Prices

October 30, 2016

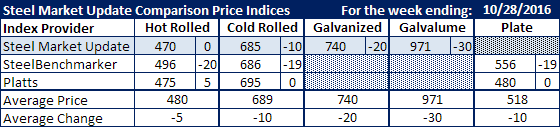

Comparison Price Indices: Bottoming Out in Preparation for the Turn

Written by John Packard

Flat rolled steel prices are bottoming out and we are already seeing the potential for hot rolled being the first product to move higher. In the table below are the three steel indexes followed by Steel Market Update.

Platts was the first index to report hot rolled prices as moving higher this past week. At $475 per ton, Platts is up $5 per ton ($0.25/cwt) compared to the prior week. SMU kept our index the same at $470 per ton while SteelBenchmarker reported their prices as being $20 per ton lower but, at $496 per ton they are well above Platts and SMU.

Cold rolled is a little more consistent with SMU and SteelBenchmarker down to $685 and $686 per ton, respectively. Platts is $10 per ton above us at $695 per ton.

SMU took both galvanized and Galvalume index averages down while the big spread continued in plate. Platts had their plate average unchanged at $480 per ton.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.