Prices

October 2, 2016

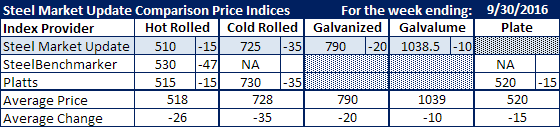

Comparison Price Indices: The Pace of Sinking Prices Picks Up

Written by John Packard

Flat rolled steel prices took a nose dive this past week according to the steel indexes followed by Steel Market Update. We saw large double digit drops in hot rolled, cold rolled, galvanized, Galvalume and plate.

Benchmark hot rolled continues its march toward sub-$500 per ton averages. We lowered our average by $15 per ton to $510 per ton. Platts also dropped their HRC average by $15 and their $515 per ton number is close to ours. Steelbenchmarker, which only produces prices twice per month, shed $47 per ton off their index average but they still trail SMU and Platts by $15-$20 per ton.

On cold rolled both SMU and Platts saw prices down $35 per ton taking our index average to $725 per ton while Platts moved their number to $730 per ton. For some reason SteelBenchmarker did not report cold rolled prices this past week.

SMU saw galvanized prices as being $20 per ton lower last week than the previous week. We are now reporting .060” G90 galvanized as being $790 per ton.

Galvalume dropped $10 per ton (SMU) while Platt prices were seen as being $15 per ton lower than the week prior.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.