Prices

November 13, 2016

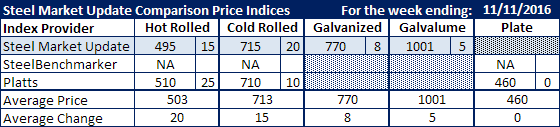

Comparison Price Indices: Rollercoaster Moving Up as Cycle Changes

Written by John Packard

Is everyone strapped in? The rollercoaster is clearly on the way back up and the question today is will benchmark hot rolled exceed the previous cycle highs of $635 per ton ($31.75/cwt) set in mid-June 2016?

Flat rolled steel indexes followed by Steel Market Update recorded higher average pricing on hot rolled, cold rolled, galvanized, Galvalume with the only exception being plate products this past week.

Benchmark hot rolled broke through the $500 per ton barrier with Platts at $510 per ton up $25 per ton for the week while SMU was a tad below at $495 per ton. Steel Market Update showed their HRC average as being up $15 per ton compared to the week prior. Earlier in the week ArcelorMittal USA signaled to the HRC market that the minimum base price should be at $520 per ton ($26.00/cwt) plus extras.

Cold rolled prices have broken through $700 per ton with SMU at $715 per ton ($35.75/cwt) and Platts a tad below at $710 per ton. We did not receive SteelBenchmarker prices for this week as they only report prices twice per month.

Galvanized averages rose $8 per ton on .060” G90 material. Galvalume also moved higher by $5 per ton on .0142” AZ50, Grade 80.

Platts showed plate prices as being unchanged last week compared to the previous week.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.