Market Data

November 10, 2016

Steel Mill Negotiations: Mills React to Price Increases

Written by John Packard

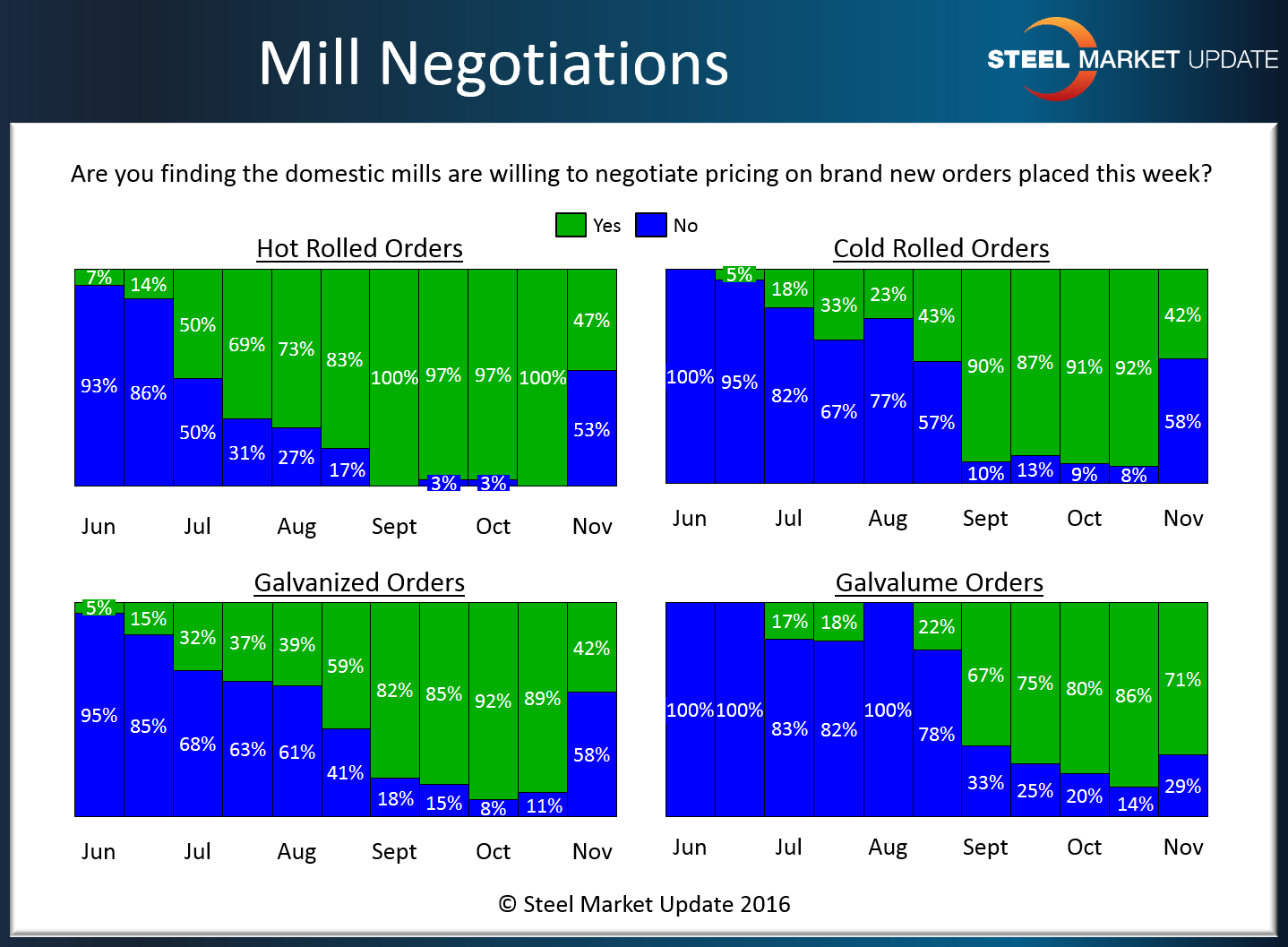

One of the areas of our focus during our twice monthly flat rolled steel trends survey is how flexible are the domestic steel mills when negotiating spot steel prices with their customers? Over the past three months the mills have been willing to discuss discounts in order to obtain business. We found this on all products: hot rolled, cold rolled, galvanized and Galvalume with hot rolled being the weakest of the four.

With the two price increase announcements having been made since our last analysis, we have found a significant change in the negotiating positions being taken by the domestic steel mills.

Hot rolled coil had 97-100 percent of our survey respondents reporting the mills as negotiating on pricing during the months of September and October. Now in early November we have seen those reporting that way dropping to 47 percent.

Cold rolled coil was not quite as dire as hot rolled but still 87-92 percent of our respondents reported the mills as willing to negotiate CRC spot pricing during the months of September and October. That number dropped by more than half as only 42 percent are reporting CRC pricing as negotiable.

The galvanized story is similar to that of cold rolled with 82-92 percent reporting the mills as negotiable during the month of September and October. That number is now 42 percent.

Galvalume is the one product where prices continue to be negotiable according to those taking our survey this week. Seventy one percent of those responding to our AZ questions report the product as negotiable at the domestic mills.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.