Market Data

October 20, 2016

SMU Steel Buyers Sentiment Index: Surprise Bounce?

Written by John Packard

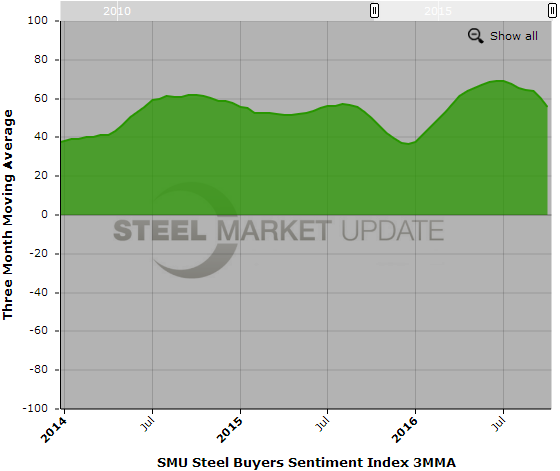

We saw a single data point “bounce” this week in both the Current and Future SMU Steel Buyers Sentiment Indexes. Does it mean anything significant? In our opinion it is too early to tell.

Current Sentiment, which measures how buyers and sellers of flat rolled steel feel about their company’s ability to be successful in the existing (current) market conditions rose to +53. The new single data point level is +10 points more optimistic (higher) than what we reported at the beginning of October. One year ago Current Sentiment was +32 so those companies buying and selling steel are in a much more optimistic place now than last year.

We prefer to look at our Sentiment Index based on a three month moving average (3MMA) which tends to take the bumps and grinds out of the single data point numbers and smooth out the data so we can better identify the underlying trend. Even with a +10 point jump the trend for Current Sentiment is waning optimism as our 3MMA came in at +54.50 down from the +55.67 reported at the beginning of the month. Even so, our Current Sentiment Index 3MMA is more optimistic today than what we saw one year ago when the 3MMA was +45.83.

SMU is a bit surprised to see a bounce at this point in time considering the drop in steel prices and demand as well as seasonal factors. We will watch this carefully going forward to see if the single data point bounce is just an aberration or the beginning of a change in anticipation of a bottoming of market prices?

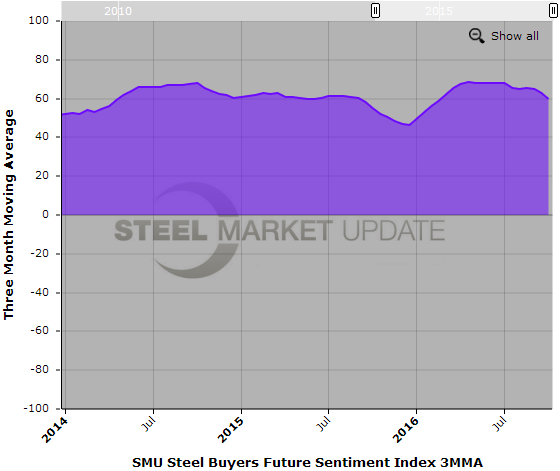

SMU Future Steel Buyers Sentiment Index

Like Current Sentiment, flat rolled steel buyers and sellers reported a bounce (more optimistic) regarding how they feel about their company’s ability to be successful 3-6 months into the future. Future Steel Buyers Sentiment Index was measured this week as being +61. We are up +10 points over what we had reported at the beginning of this month. Future Sentiment is +20 points more optimistic than what we recorded one year ago.

Looking at Future Sentiment from a three month moving average perspective we are seeing a leveling out with Steel Buyers Future Sentiment being +60.50 up a fraction of a point (+0.67) over what was reported at the beginning of this month. One year ago Future Sentiment was +51.83.

It is important to point out that positive (+) readings mean buyers and sellers are optimistic about their company’s chances for success. We actually saw the most optimistic numbers ever for our index earlier this year as Current Sentiment hit +71 twice (April 15 and July 1, 2016) and the 3MMA for Current Sentiment also reached its zenith on July 1, 2016 at +69.17.

What our Respondents are Saying

“The offshore Galvalume market has turned on the heels of the potential for circumvention issues involving Viet Nam. The general trade issues involving coated and cold rolled could possibly do the same over time. Most companies are now trying to determine when the bottom will be reached. This is a positive development.” Trading company

“Seasonal slowdown as prices try to find a bottom.” Service center

“Our annual RFQ [request for quote] is 42k tons lower than last year’s RFQ due to lower expected sales. The Koreans and Chinese sourced product manufacturers are significantly undercutting us on price and taking market share.” Manufacturing company

“Very quiet” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 41 percent were manufacturing and 44 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.