Market Data

September 30, 2016

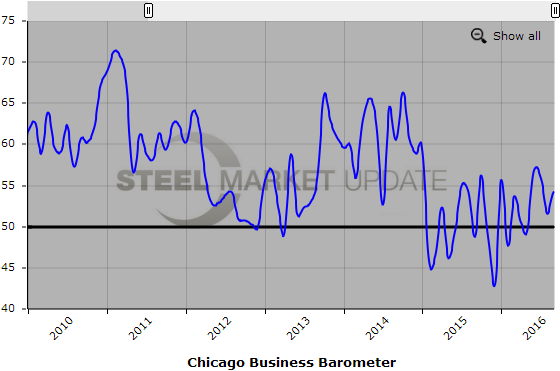

Production Increases Reflected in Chicago Business Barometer

Written by Sandy Williams

The September Chicago Business Barometer indicated that production was at its highest level since January of this year. The Barometer rose 2.7 points to 54.2 on strong gains in production. The production index jumped 7.3 points to 59.8 while new orders remained unchanged from August.

Backlogs remained below the neutral point of 50. Supplier deliveries lengthened to its highest level since May and lead times were longest in 12 months. The inventory index was just above 50 with firms evenly split on whether they were increasing or decreasing inventories.

The prices paid index rose slightly in September after falling for the four previous months. The rise indicated a possible increase in supply chain inflationary pressures.

Employment was the only component of the index to fall in September after reaching a 16 month high in August.

Firms were asked whether the presidential elections were having an impact on business and 79 percent said the effects were negligible.

“Economic growth in the US appears to have picked up a little at the end of the third quarter and although the Employment component fell, this was on the back of a relatively strong showing in the previous month. Note Employment usually lags changes in orders and output, so it was not that surprising to see this component weakening in September,” said Lorena Castellanos, senior economist at MNI Indicators.

About the Chicago Business Barometer

The Chicago Business Barometer, produced monthly by ISM and MNI Indicators, is a closely watched leading indicator of U.S. economic activity and is based on a survey panel of purchasing/supply chain professionals, primarily drawn from membership of the Institute for Supply Management-Chicago (ISM-Chicago). The survey panel contains both manufacturing and non-manufacturing firms, many with global operations. A reading above 50 indicates expansion, and below 50 indicates contraction.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.