Prices

November 16, 2016

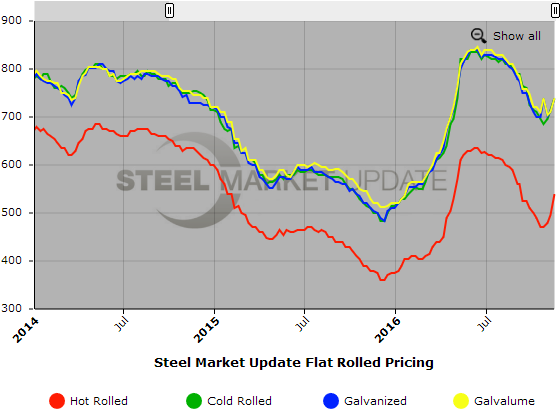

SMU Price Ranges & Indices: Only Direction is Up

Written by John Packard

Flat rolled steel prices shot up this week in response to two price increase announcements within the past 8 days. ArcelorMittal provided base price guidance on Monday for $560 for hot rolled ($28.00/cwt) and $780 base on cold rolled and coated ($39.00/cwt). A number of mills followed with some announcing $30-$40 per ton and others (NLMK USA) following with specific base price levels matching ArcelorMittal.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $520-$560 per ton ($26.00/cwt- $28.00/cwt) with an average of $540 per ton ($27.00/cwt) FOB mill, east of the Rockies. The lower end of our range jumped up $50 per ton over one week ago while the upper end increased $40 per ton. Our overall average is up $45 per ton over last week. Our price momentum on hot rolled steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $720-$760 per ton ($36.00/cwt- $38.00/cwt) with an average of $740 per ton ($37.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton over last week while the upper end rose $20 per ton. Our overall average is up $25 per ton over one week ago. Our price momentum on cold rolled steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU Base Price Range is $36.00/cwt-$38.00/cwt ($720-$760 per ton) with an average of $37.00/cwt ($740 per ton) FOB mill, east of the Rockies. The lower end of our range rose $40 per ton over one week ago while the upper end increased $20 per ton. Our overall average is up $30 per ton over last week. Our price momentum on galvanized steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU Range is $780-$820 per net ton with an average of $800 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU Base Price Range is $36.00/cwt-$38.00/cwt ($720-$760 per ton) with an average of $37.00/cwt ($740 per ton) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton over last week while the upper end increased $20 per ton. Our overall average is up $30 per ton over one week ago. Our price momentum on Galvalume steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1011-$1051 per net ton with an average of $1031 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.