Distributors/Service Centers

November 27, 2016

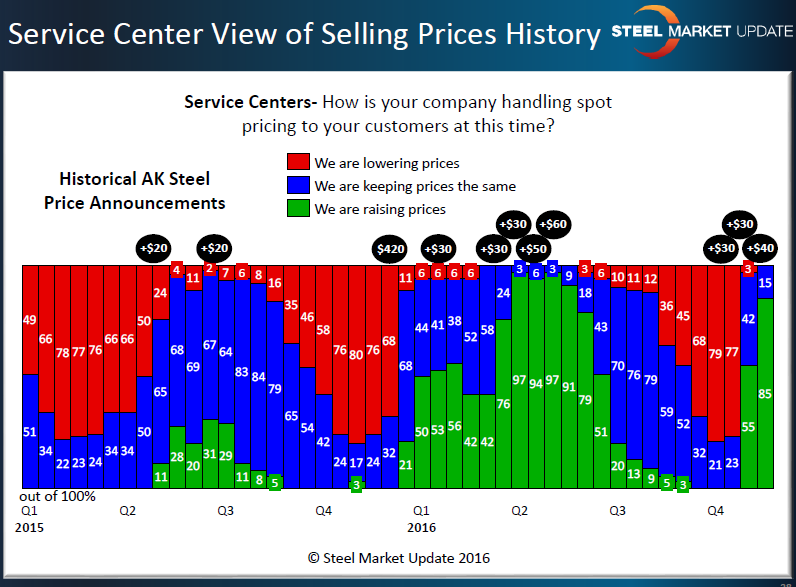

SC Spot Prices: Classic Capitulation Equals Support for Price Increases

Written by John Packard

Flat rolled steel service centers and wholesalers sell material into what is called the “spot” market. The spot market is where a service center customer buys material at whatever price the market will bear in order to fill a short term need. Over the years Steel Market Update has found that when flat rolled steel distributors are “dumping” steel (i.e. selling to their spot customers at lower and lower prices in order to move inventory) they reach a point which we call “Capitulation.” Capitulation is the point when 75 percent or more of our survey respondents are reporting that their company is lowering prices to their spot customers. Once we reach the point of Capitulation our survey history shows distributors are ready to accept price increases in order to stop the cycle and bring value back to their inventories.

We reached Capitulation in early October 2016 and the first price increase announcement was made on October 21st. Since then there have been two more announcements for a total of three.

On the flip side, when service centers are raising their spot prices this is a bullish sign that the distributors are supporting the domestic steel mills efforts to increase prices. As you can see by the graphic below we are currently involved in a classic Capitulation-Price Support cycle by the service centers with the domestic mills now having raised prices three times since late October.

In the graphic above the black circles above the bars represent AK Steel price increase announcements. We use AK Steel because they publish their price announcements in the “News” section of their website. This makes it easier for our non-steel buying readers to follow steel prices with as much transparency as possible.

SMU Note: Not all mills mirror what AK Steel may announce at any one point in time. To get a specific mill’s pricing on the products you need to buy contact your mill representative or sales manager.