Prices

November 8, 2016

SMU Price Ranges & Indices: Mills Have Momentum, Prices Moving Higher

Written by John Packard

Steel buyers and steel mill sellers are beginning to come to the same conclusion, the steel mills have the momentum and flat rolled steel prices are beginning to rise. What may be surprising steel buyers, especially those who do not read publications like Steel Market Update, is the pace and the strength of the market swing may be greater than many thought possible. There are a number of factors affecting the psychology of this market: ferrous scrap prices are moving higher than expected and many believe scrap will continue to move higher for a number of months to come, helping to keep pressure on buyers as steel prices move higher in reaction to the higher scrap numbers. We are also seeing tremendous movement in coking coal prices which we saw this morning as being $307. ArcelorMittal made mention to how coal prices were affecting their business and you can read their comments in the earnings article in tonight’s newsletter.

We are also seeing lead times beginning to move out with some surprises – NLMK Portage hot rolled is out into early January, there are questions as to exactly where SDI lead times are as they are reporting strong bookings. We will have information on lead times in the Thursday edition of SMU as we are conducting one of our flat rolled steel market trends surveys right now.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $470-$520 per ton ($23.50/cwt- $26.00/cwt) with an average of $495 per ton ($24.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton over one week ago while the upper end rose $20 per ton. Our overall average is up $15 per ton over last week. Our price momentum on hot rolled steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $690-$740 per ton ($34.50/cwt- $37.00/cwt) with an average of $715 per ton ($35.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton over last week while the upper end jumped $30 per ton. Our overall average is up $20 per ton over one week ago. Our price momentum on cold rolled steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU Base Price Range is $34.00/cwt-$37.00/cwt ($680-$740 per ton) with an average of $35.50/cwt ($710 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same over one week ago while the upper end rose $15 per ton. Our overall average is up $7.50 per ton over last week. Our price momentum on galvanized steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU Range is $740-$800 per net ton with an average of $770 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU Base Price Range is $34.00/cwt-$37.00/cwt ($680-$740 per ton) with an average of $35.50/cwt ($710 per ton) FOB mill, east of the Rockies. The lower end of our range is unchanged over last week while the upper end increased $10 per ton. Our overall average is up $5 per ton over one week ago. Our price momentum on Galvalume steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $971-$1031 per net ton with an average of $1001 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-7 weeks

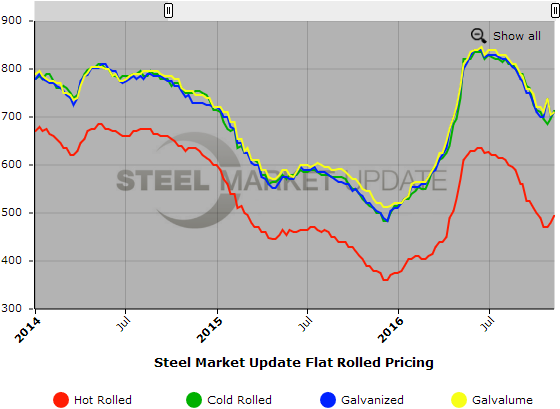

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.