Market Data

October 6, 2016

SMU Steel Buyers Sentiment Index Plunges

Written by John Packard

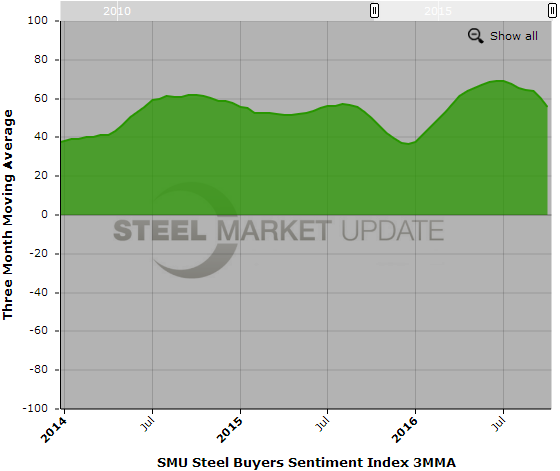

Buyers and sellers of flat rolled steel are becoming less enthusiastic about their company’s ability to be successful both now and into the near future. SMU Steel Buyers Sentiment Index has been steady decline since peaking with an all time high of +71 in early July 2016. Based on our latest market trends analysis Current Sentiment is at its lowest point at +43 since the middle of December 2015.

We are attributing much of the change to a less optimistic Sentiment trend to the erosion we have seen in flat rolled pricing over the past few months. We are also seeing more competitive pressures within the service center segments of the industry as distributors fight over the orders that are available and also attempt to remove higher cost inventories.

Here are the Current Sentiment key data points: At +43 (this is a single data collection point and not our 3 month moving average) our index dropped 6 points from the +49 reported during the middle of September and is down 20 points in just the past 30 days. One year ago Current Sentiment was +37 and the trend was rising.

When looking at Current Sentiment from a 3 month moving average (3MMA) perspective the latest number is +55.67 down from the +60.33 reported two weeks ago and even further below the +63.67 reported at the beginning of June. One year ago Current Sentiment 3MMA was +49.83 so we continue to be above year ago levels but the trend lines are moving in opposite directions.

SMU Future Steel Buyers Sentiment Index

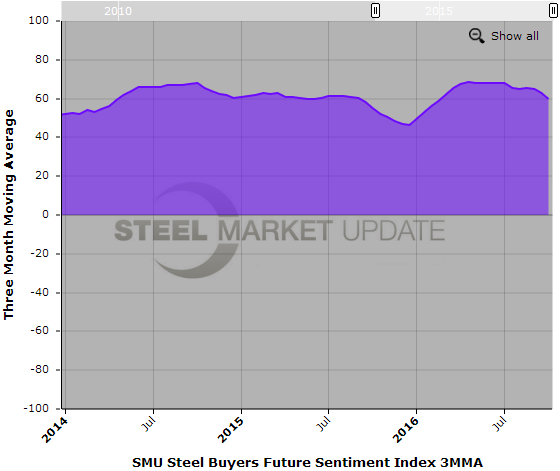

Future Sentiment, which measures how buyers and sellers of flat rolled steel feel about their company’s ability to be successful three to six months into the future, dropped to a 10 month low at +51. This new single data point number is 8 points lower than mid-September and is at its lowest point since mid-December 2015. One year ago our single data point Future Sentiment was reported by SMU to be +43.

Looking at Future Sentiment from a 3 month moving average perspective the new number is +59.83 which is down from the +62.83 reported two weeks ago and the +64.83 recorded one month ago. One year ago Future Sentiment 3MMA was +55.0.

What our Respondents are Saying

“Our spreads will be negatively impacted by the drop in CRU, so we are tempering our outlook. However, as compared to our peer group we expect less negative impact due to our purchasing strategies.” Service center

“Other service centers in our market are selling the price short, at or below replacement.” Service center

“Demand is still mushy and pricing almost ridiculous.” Service center

“Hoping for some opportunities now that steel prices are coming down.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 43 percent were manufacturing and 44 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.