Prices

November 19, 2016

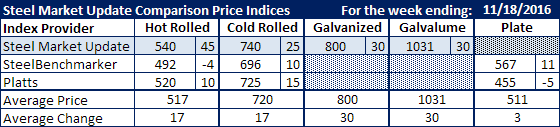

Comparison Price Indices: Wide Spreads Between Indexes

Written by John Packard

Flat rolled steel prices increased on two of the three steel indexes with benchmark hot rolled up $45 per ton according to Steel Market Update with Platts reporting HRC prices as being up $10 per ton. SteelBenchmarker, on the other hand, saw HRC prices as being down $4 per ton. So, we have quite a spread between the three averages: SMU has HRC at $540 per ton, Platts has HRC at $520 per ton and SteelBenchmarker has HRC at $492 per ton.

Cold rolled prices we seen as being higher on all three indexes, however there is a large spread between the three here as well. SMU has CRC up $25 per ton to $740 per ton, Platts saw CRC as up $15 to $725 per ton and SteelBenchmarker has CRC prices at $696 per ton, up $10 from their last report which was two to three weeks ago (SteelBenchmarker only reports their prices twice per month).

Galvanized prices were seen as being up $30 by SMU with .060″ G90 hitting $800 per ton. The G90 extra prior to the changes made last week was $60 per ton.

Galvalume prices also rose $30 per ton with .0142″ AZ50, Grade 80 hitting $1031 per ton.

The reported plate prices were at complete odds with one another. Platts saw plate as being down $5 per ton to $455 per ton while SteelBenchmarker reported plate as being up $11 to $567 per ton. It appears there is a need for SMU to begin indexing plate prices and we will work toward doing just that in the near future.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.