Analysis

October 4, 2016

U.S. Auto Sales Slide Into Autumn

Written by Sandy Williams

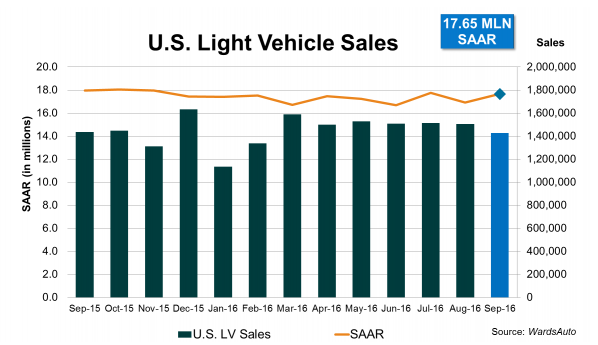

WardsAuto reports total volume for U.S. light vehicle sales in September was 1.428 million units, down 0.7 percent from a year ago. The seasonally adjusted annual rate for September rebounded to 17.7 million units from August’s total of 16.9 million, but was below the 18 million mark reached in September 2015.

Most automotive manufacturers reported single digit year-over-year declines in September. Exceptions were FCA US and Mercedes-Benz, each with sales up 3 percent and Subaru up 14.7 percent. General Motors and Ford sales fell 5.2 percent and 8.8 percent, respectively.

“If the 4-month pattern continues in October, and its SAAR falls well short of September’s and inventory levels remain above year-ago totals, expect a strong end of the year, with volumes gaining momentum in November that lasts into December. Furthermore, October’s SAAR also could fall off from September’s because it is the start of the ’17 model-year and automakers might want to test how well pricing holds up on their newer vehicles by decreasing incentive activity.”

Despite softer September sales the automotive industry is still turning in strong performances month after month.

“Key economic fundamentals like a strong jobs market, rising personal incomes, low fuel prices and low interest rates continue to point toward strong industry performance,” said Mustafa Mohatarem, GM’s chief economist. “We think the industry is well positioned for a continued high level of customer demand into the foreseeable future.”