Market Segment

November 1, 2016

NLMK USA: Declining Volumes Offset by Higher Pricing

Written by Sandy Williams

The NLMK Group reports combines results for its Foreign Rolled Products Segment which includes NLMK USA and six strip and plate production sites in Europe, including NLMK Dansteel in Denmark. NLMK USA is comprised of NLMK Pennsylvania, NLMK Indiana and Sharon Coating.

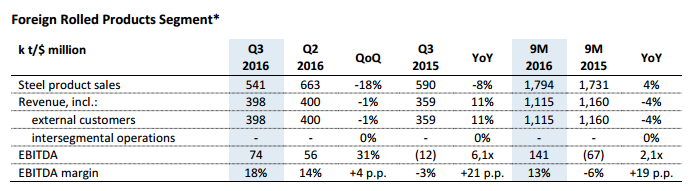

The segment saw Q3 sales decline to 541,000 tonnes, down 18 percent from Q2 and 8 percent year over year. The decrease was due to softer demand and normalization of inventory in the U.S. and seasonally slower demand in Europe. NLMK USA sales totaled 444,000 tonnes for the quarter.

Revenue for the segment totaled $398 million compared to $400 million in Q2 due to higher prices in the quarter offsetting lower sales volume. EBITDA grew 31 percent to $74 million from second quarter. EBITDA margin of 18 percent was the highest since 2008.

NLMK expects higher costs, supply discipline and ongoing trade actions to support the pricing environment in the U.S. through the end of 2016.