Analysis

October 26, 2016

September New Home Sales Up 3.1% After Downward Revisions

Written by Sandy Williams

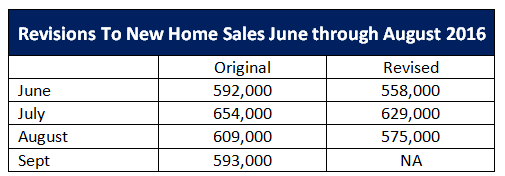

New home sales rose 3.1 percent to a seasonally adjusted annual rate of 593,000 in September, according to data from U.S. Census Bureau and the Department of Housing and Urban Development. Compared to a year ago, sales of single-family houses increased 29.8 percent. The increase follows downward revisions to June, July and August.

The median sales price was $313,500 in September and the average sales price was $377,000, up 1.9 percent and 2.7 percent from September 2015, respectively.

At the end of September an estimated 235,000 houses were for sale, representing a supply of 4.8 months at the current sales rate.

Regionally, September sales were strongest in the South at 338,000 and West at 147,000. Estimated sales in the Midwest totaled 76,000 and in the Northeast 32,000. On a year-over-year basis all four regions made gains, ranging from 25.7 percent in the South to 60.0 percent in the Northeast.

IHS Global Insight economist Kristin Reynolds wrote, “Sales of new homes rose in September, but only after sizeable downward revisions to prior months, highlighting the volatility of the data. The increase is not statistically significant, but growth compared to a year earlier is positive. The third quarter was on-track to grow faster than the second quarter, but now growth will still be solid, but not accelerate from the prior quarter.” IHS expects new home sales to progress moderately through the end of 2016.