Market Data

October 25, 2016

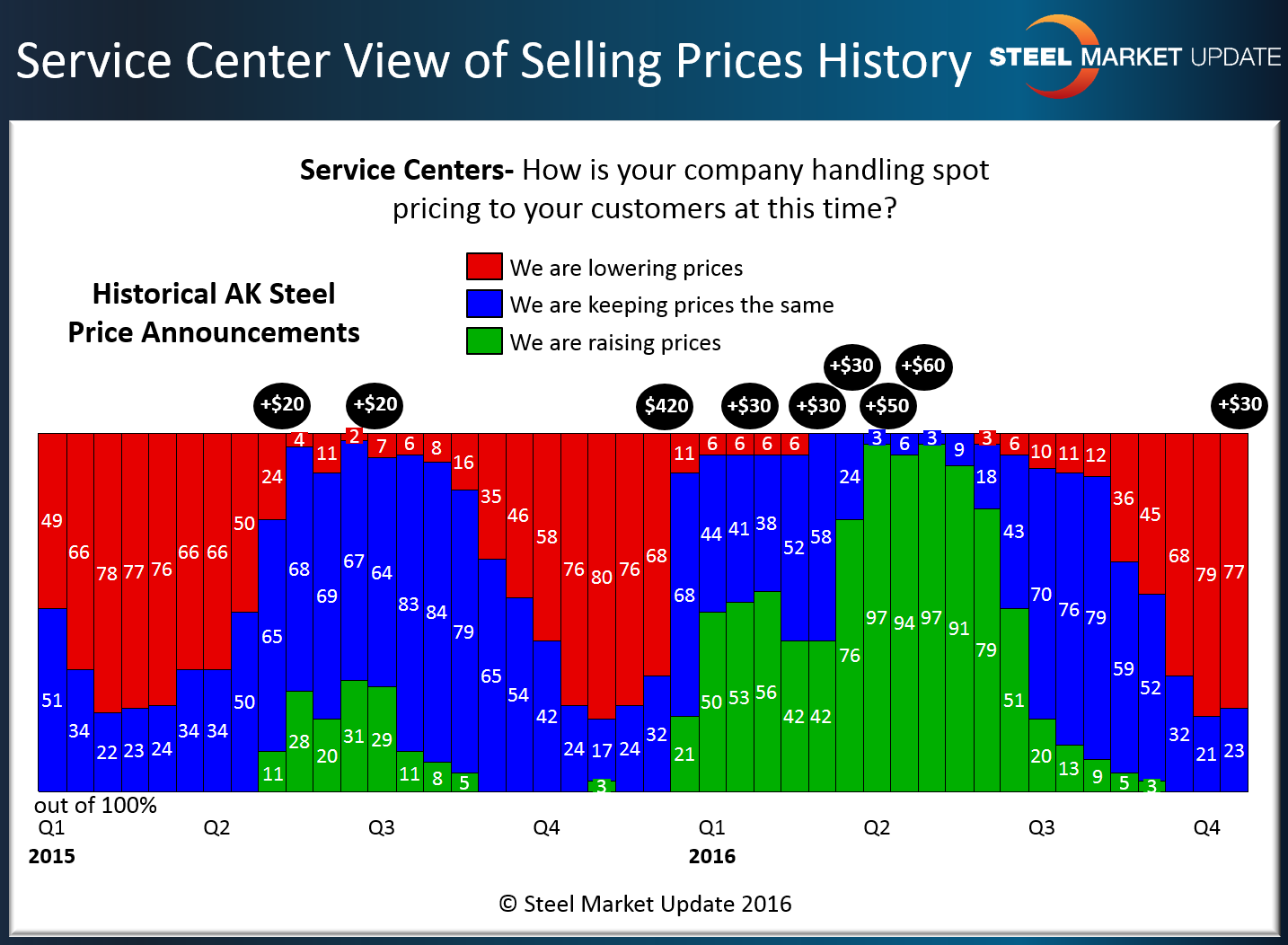

Steel Service Centers at Point of Capitulation: Supportive of Price Increase

Written by John Packard

Steel Market Update has been reporting flat rolled steel service centers had reached the point of “capitulation” earlier this month. History has shown that when the service centers reach the point of capitulation they tend to support flat rolled steel price increases being made by the domestic steel industry. Essentially, the steel distributors are attempting to remove the pain of inventories being devalued by reversing the pricing trend.

Capitulation is the point at which 75 percent of the flat rolled steel service centers report their company as lowering spot steel prices to their customers. The data is part of the Steel Market Update flat rolled steel market trends analysis which we conduct twice per month.

We concluded our most recent market trends analysis last week at which time 77 percent of our service center respondents reported their company as lowering spot pricing.

On Friday, US Steel became the first steel mill to announce a spot base price increase of $30 per ton on flat rolled steel.

The graphic below provides the history of service center spot price trend since the beginning of 2015. Each black circle with a number in it located above the red bars reference a price increase announcement made by AK Steel. We use AK Steel as our benchmark because they are the only mill that publishes their increase announcements on their website and therefore are easy to confirm at any point in time.