Market Data

November 22, 2016

SMU Steel Buyers Sentiment Index: Looking at a More Optimistic Industry?

Written by John Packard

Twice per month Steel Market Update conducts an analysis of the flat rolled steel market. One of the proprietary products that comes out of this effort is the SMU Steel Buyers Sentiment Index. Our index measures how steel buyers and those that sell flat rolled steels feel about their company’s ability to be successful both in the existing (Current Sentiment) market environment as well as three to six months into the future (Future Sentiment).

We have found over the years that the SMU Steel Buyers Sentiment Index is a leading indicator into the minds of those associated with the steel industry, thus helping us better understand the true direction of the flat rolled markets.

We analyze the data we develop in a number of ways. We have the single data point created out of our twice monthly survey. This week our Current Sentiment Index is being reported as being +58 which is up five points from the +53 recorded at the beginning of November. One year ago our Current Sentiment Index for mid-November was +37. Steel Market Update believes this +21 point improvement is a sign of better things may soon be coming to the industry as we move into 2017.

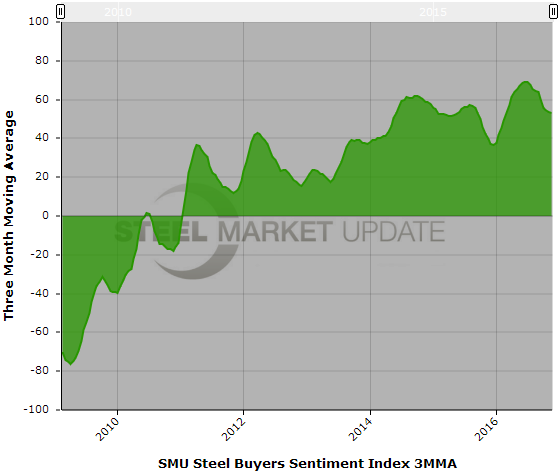

Before we are ready to make any predictions it is important to check the three month moving average (3MMA) as we strive to take any bumps and grinds out of the single numbers. Is the +58 reported today enough to change the 3MMA trend line?

The 3MMA for Current Sentiment is +53.17 which is lower than the +53.67 reported at the beginning of the month and well below the +69.17 recorded at the beginning of July 2016. The trend has been for Sentiment has been slowing (less optimistic) as buyers and sellers of steel have had to deal with slowing steel demand, questions about what impact politics would play on the markets as well as rising commodity prices.

The +58 is the first time our single data point is higher than the three month moving average since the +71 recorded during the first week of July. The question remains are we seeing the bottom of the 3MMA trend line and will it reverse course, just as prices have reversed course, and move higher from here?

Time will tell but SMU is cautiously optimistic.

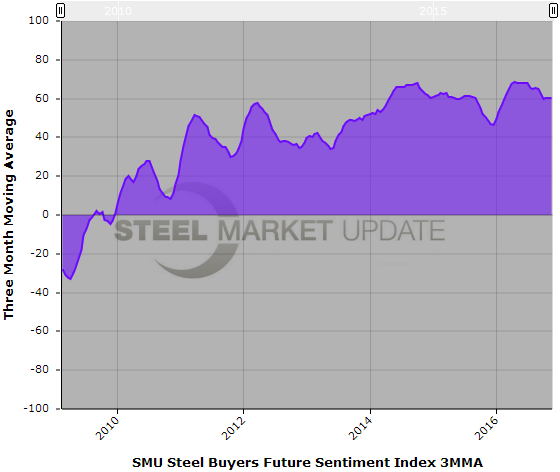

SMU Future Sentiment Index

Our Future Sentiment Index, which measures how steel buyers and sellers of flat rolled steel feel about their company’s chance of success three to six months into the future, is being reported at +63 which is the same as what we reported at the beginning of November. This is +16 points better (more optimistic) than what we recorded one year ago.

When looking at Future Sentiment from a three month moving average (3MMA) our Index is being reported to be +60.17 which is slightly lower than the +60.33 reported at the beginning of November. However, we have seen our Future 3MMA bouncing a bit over the past couple of months and we are of the opinion that this could be a sign of a bottoming of the less optimistic trend in preparation for a move higher from here. As with Current Sentiment the +63 is higher than the three month moving average which is a good sign.

What our Respondents are Saying:

“Another up cycle – with possibly more momentum than the cycle of first half 2016.” Steel mill

“Overall market is good. There will be inventory replenishment but supply sources are still a question.” Trading company

“With current administration ending and incoming administration, we are hopeful.” Service center

“Fearful greedy mills will create a stall or lull in market as people will buy heavy in December at lower prices for 60-120 days worth of inventory.” Toll processor

Seasonal issues seemed to be on the minds of a large number of those responding to our mid-November flat rolled market trends analysis.

“End of the year slow-down.” Service center

“Decline is seasonal.” Manufacturing company

“Winter months – slower [business].” Manufacturing company

“Slow season for construction.” Manufacturing company

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 43 percent were manufacturing and 44 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.