Market Data

October 20, 2016

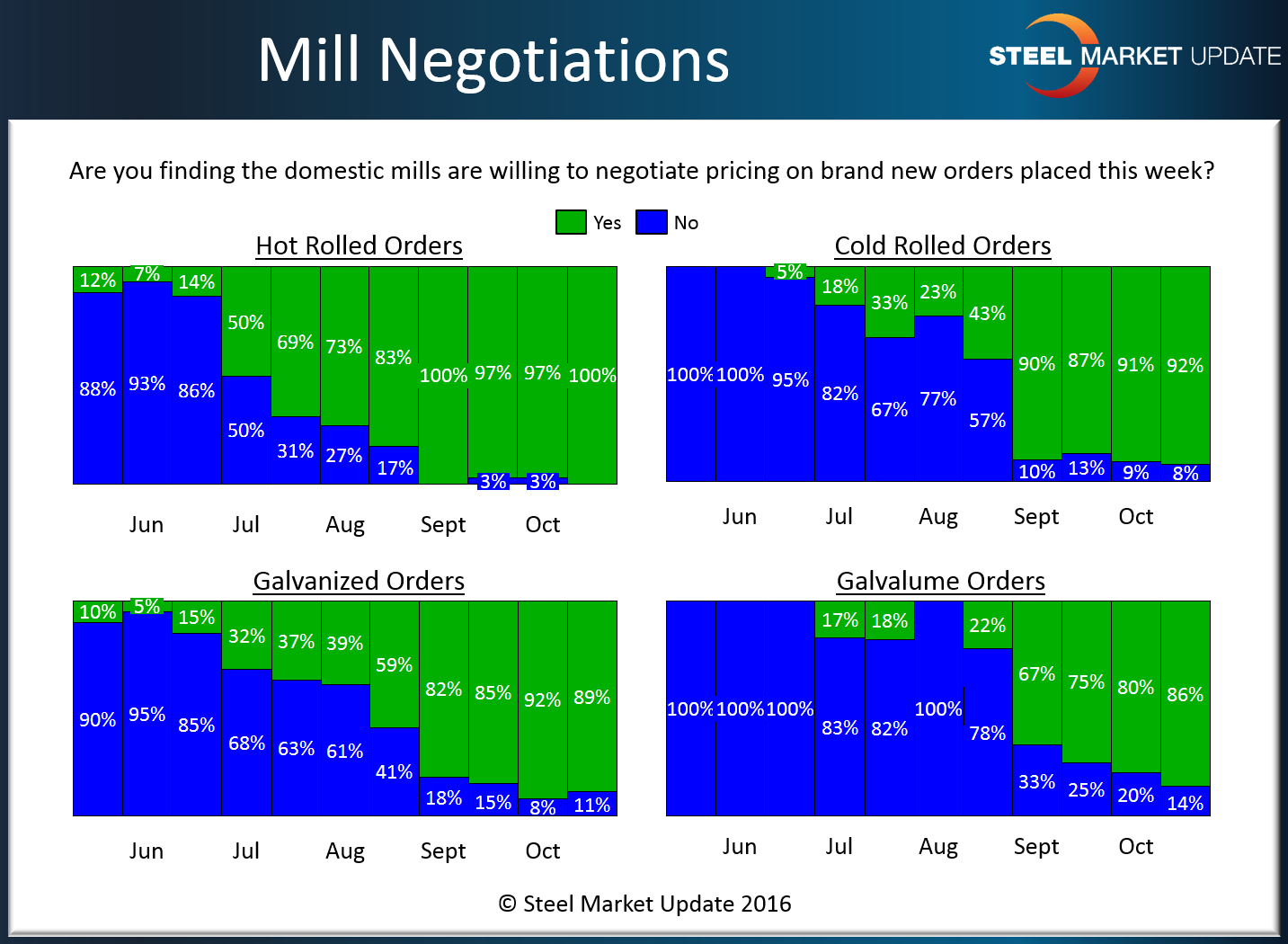

Steel Mills Still Willing to Negotiate Flat Rolled Steel Prices

Written by John Packard

The domestic steel mills in North America continue to be willing to negotiate spot steel prices on hot rolled, cold rolled, galvanized and Galvalume products according to those responding to this week’s Steel Market Update flat rolled market trends survey.

It has now been a number of months since the mills were last in a strong negotiating position. Hot rolled is no longer the weakest product as all of the flat rolled products have been bitten by the “let’s make a deal” bug.

Manufacturing companies and service centers reported unanimously that steel mills are willing to negotiate hot rolled spot prices. This has been the case on HRC negotiations since the beginning of September 2016.

Cold rolled is not quite unanimous but with 92 percent of the respondents reporting the mills as willing to negotiate CRC pricing, it might as well be. You have to go back to mid-August to see less than 50 percent of our respondents reporting spot prices as negotiable.

Galvanized is similar to cold rolled with 89 percent of the respondents reporting spot prices as negotiable and Galvalume is close behind with 86 percent. Seasonality is now coming into play with Galvalume which may be one of the reasons for that percentage increasing over the past couple of months.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.