Prices

October 25, 2016

SMU Price Ranges & Indices: Lower Pricing Due to Last Minute Deals

Written by John Packard

The flat rolled steel markets are in a state of confusion as both buyers and sellers of steel decide what is a fair price for hot rolled, cold rolled and coated steels based on existing market conditions both in the United States but also the rest of the world. Even though there have been price increase announcements from virtually all of the domestic flat rolled steel mills, we have found orders were being placed on Friday, Monday and even, in some cases, as late as today at numbers given prior to the announcements being made.

Even one of the steel mills admitted to Steel Market Update earlier today that base prices on coated steels eroded late last week. We were told, “Market slipped to $33’s to $35. Quoting higher, but until people buy at the higher price the new price is not real yet.”

Our digging uncovered a number of adjustments (lower) in our numbers. We do not consider this to be unusual as there always seem to be a number of “special deals” being consummated just as steel prices begin to turn. Whether or not the turn actually happens is something that will be debated over the coming days. Ultimately, as the steel mills suggested to us in the quote above, buyers will begin buying again and we will see how much (if any) of the increases actually stick.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $440-$500 per ton ($22.00/cwt- $25.00/cwt) with an average of $470 per ton ($23.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to our last update on Friday of last week. Our overall average is unchanged over last week. Our price momentum on hot rolled steel has been adjusted to Neutral which means the market is in transition and we will have to wait a week or two to see exactly what direction prices will move.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $660-$710 per ton ($33.00/cwt- $35.50/cwt) with an average of $685 per ton ($34.25/cwt) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton over last week as did the upper end. Our overall average is down $10 per ton over one week ago. Our price momentum on cold rolled steel has been adjusted to Neutral which means the market is in transition and we will have to wait a week or two to see exactly what direction prices will move.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU Base Price Range is $32.50/cwt-$35.50/cwt ($650-$710 per ton) with an average of $34.00/cwt ($680 per ton) FOB mill, east of the Rockies. The lower end of our range declined $30 per ton over one week ago while the upper end dropped $10 per ton. Our overall average is down $20 per ton over last week. Our price momentum on galvanized steel has been adjusted to Neutral which means the market is in transition and we will have to wait a week or two to see exactly what direction prices will move.

Galvanized .060” G90 Benchmark: SMU Range is $710-$770 per net ton with an average of $740 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 2-8 weeks

Galvalume Coil: SMU Base Price Range is $32.50/cwt-$35.50/cwt ($650-$710 per ton) with an average of $34.00/cwt ($680 per ton) FOB mill, east of the Rockies. The lower end of our range fell $40 per ton over last week while the upper end declined $20 per ton. Our overall average is down $30 per ton over one week ago. Our price momentum on Galvalume steel has been adjusted to Neutral which means the market is in transition and we will have to wait a week or two to see exactly what direction prices will move.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $941-$1001 per net ton with an average of $971 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

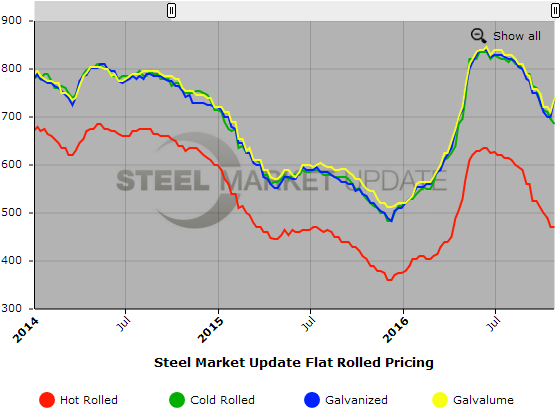

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.