Government/Policy

October 4, 2016

Commerce Amends HR Dumping Duties for Australia, Korea and Turkey

Written by Sandy Williams

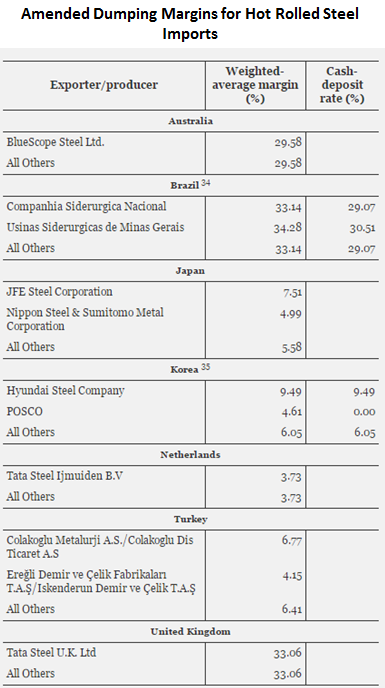

The Department of Commerce announced adjustment to the antidumping duties assigned to Australia, Korea and Turkey in the hot rolled steel investigation.

Regarding the Australia AD orders, Commerce agreed with the Petitioners that there were two ministerial errors. The Department failed to fully adjust BlueScope Steel’s normal value for processing revenue and freight revenue. It, therefore, increased BlueScope’s weighted-average dumping margin from 29.37 to 29.58. Because the “all others” margin is based solely on BlueScope’s margin, the “all others” margin was increased to 29.58.

The Department found that in the Korea determination there were ministerial errors in calculating the margin for POSCO that did not correctly implement certain revised indirect selling expense figures. The antidumping margin for POSCO has been increased from 3.89 percent to 4.61 percent. The “all others” rate is based in part on POSCO’s dumping margin so it has been increased to 6.05 percent from 5.55 percent.

Turkey steel mill Colakoglu alleged that an incorrect denominator was use in its calculation of indirect selling expenses ratio. Commerce agreed and reduced Colakoglu’s AD margin from 7.15 percent to 6.77 percent. Several errors in the calculation of dumping margins for Ereğli Demir ve Çelik Fabrikalari T.A.Ş. and its Affiliates (Erdemir) resulted in a margin increase from 3.66 percent to 4.15 percent. Because subsidies by the government of Turkey were determined to be negligible, the accompanying countervailing investigation was terminated and the cash deposit rates were eliminated. The “all others” rate increased to 6.41 percent based on Colakoglu’s and Erdemir’s amended margins.