Government/Policy

October 16, 2016

Trade Cases Past & Present Limit Supply of Flat Rolled & Plate

Written by John Packard

Steel Market Update asks our readers to interact with us anytime they need help finding information or if they have a question about the steel industry. During the process of responding to these requests many times we find ourselves doing research on a topic that would be of interest to a larger audience.

On Friday one of our readers approached Steel Market Update (SMU) to see if we could help provide insights into both the existing flat rolled steel trade cases as well as past trade cases that are still in force (example: Chinese hot rolled). We rolled up our sleeves and with the help of trade attorney Lewis Leibowitz and the person who asked the original question we were able to come up with what we hope will become a master list.

The original question asked by the manufacturing company subscriber was, “Is there a chance that you have a table handy or can direct me to one that shows all countries that the DOC has AD and CVD margins against for HR, CR and CORE?”

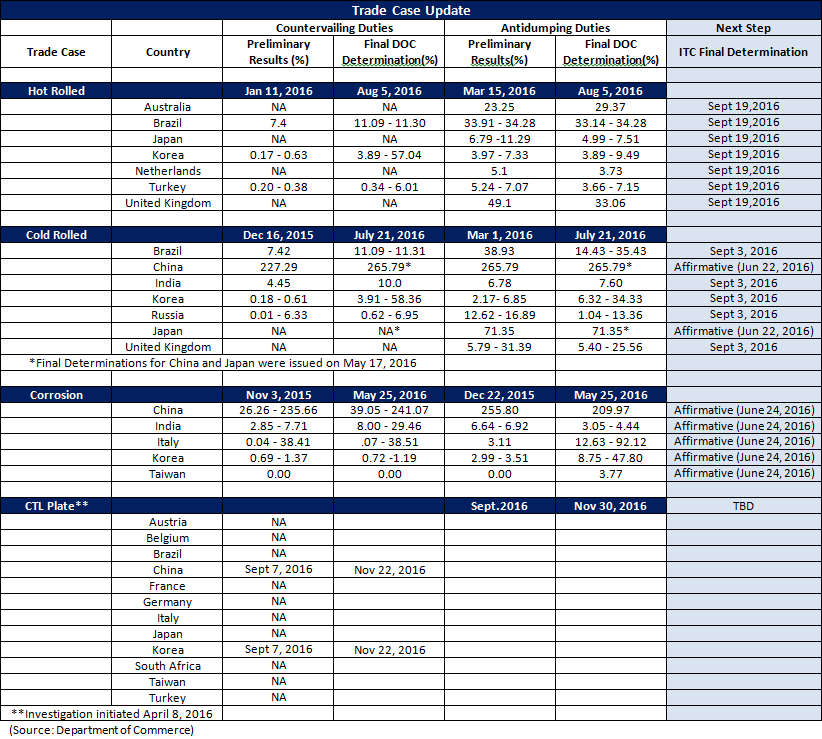

We provided a table of the existing cases as of September 2016 (see above). We then got a note back with a more detailed explanation of what the manufacturing company was trying to accomplish:

“These are all of the current cases [What we shared with him and reproduced above]. I have something similar on my side and took it a step further internally to illustrate what the cost/ton impact is when measured against world export market pricing. The presumption would be that the trader is paying something close to the world export price and the duty upon entry here would be based on that transaction price.

I’m trying to determine if there other cases that preceded these and if there are, who is involved and what duty rates are being applied? I’m guessing that there are other countries with cases and duties, but I don’t have a way to know that.”

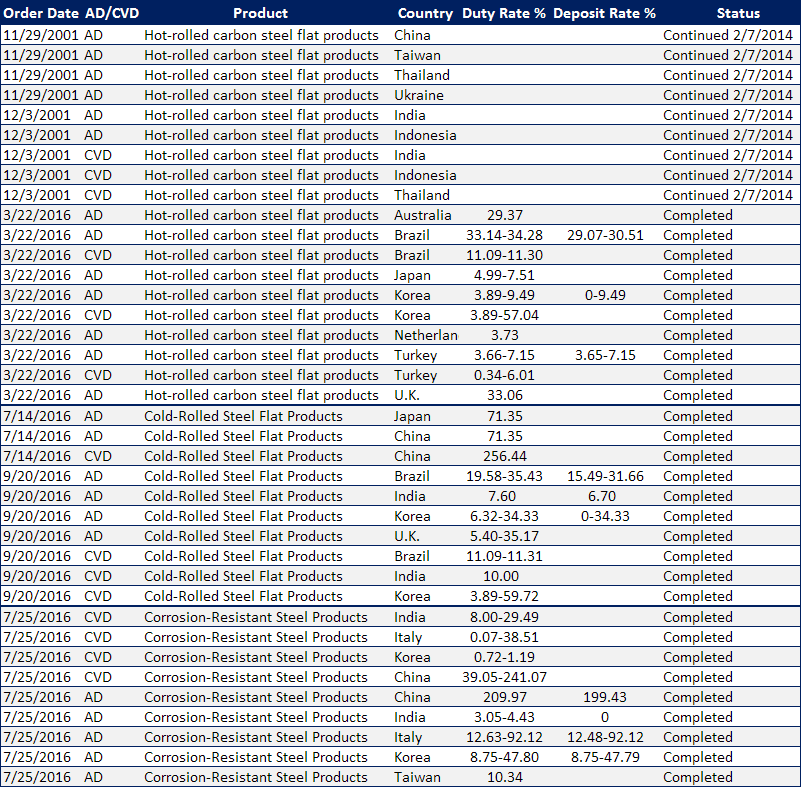

SMU reacted to the request for more information by reaching out to a couple of people who are involved with trade. The first to respond back to us was trade attorney Lewis Leibowitz who pointed us to a couple of areas within the US Department of Commerce dealing with antidumping (AD) and countervailing duties (CVD) and the status of each case/country/mill. This proved to be quite helpful and resulted in us finding the old orders that are still in force (all hot rolled). We added what we found and put the data into a new table by product.

You will notice that we have a column which is not yet filled in called “deposit rates” which are what the importer of record actually has to pay when the steel arrives. As Mr. Leibowitz explained to us on Friday, “There are no short cuts to getting effective deposit rates. I believe there are services, but you have to pay for them. I don’t use them because I know how to find them… it takes a few steps to make sure they are right–Commerce can issue amended results long after the final determination. Then there are court cases that can change them too.”

Our intention is to begin to keep track of each of these cases and building a data base for our Premium level customers (as this is time consuming and expensive to collect and maintain the data). We will populate our website with this data in the coming days.

Hot Rolled Carbon Steel

Besides the hot rolled suit filed in 2015 there are a number of countries who have dumping orders against them and are essentially prevented from bringing product into the United States due to prohibitive dumping margins having been accessed. The open orders include the following countries:

China – Original Order Date = November 29, 2001 – Status: Order continued by Commerce following 2nd Review for 5 years effective February 7, 2014.

India – Original Order Date – December 3, 2001 – Status: Order continued by Commerce following 2nd review for 5 years effective February 7, 2014. India has both AD and CVD actions against it.

Indonesia – Original Order Date – December 3, 2001 – Status: Order continued by Commerce following 2nd review for 5 years effective February 7, 2014. Indonesia has both AD and CVD actions against it.

Taiwan – Original Order Date – November 29, 2001 – Status: Order continued by Commerce following 2nd review for 5 years effective February 7, 2014.

Thailand – Original Order Date – December 3, 2001 – Status: Order continued by Commerce following 2nd review for 5 years effective February 7, 2014.

Ukraine – Original Order Date – November 29, 2001 – Status: Order continued by Commerce following 2nd review for 5 years effective February 7, 2014.

Russia – Original Order Date – July 12, 1999 – Status: Suspension agreement continued by Commerce for 5 years effective June 17, 2011. Termination of the suspension agreement and issuance of antidumping duty order effective December 19, 2014 (79 FR 77455, December 24, 2014).

You can find more information about “Sunset Reviews” on the International Trade Commission website.