Market Data

November 1, 2016

ISM Manufacturing PMI Improves in October

Written by Sandy Williams

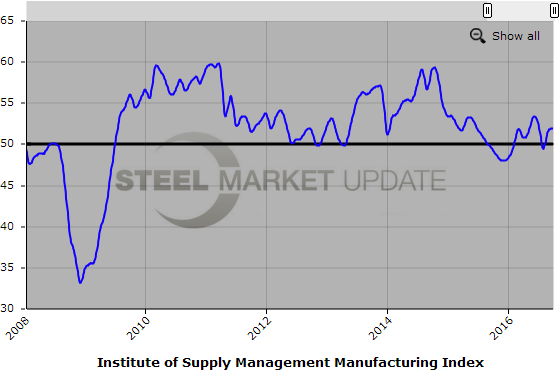

Economic activity in the manufacturing sector expanded at a faster rate in October, according to the latest Manufacturing ISM Report on Business. The PMI index, which covers manufacturing activity for the entire United States, registered 51.9, a 0.4 increase from September. A reading above 50 indicates expansion of the manufacturing economy and below 50 indicates contraction. The average reading for the past 12 months was 50.8 with a high of 53.2 in June and a low of 48.0 in Dec. 2015.

The new orders index registered 52.1, down 3 percentage points from September. Production increased 1.8 percentage points to 54.6. The backlog index decreased to 45.5 for the fourth consecutive month of contraction. The supplier deliveries index registered 52.2 indicating slower deliveries.

Inventories of raw materials contracted for the 16th consecutive month. Customer inventories were considered too low at an Index reading of 47.5. Five manufacturing industries in the October survey, including Primary Metals, Fabricated Metal Products and Transportation Equipment, reported customer inventories were too high.

Prices for raw materials increased for the eighth consecutive month. The Index rose 1.5 points to 54.5 in October.

Import increased by 3.0 percentage points to 52.0 percent after two months of contraction. Exports gained 0.5 points to register 52.5 indicating the eighth month of consecutive growth.

The employment index gained 3.2 points, climbing to 52.9 percent from 49.7 percent in September.

Bradley J. Holcomb, chair of the ISM survey committee, noted that respondents cited “a favorable economy and steady sales, with some exceptions.”

Comments from survey respondents:

- “We are looking at a considerable slowdown for October and November. Production is down 20 percent.” (Primary Metals)

- “Business is much better.” (Fabricated Metal Products)

- “Due to the hurricane and other storms, our business is up significantly.” (Machinery)

- “Ongoing strength seen in 2016 — it’s a good year.” (Miscellaneous Manufacturing)

- “Customers continue to press price reductions.” (Transportation Equipment)

- “Hard to predict oil price dynamics, but there seems to be a consensus that the market is stabilizing, at least above USD 50 bbl this month.” (Petroleum & Coal Products)

Below is a graph showing the history of the ISM Index. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.