Market Data

October 6, 2016

Global Economic Outlook: IMF October 2016

Written by Peter Wright

We include here an unabridged statement from the IMF that was released on Tuesday this week which forecasts economic growth for all regions and nations through 2021. The IMF reduced its forecast for economic growth in the US in 2016 from 2.4 percent in the April forecast to 1.68 percent and in 2017 from 2.5 percent to 2.2 percent. Our SMU data analysis follows with comments about the future of global and domestic steel demand through 2021. We believe that an understanding of global influences is essential if we are to have any idea what the future of the US steel market will look like.

![]() IMF Sees Subdued Global Growth, Warns Economic Stagnation Could Fuel Protectionist Calls

IMF Sees Subdued Global Growth, Warns Economic Stagnation Could Fuel Protectionist Calls

Global economic growth will remain subdued this year following a slowdown in the United States and Britain’s vote to leave the European Union, the IMF said in its October 2016 World Economic Outlook. “Taken as a whole, the world economy has moved sideways,” said IMF chief economist and economic counsellor, Maurice Obstfeld. “We have slightly marked down 2016 growth prospects for advanced economies while marking up those in the rest of the world,” he said.

The report highlighted the precarious nature of the recovery eight years after the global financial crisis. It raised the specter that persistent stagnation, particularly in advanced economies, could further fuel populist calls for restrictions on trade and immigration. Obstfeld said such restrictions would hamper productivity, growth, and innovation. “It is vitally important to defend the prospects for increasing trade integration. Turning back the clock on trade can only deepen and prolong the world economy’s current doldrums.”

To support growth in the near term, the central banks in advanced economies should maintain easy monetary policies, the IMF said. But monetary policy alone won’t restore vigor to economies dogged by slowing productivity growth and aging populations, according to the new report. Where possible, governments should spend more on education, technology, and infrastructure to expand productive capacity while taking steps to alleviate inequality. Many countries also need to counteract waning potential growth through structural reforms to boost labor force participation, better match skills to jobs, and reduce barriers to market entry.

The world economy will expand 3.1 percent this year, the IMF said, unchanged from its July projection. Next year, growth will increase slightly to 3.4 percent on the back of recoveries in major emerging market nations, including Russia and Brazil.

Advanced Economies: U.S. Slowdown, Brexit

Advanced economies will expand just 1.6 percent in 2016, less than last year’s 2.1 percent pace and down from the July forecast of 1.8 percent. The IMF marked down its forecast for the United States this year to 1.6 percent, from 2.2 percent in July, following a disappointing first half caused by weak business investment and diminishing pace of stockpiles of goods. U.S. growth is likely to pick up to 2.2 percent next year as the drag from lower energy prices and dollar strength fades. Further increases in the Federal Reserve’s policy rate “should be gradual and tied to clear signs that wages and prices are firming durably.” Uncertainty following the “Brexit’’ referendum in June will take a toll on the confidence of investors. U.K. growth is predicted to slow to 1.8 percent this year and to 1.1 percent in 2017, down from 2.2 percent last year.

The euro area will expand 1.7 percent this year and 1.5 percent next year, compared with 2 percent growth in 2015.

“The European Central Bank should maintain its current appropriately accommodative stance,” the IMF said. “Additional easing through expanded asset purchases may be needed if inflation fails to pick up.”

Growth in Japan, the world’s number 3 economy, is expected to remain subdued at 0.5 percent this year and 0.6 percent in 2017. In the near term, government spending and easy monetary policy will support growth: in the medium term, Japan’s economy will be hampered by a shrinking population.

Emerging Market Growth Expected to Accelerate

In emerging market and developing economies, growth will accelerate for the first time in six years, to 4.2 percent, slightly higher than the July forecast of 4.1 percent. Next year, emerging economies are expected to grow 4.6 percent. However, prospects differ sharply across countries and regions.

In China, policymakers will continue to shift the economy away from its reliance on investment and industry toward consumption and services, a policy that is expected to slow growth in the short term while building the foundations for a more sustainable long-term expansion. Still, China’s government should take steps to rein in credit that is “increasing at a dangerous pace’’ and cut off support to unviable state-owned enterprises, “accepting the associated slower GDP growth,” the IMF said. China’s economy, the world’s second largest, is forecast to expand 6.6 percent this year and 6.2 percent in 2017, down from growth of 6.9 percent last year.

“External financial conditions and the outlook for emerging market and developing economies will continue to be shaped to a significant extent by market perceptions of China’s prospects for successfully restructuring and rebalancing its economy,’’ the IMF said.

Growth in emerging Asia, and especially India, continues to be resilient. India’s gross domestic product is projected to expand 7.6 percent this year and next, the fastest pace among the world’s major economies. The IMF urged India to continue reform of its tax system and eliminate subsidies to provide more resources for investments in infrastructure, education, and health care.

Sub-Saharan Africa’s largest economies continue to struggle with lower commodity revenues, weighing on growth in the region. Nigeria’s economy is forecast to shrink 1.7 percent in 2016, and South Africa’s will barely expand. By contrast, several of the region’s non-commodity exporters, including Côte d’Ivoire, Ethiopia, Kenya, and Senegal, are expected to continue to grow at a robust pace of more than 5 percent this year.

Economic activity slowed in Latin America, as several countries are mired in recession, with recovery expected to take hold in 2017. Venezuela’s output is forecast to plunge 10 percent this year and shrink another 4.5 percent in 2017. Brazil will see a contraction of 3.3 percent this year, but is expected to grow at 0.5 percent in 2017, on the assumption of declining political and policy uncertainty and the waning effects of past economic shocks.

Countries in the Middle East are still confronting challenging conditions from subdued oil prices, as well as civil conflict and terrorism.

Overarching Policy Challenge

Given the still weak and precarious nature of the global recovery, and the threats it faces, the IMF underscored the urgent need for a comprehensive, consistent, and coordinated policy approach to reinvigorate growth, ensure it is distributed more evenly, and make it durable. “By using monetary, fiscal, and structural policies in concert—within countries, consistent over time, and across countries—the whole can be greater than the sum of its parts,” Obstfeld concluded.

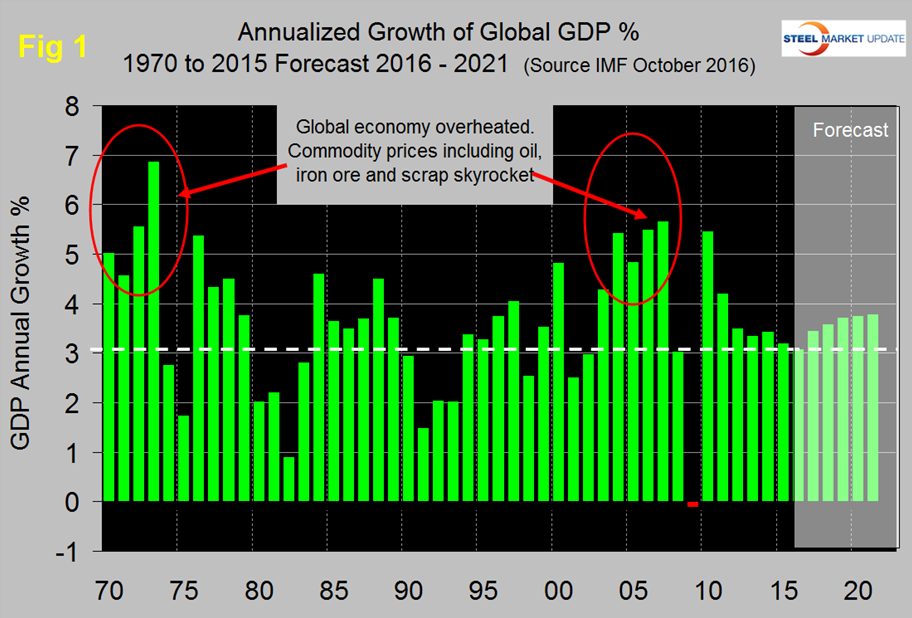

SMU Data Analysis: Figure 1 shows the growth of global GDP since 1970 with this month’s IMF forecast through 2021.

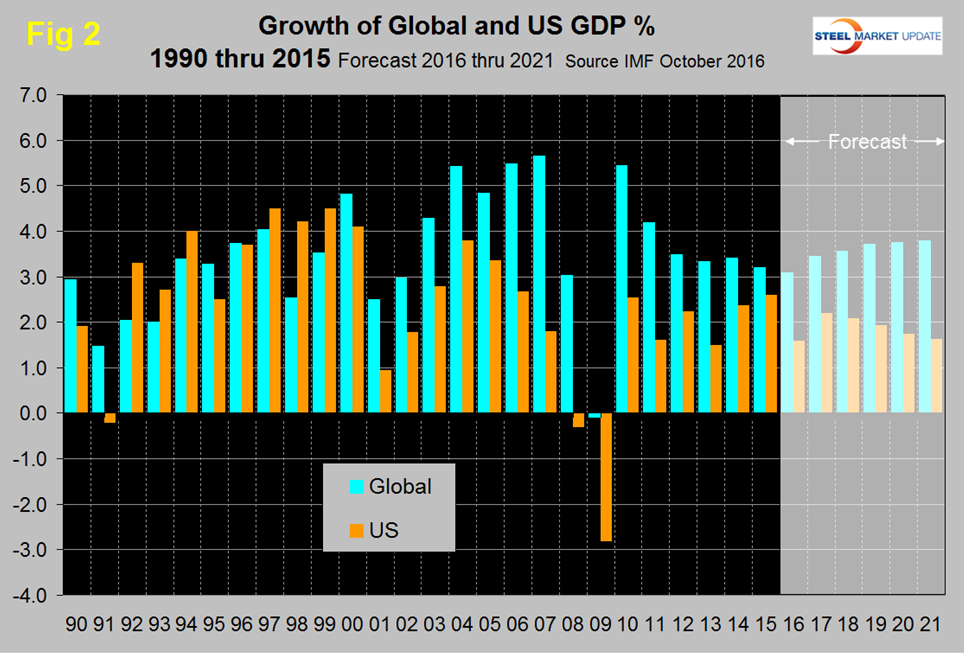

We have highlighted the periods of the early seventies and the mid 2000s when the commodity bubbles prevalent at those times were driven by unusually high and sustained global growth. The collapse of the commodity bubble in the last decade coincided with the US banking and housing crisis, setting up the perfect storm. Global growth has lacked volatility and gradually declined in the years 2012 through 2016 followed by a forecasted slow improvement through 2021. Prior to the 2001 recession, the US held its own in the economic growth stakes but between 2001 and 2008, growth in the US averaged 1.84 percent less per year than the growth of the global economy as a whole (Figure 2).

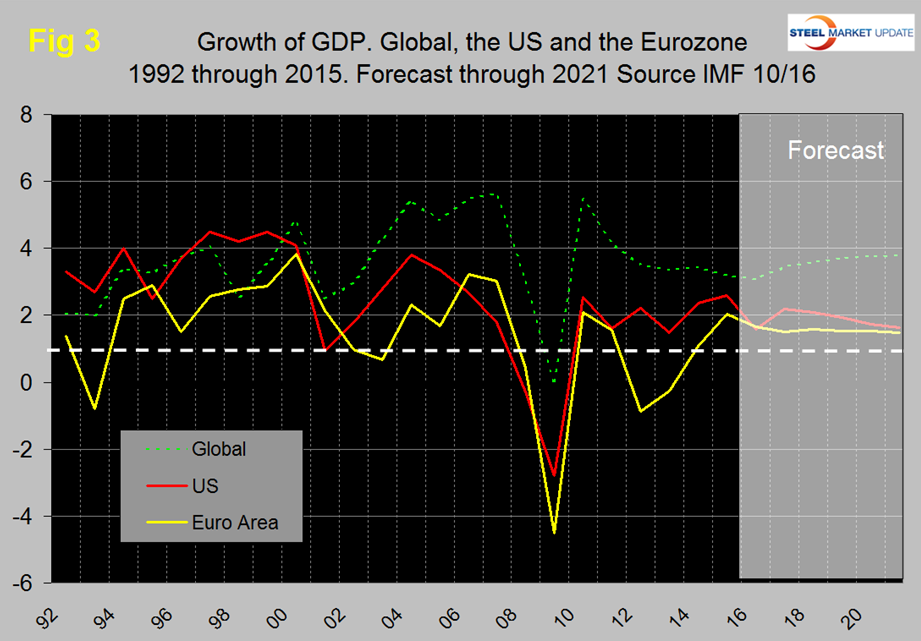

In the years 2011 through 2015 the gap narrowed to 0.60 percent. The difference is forecast to widen to 2.16 percent as global growth climbs back to 3.78 in 2021. The US has outperformed the Eurozone in every year since 2008 and is forecast to continue to do so through 2021 (Figure 3) though the gap is expected to close.

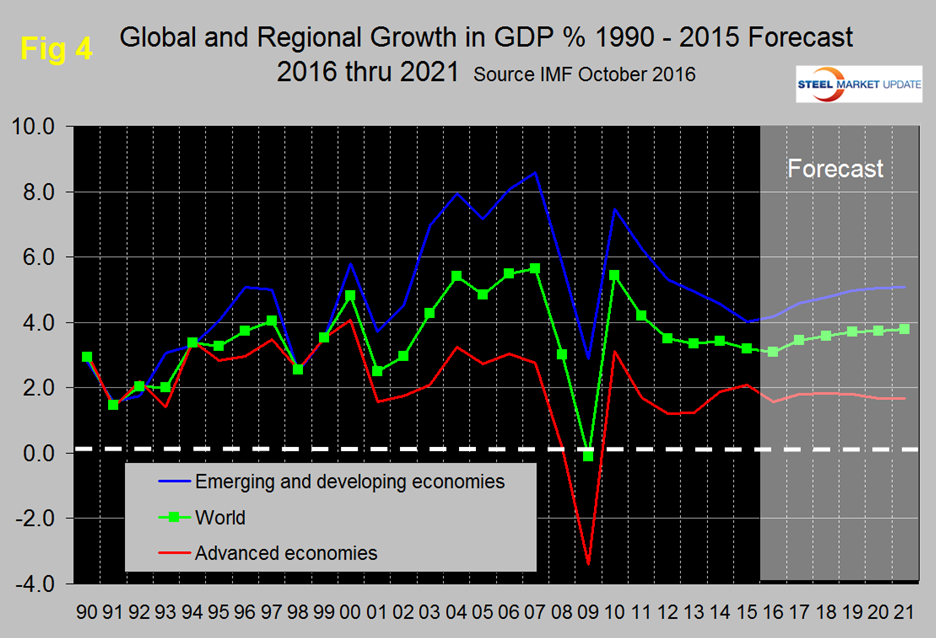

Figure 4 shows the growth comparison between emerging and developing economies and the advanced economies, that gap is projected to widen in the rest of this decade.

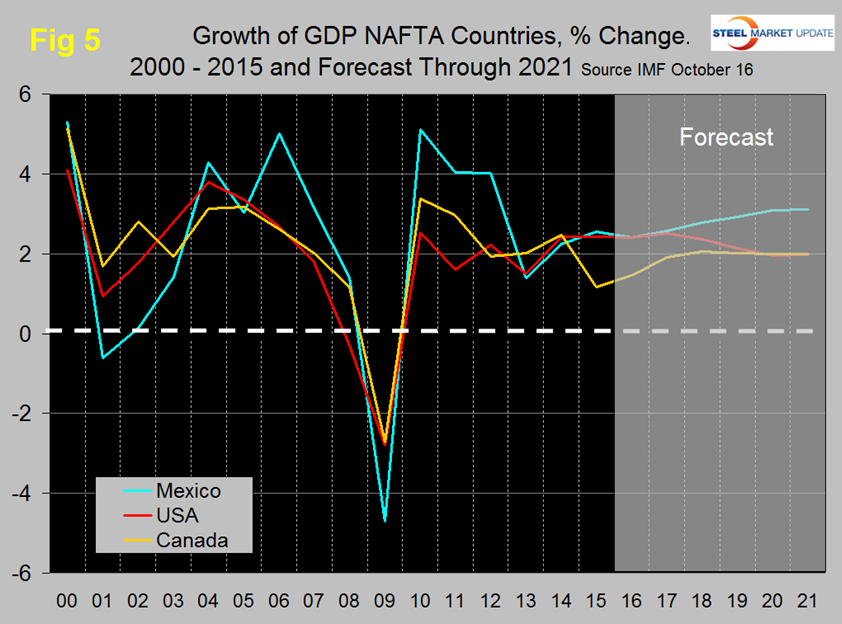

Within NAFTA, the growth of GDP of all three nations coincided in 2014. Mexico and the US will track each other through 2017 then Mexico will pull away as the US growth declines. Canada performed relatively badly in 2015 and is expected to catch up with the US in 2019 through 2021 (Figure 5).

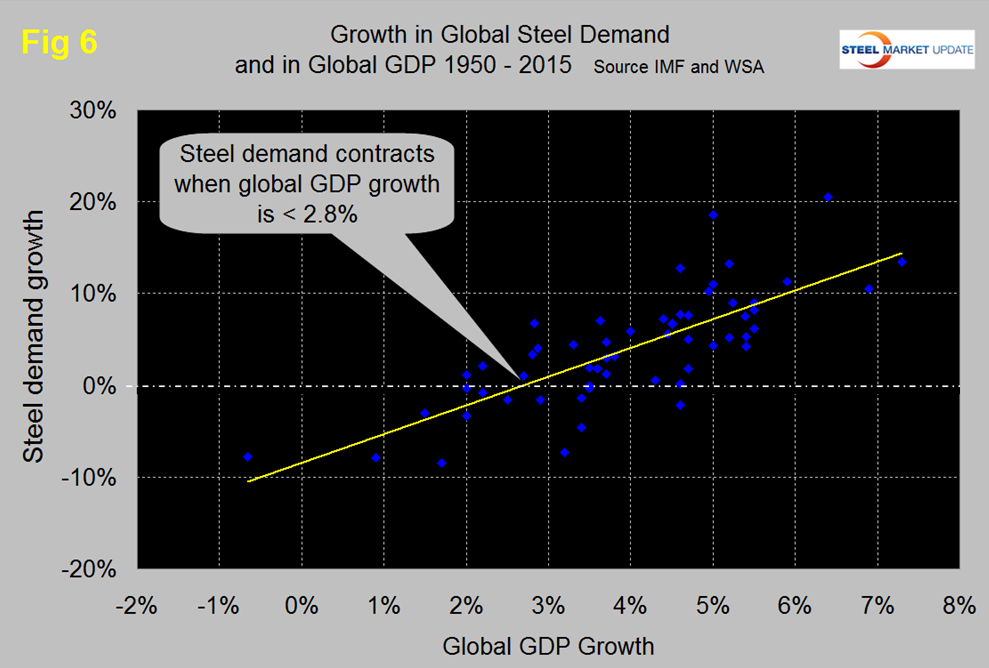

There is a relationship between the growth of GDP and steel demand at both the international and national level which also extends to other commodities such as cement. There are two interesting aspects to this relationship. First, the cyclical change in steel demand is vastly more volatile than the change in GDP which we attribute to the inventory response throughout the supply chain. Secondly, as discovered by our friends at “Steel Guru,” 1 percent growth in GDP does not result in 1 percent growth in steel demand. At the global level it takes a 2.8 percent increase in GDP to get any increase in steel demand (Figure 6).

This is a long term average over a period of 65 years and based on the added volatility of steel can be a predictor of the immediate future. For example, after the disastrous decline in steel demand in 2009 there was no doubt that a huge cyclical rebound would occur as inventory managers throughout the world began to react to the economic recovery. If the IMF forecast proves to be correct then the growth in steel demand will improve to around 3 percent next year. In the US steel market it requires about 2.5 percent growth in GDP to generate growth in steel demand, therefore, if current forecasts prove to be correct regarding the US economy, we cannot expect a surge in steel demand in this decade.