Market Data

October 9, 2016

Service Center Spot Steel Resell Prices Reaching the Point of Capitulation?

Written by John Packard

Both manufacturing companies and flat rolled steel service centers are reporting more than 75 percent of the distributors as offering ever lower spot steel prices. The 75 percent level is important to Steel Market Update as we have pegged it as the level, when reached and maintained, as being the point of Capitulation. That point where service centers can no longer tolerate the devaluation of their inventories and begin suggesting it is time for the domestic steel mills to raise flat rolled steel prices which the service centers will then support.

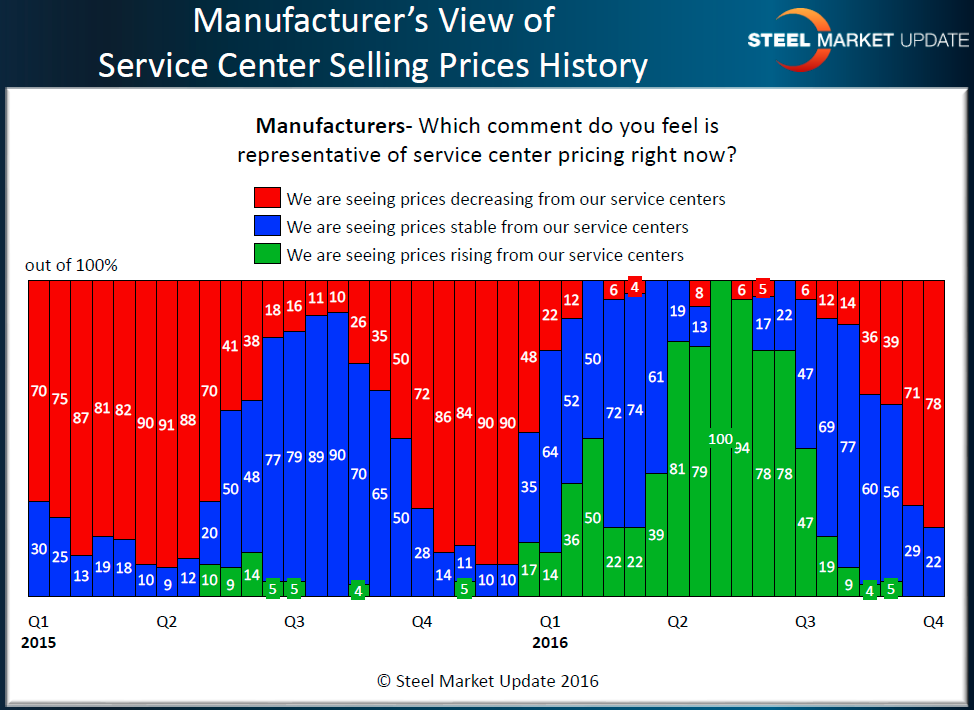

Seventy-eight percent of the manufacturers who responded to last week’s flat rolled steel market trends survey reported their distributor suppliers as offering lower spot prices. This is six points higher than two weeks ago and double what was reported at the beginning of September (39 percent).

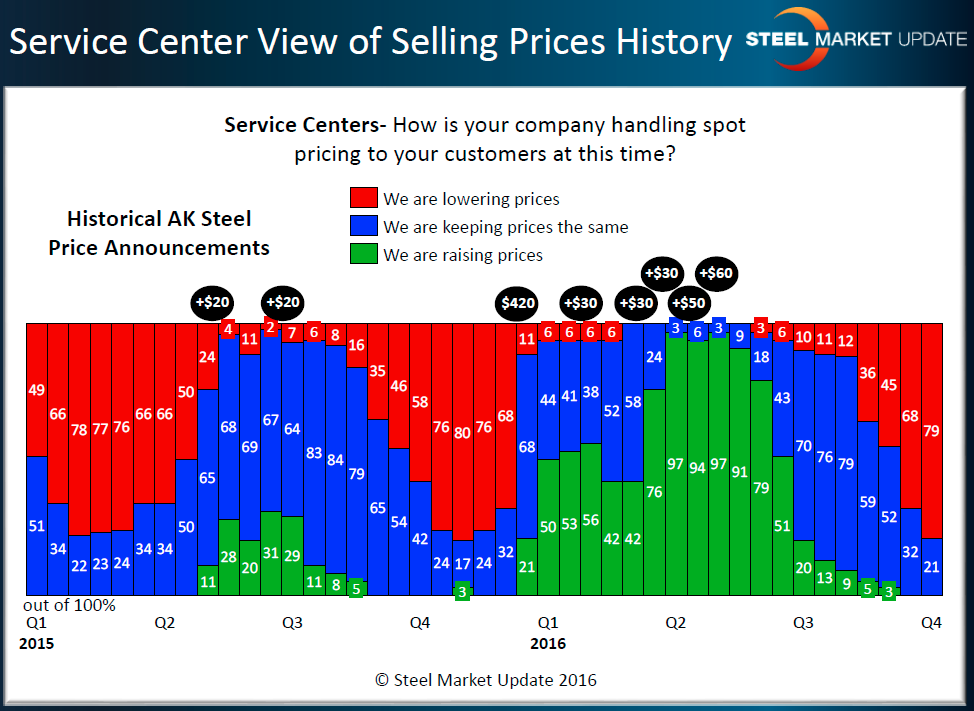

Service centers were nearly identical with seventy-nine percent of the distributors advising that their company was lowering flat rolled steel prices into the spot markets. This is eleven points higher than two weeks ago and thirty-four percentage points higher than what we reported for distributors at the beginning of September.

SMU believes that true “capitulation” may take some time as many service centers are adjusting their spot sales prices to reflect their replacement costs which have been dropping since orders were placed in late June/early July. That lower priced steel is now hitting the distributors’ docks and there is even cheaper cost steel coming behind it.

We need to hear more comments like this one which was left behind during the survey process last week, “We are doing the best we can to keep pricing but competition is forcing us to lower some pricing.” As opposed to another comment from a second service center, “Adjusting as necessary and relative to replacement cost.” Capitulation comes when there is pain associated with the lowering of prices and that could take a few weeks (or longer) to occur based on our past experience and opinion.

We have provided the historical graphics associated with both the manufacturing companies responses and those of the service centers/wholesalers to provide some context for those of you making buying or selling decisions based on what you think will happen with steel prices (and when). The service center graphic has the AK Steel price increase announcements above the bars as a point of reference for our readers.

Also, please note that Premium level members/subscribers have access to most of the survey data produced by Steel Market Update twice per month. The data is now on our website for our Premium level members and those on a trial of our products and can be found under the Analysis tab on our website (must be logged in). If you are an Executive level subscriber and would like more information about becoming a Premium level member please contact us at 800-432-3475 or info@SteelMarketUpdate.com