Market Data

October 11, 2016

SMU Survey Capturing Challenges in Demand

Written by John Packard

One of the key questions Steel Market Update is being asked is: what is the status of steel demand being seen by manufacturers and flat rolled steel service centers in the current market? This is an area we cover during our twice monthly trends analysis of flat rolled steel market. So, let’s take a moment to look at what our survey respondents had to say about demand for their products.

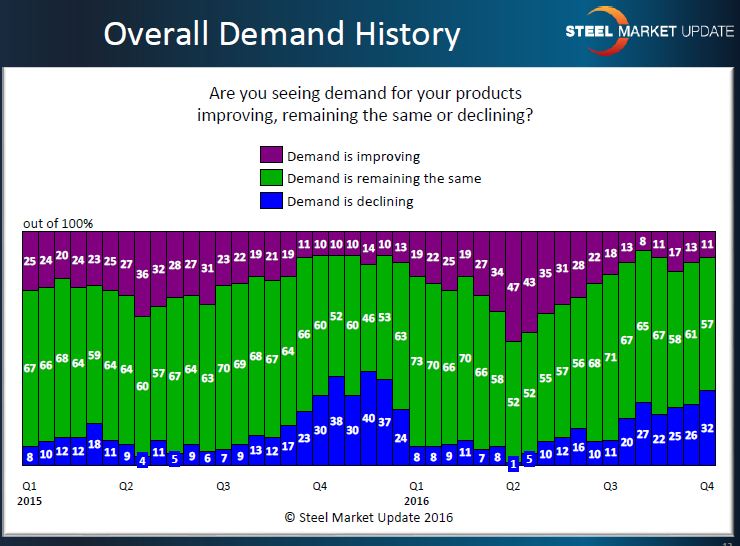

What we have been seeing is a steady slowdown in demand going back to early second quarter 2016. As we enter the fourth quarter it is normal for the industry to undergo seasonal challenges associated with the coming of winter and the Holidays in November and December and we are seeing that again this year.

The responses we received last week from all of our respondents are typical for early fourth quarter levels as you can see by the graphic below which represents the opinions of all of the individuals participating this past week (for more details about those participating go to the end of this article):

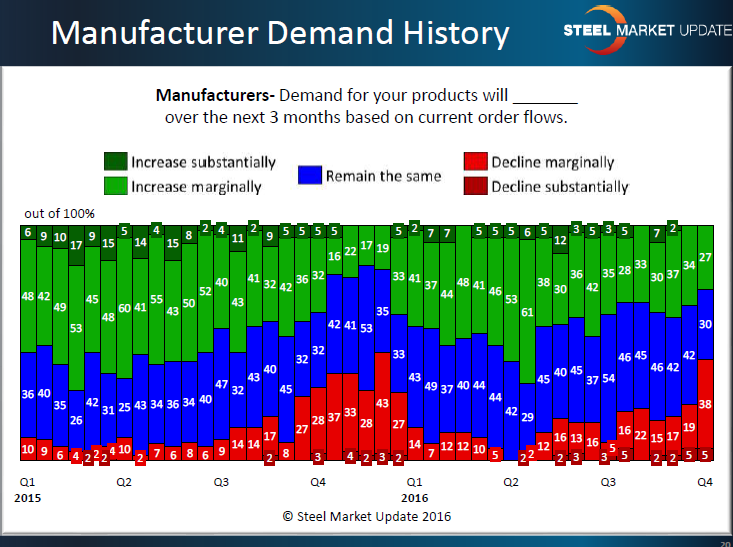

However, when looking at data coming from just the manufacturing sector we saw some breaks with what we reported for demand last year. One year ago 31 percent of the manufacturing companies were reporting demand as declining either marginally or substantially. This year that number is 43 percent. One year ago 37 percent of manufacturing companies were reporting demand as either increasing marginally or substantially. This year we found 27 percent of manufacturing companies reporting improving demand. So, from the manufacturing responses we received last week demand does appear to be coming under some stress. Again, we believe a portion of the weakening is related to normal season factors but we can’t ignore the double digit changes when compared to one year ago and we will need to watch to see if this negative trend continues into 1st Quarter 2017.

What Our Respondents Had to Say

“Heavy manufacturing and infrastructure projects remain depressed, evidenced by the lack of plate consumption currently in N. America. Likely, this is an effect generated by the uncertainty of the U.S. presidential election and should correct (regardless of candidate) once a new fiduciary policy is put into place.” Steel mill

“Demand has slowed considerably , very quiet, everyone asking what is going on?” Service center

SMU Steel Market Trends Survey Participants

Last week Steel Market Update (SMU) conducted our early October flat rolled steel market trends analysis. We invite just shy 550 companies to participate and the breakdown of what kind of companies participated in last week’s survey is as follows: 44 percent were service centers/wholesalers, 42 percent where manufacturing companies, 7 percent were trading companies, 4 percent toll processors and 3 percent steel mills.