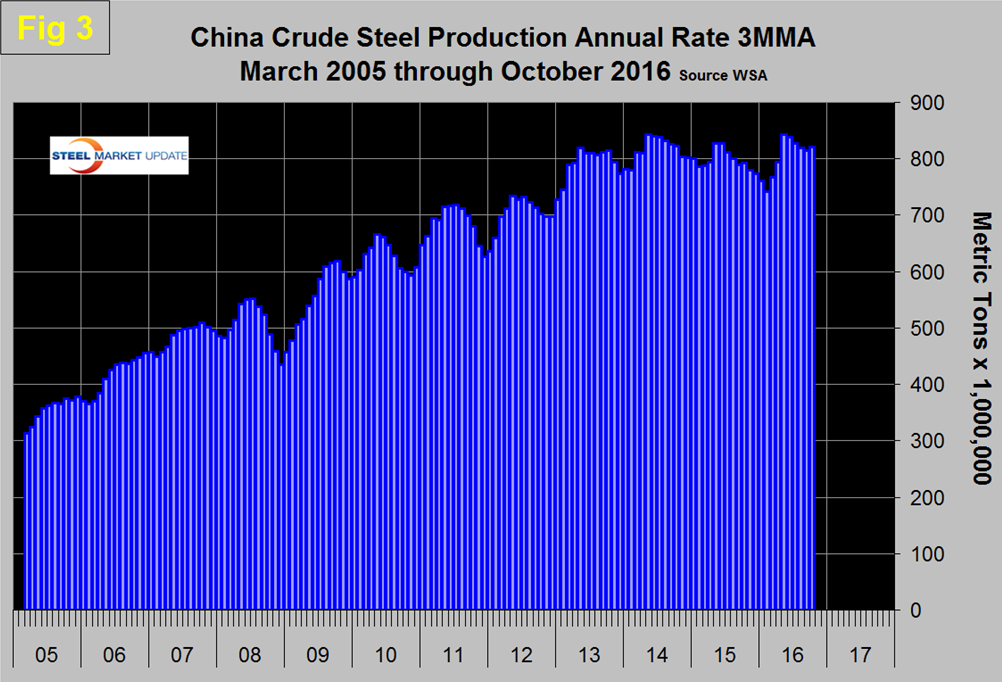

In this update we are re-playing charts that we first published in our analysis of global steel production. Figure 3 shows the 3MMA of China’s crude steel production since March 2005.

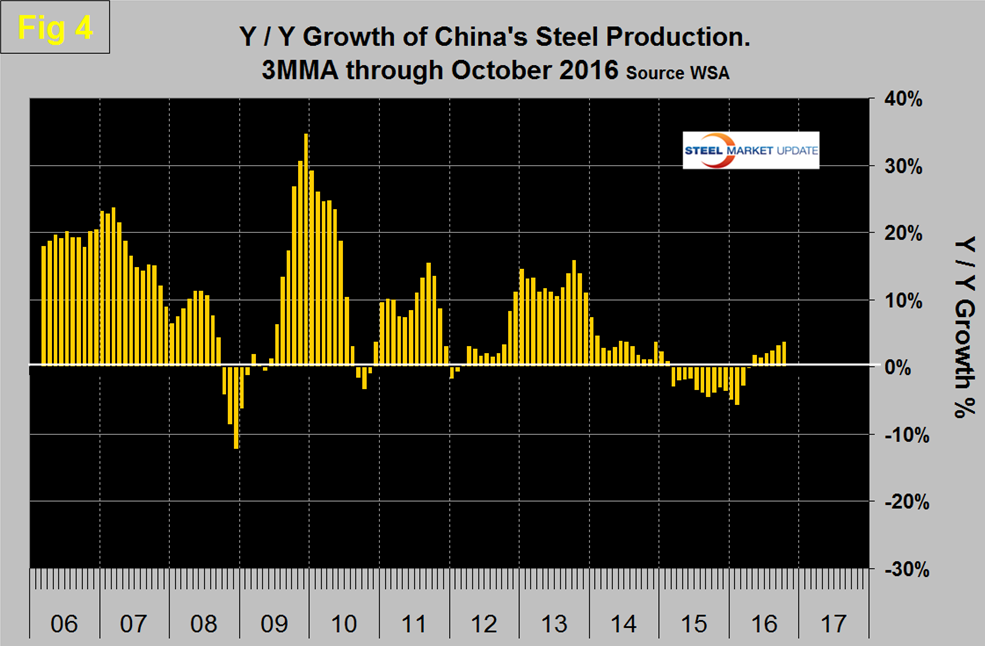

China’s production after slowing for 13 straight months on a 3MMA basis year over year returned to positive and accelerating growth each month in the May through October time frame and accounted for 50.3 percent of global production in October. The slowdown in Chinese steel production that the rest of the world has demanded is NOT happening. Another way of looking at the change in growth is shown in Figure 4.

The May through October results followed zero growth in April. In early November the Ministry of Industry and Information Technology stated that foreign companies will be encouraged to participate in the reorganization of Chinese steel companies. Under the plan, the amount of crude steel capacity in China is to be cut by up to 150 million tons, to less than one billion tons by 2020, as demand for the product drops. Any project that aims to expand steel production capacity will be banned. The plan also requires energy consumption in the steel industry to be reduced by more than 10 percent while major pollutants must be cut by more than 15 percent. The central government reiterated that cutting overcapacity is high on its reform agenda as excess capacity in sectors such as steel and coal has weighed on the country’s overall economic performance.

SMU Comment: We estimate that global steel overcapacity is now about 460 million tonnes per year and of that a high proportion is in China who is now pushing more than the total of US steel production onto the world market. The November announcement by the Ministry of Industry and Information Technology is not encouraging if as implied, Chinese steel production falls in line with declining domestic demand. The rest of the world needs a much higher decline in production.