Market Data

November 27, 2016

SMU Flat Rolled Steel Market Trends Survey: Price Increase Announcements & Lead Times

Written by John Packard

Twice per month Steel Market Update (SMU) conducts a survey of the flat rolled steel markets. We invite close to 600 people representing approximately 550 companies spread out around the United States and Canada. We concentrate on two main steel buying groups: manufacturing companies and service centers/wholesalers. Our most recent market trends analysis was completed on Wednesday, November 23rd during which 44 percent of our respondents were distributors/wholesalers, 42 percent were manufacturing companies with the balance being made up of steel mills (6 percent), trading companies (6 percent) and finally toll processors (2 percent).

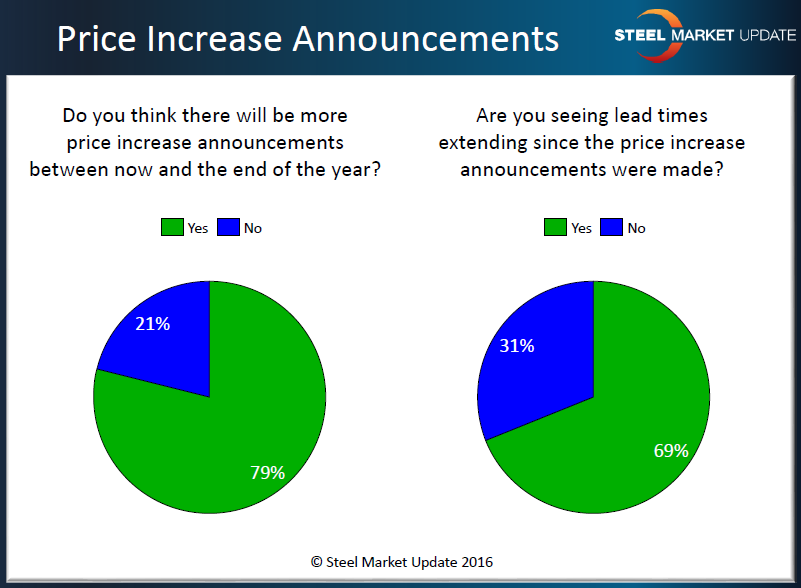

With flat rolled steel price increase announcements becoming the norm over the past four weeks we wanted to know if steel buyers/sellers and executives in the industry had any opinions regarding the chances of more flat rolled price increases being made prior to the end of the year. We also wanted to know if the announcements already made (and there have been three to date) were having any impact on lead times, thus creating an environment where steel buyers need to make decisions to buy sooner than just a few weeks ago.

As you can see in the graphic below, 79 percent of our respondents believe more price announcements are coming and 69 percent of our respondents are reporting lead times as extending on flat rolled products since the announcements were made.

What Our Respondents are Saying on the Subject of More Price Increases before Year’s End:

“If the mills try another one, they will push it too far. We all know what happens when they have done that in the past, collapse.” Service center

“I think it will be too much too fast and they will beg for orders in January and February.” Service center

“[There will be more price increases] only if the lead times remain extended.” Manufacturing company

“I am betting on one more.” Service center

“I know plate is going up again.” Service center

“[There will be more price increases} if only to get the first 3 to stick.” Service center

“Absolutely” Service center

What Our Respondents are Saying on the Subject of Lead Times Extending Since Price Announcements:

“Some recovery in lead times. They were inflated in first half 2016, backed off in 3rd Q 2016 and are now beginning to recover.” Steel mill

“No active quotes but understand they are into Jan for galv.” Manufacturing company

“I am quoted [told] they are extending for HR, however steel is continuing to run early; with mills wanting to release early.” Manufacturing company