Prices

October 13, 2016

Hot Rolled Futures: Winter is Coming

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

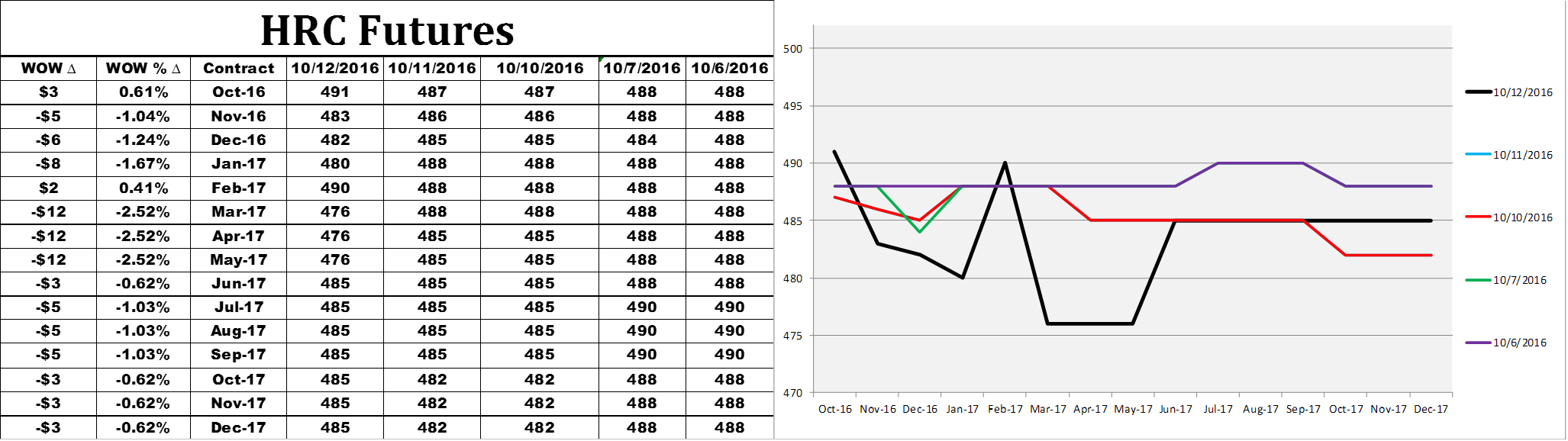

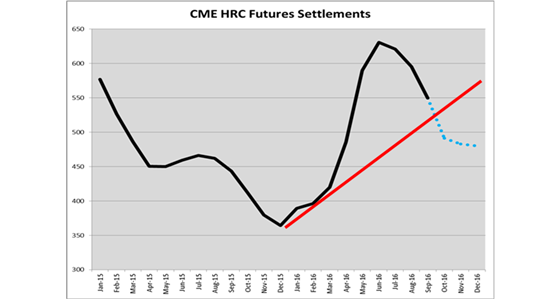

CME Midwest HRC futures took another leg down WoW and are now firmly entrenched below $500/st. If October futures settle at or below $504, HRC prices will have fallen 20% from June’s $631/st futures settlement, officially entering a bear market. The chart below shows past CME futures settlement prices with an uptrend line drawn. The blue dots are the settlement prices for Oct., Nov. and Dec. futures. Based on those settlements, HRC prices will fall into a bear market this month and break through the uptrend that began in November, 2015. A bull market that resulted in a whopping 66% gain.

So, are HRC futures and physical prices bottoming out or just getting started on their way to test the 2015 lows? It would seem that domestic fundamentals have improved in 2016. For instance, there has been significant rationalization of domestic steel mills and the success of the trade cases has shut out a massive source of downward price pressure. However, there are many influences that push flat rolled pricing.

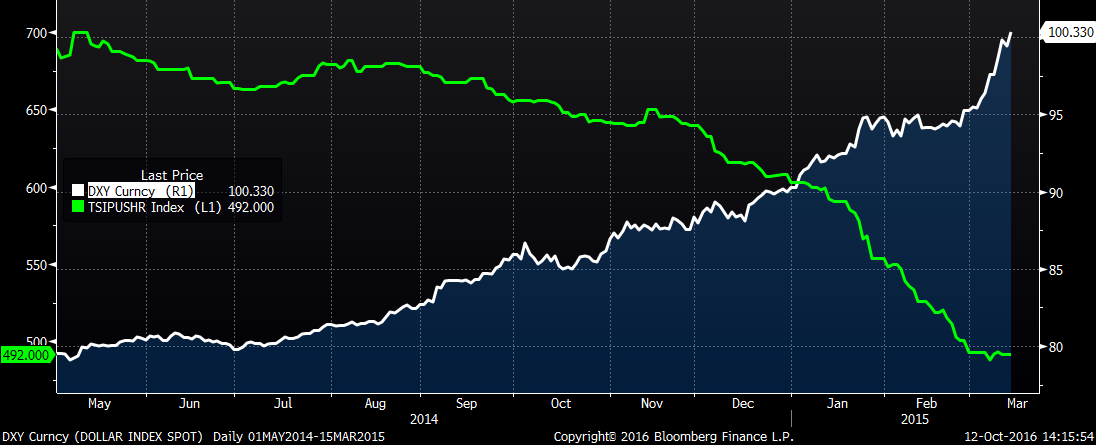

One of the stronger and most conspicuous influences is the all mighty US dollar. As you can see below, when the US dollar index significantly appreciated in 2014, it pressured all commodities lower, HRC included.

US Dollar Index vs. TSI Daily Midwest HRC Index

While the dollar’s effect on steel prices is evident, the dollar has sat in a tight down trending range since the end of 2015. In recent weeks, the dollar has begun to rally again, breaking through the downtrend that started in January, 2016. So keep watching the dollar. If it breaks out to new highs, it could answer the question above that this bear market in steel prices is just getting started.

US Dollar Index

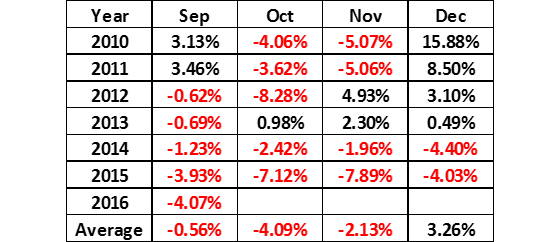

Below are the month to month settlement price changes for the CME Midwest futures back to 2010. 2014 and 2015 saw consistent MoM losses heading into the end of the year. Last month was down 4% from August and HRC futures are poised to fall again in October and enter a bear market.

If falling steel prices is bad for your business, you can transfer some of that price risk by selling short futures. The curve is currently flat in the $480 – $490 range. However, if you are uncomfortable with having an outright directional position (as opposed to the steel you own!), another hedging strategy you could employ would be to put on a “calendar spread.” In this strategy, you would sell the near term futures and buy the same number of futures later out on the curve.

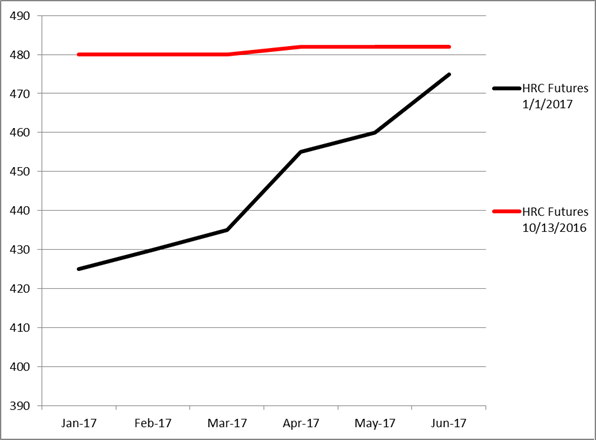

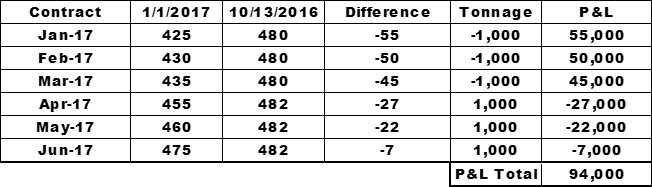

For instance, today someone sold 1000 t/m of Q1 2017 (so 1000 Jan., Feb. and Mar.) at $480 and bought 1000 t/m of Q2 2017 (so 1000 Apr., May and Jun.) at $482. If prices fall abruptly, one could see expectations of a rebound manifest itself in the forward curve. You would see the curve move into “contango” i.e. it would be upward sloping.

As far as the spread trade is concerned, the front of the curve would move down faster than the back of the curve and if you were to exit the trade using the hypothetical January 1st, 2017 settlement pricing above, the result of the trade would be a gain of $94,000:

Remember, implementing a hedging strategy can do wonders for your business. Outside of the risk transfer and stable cash flows, there are a number of other benefits. One of them I was reminded of yesterday while watching Frozen with my two and a half year old son.