Market Data

October 20, 2016

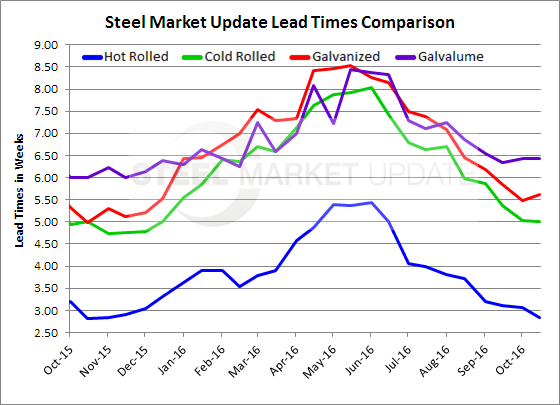

Steel Mill Lead Times: Flattening Out

Written by John Packard

Since Monday of this week Steel Market Update has been conducting a survey of the flat rolled steel market place. During the process SMU probes about a number of key topics of importance to buyers and sellers of flat rolled steel. One of the areas we deem to be very important is the status of steel mill lead times on hot rolled, cold rolled, galvanized and Galvalume steels.

Lead times are the amount of time it takes (or is promised) to produce and ship steel from the time a new order is placed. During the survey process we ask manufacturing companies and flat rolled steel service centers to provide what they are seeing as the average lead times for each. We then calculate our average based on those responses.

The lead times measured during this process are an average and are not meant to represent the lead times being quoted by any specific mill.

We have been seeing a leveling out of the flat rolled lead times over the past couple of months.

Hot rolled lead times have been hovering around 3.0 weeks since the beginning of September. This week our average came in at 2.84 barely below 3.0 weeks and almost exactly the same as what was recorded one year ago (2.82 weeks). At the beginning of September HRC lead times averaged 3.19 weeks.

Cold rolled lead times came in at 5.0 weeks essentially unchanged from the beginning of the month. At the beginning of September CRC lead times were closer to 6.0 weeks (5.87 weeks). We have seen an erosion of CRC lead times since September. One year ago CRC lead times were exactly the same at 5.0 weeks.

Galvanized lead times have been acting very much the same as cold rolled. This week we measured GI lead times as being 5.61 weeks, essentially unchanged from the beginning of the month (5.48 weeks) but down from the 6.19 weeks recorded at the beginning of September. One year ago GI lead times were averaging 5.0 weeks (4.98).

Galvalume lead times have been averaging 6.5 weeks since the beginning of September and they continued that trend this week when AZ lead times were measured to be 6.43 weeks. AZ lead times as slightly better (extended) than the 6.0 weeks recorded one year ago.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.