Prices

September 29, 2016

Hot Rolled Futures: Calm Before the Storm

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

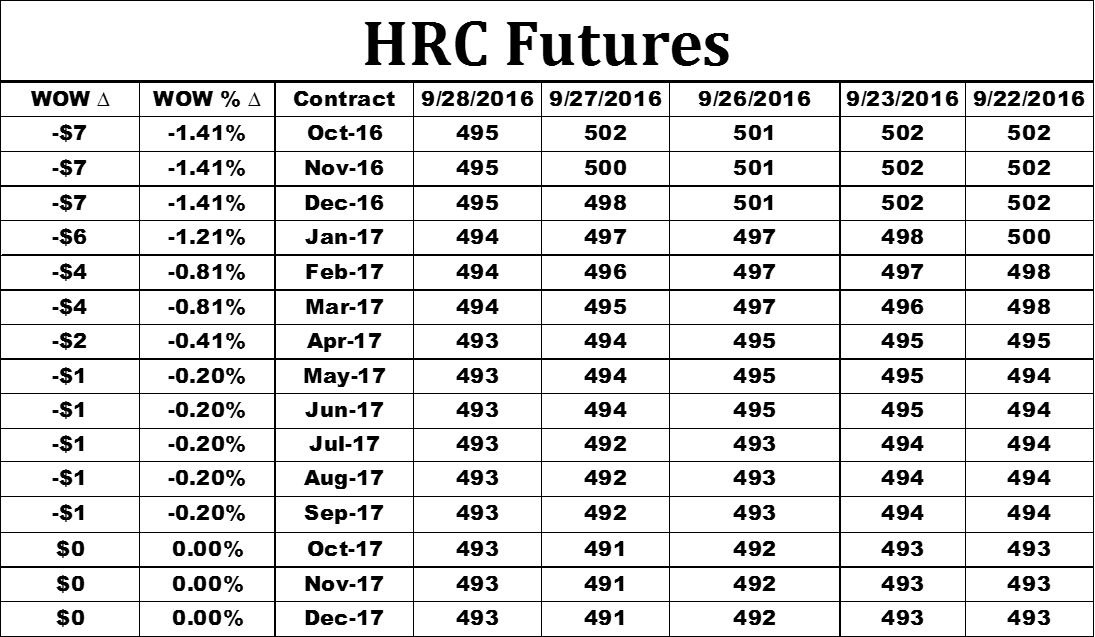

The flat US Midwest HRC futures curves drifted slightly lower, settling last night around $495/st. The futures market traded lightly last week with buyers few and far between. Only 7,840 tons traded between 9/22 and 9/28. Open interest stands at 344,800 short tons.

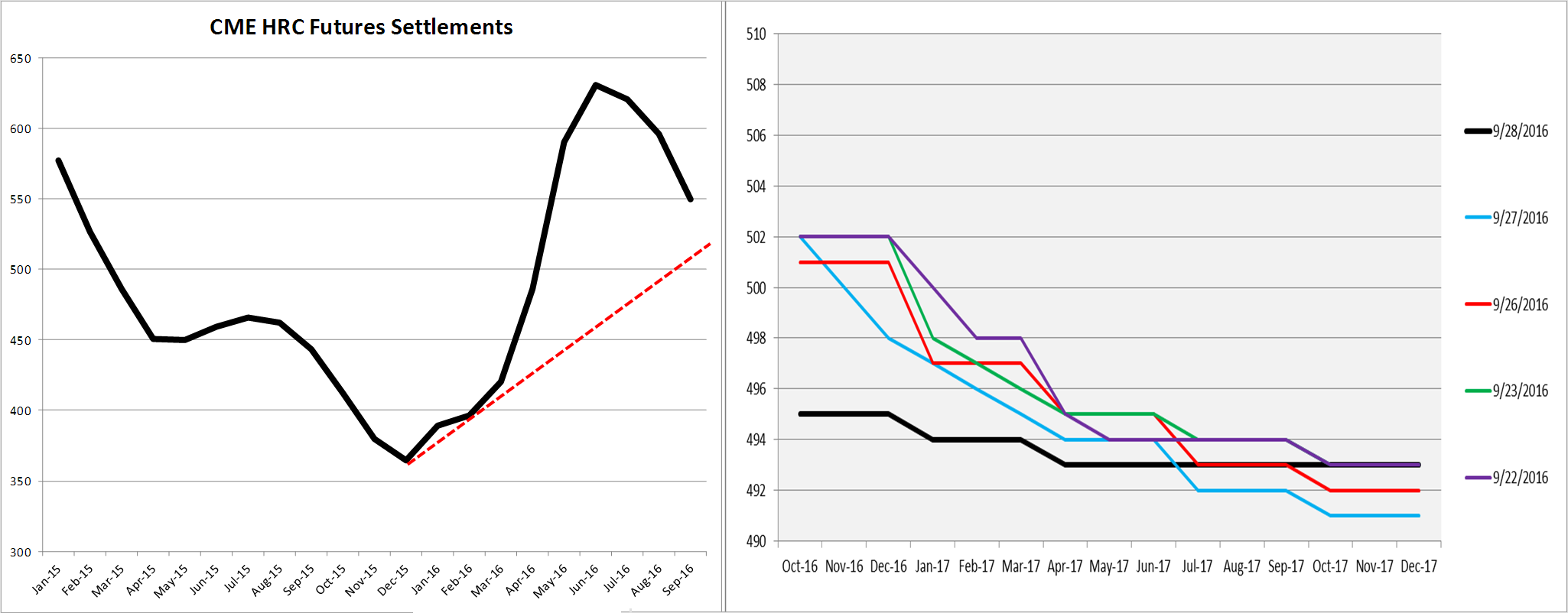

The HRC futures market is mired in low volatility. The announcements of the most recent trade case against Vietnam/China, recapitalization of Essar Algoma and OPEC’s production cut have failed to spark any movement in the curve. However, as you can see in the left chart above, while the curve periodically flattens, it’s like a spring coil waiting to pop. HRC futures are one of the most volatile commodities on earth and tend to trend for many weeks at a time. Looking at the HRC futures settlements above, the uptrend from the bottom in November, 2015 is being approached and, if broken through, could be an indication of another continued move lower as seen in 2015.

In other news, Worthington Industries announced better than expected earnings yesterday that included a $4m hedging gain. Clearly, HRC futures greatly helped their business weather this year’s crazy market. Is your business using futures to help mitigate risk?