Market Data

September 29, 2016

Consumer Confidence in September 2016

Written by Peter Wright

The source of this data is the Conference Board with analysis by Steel Market Update. Please see the end of this piece for an explanation of the indicator.

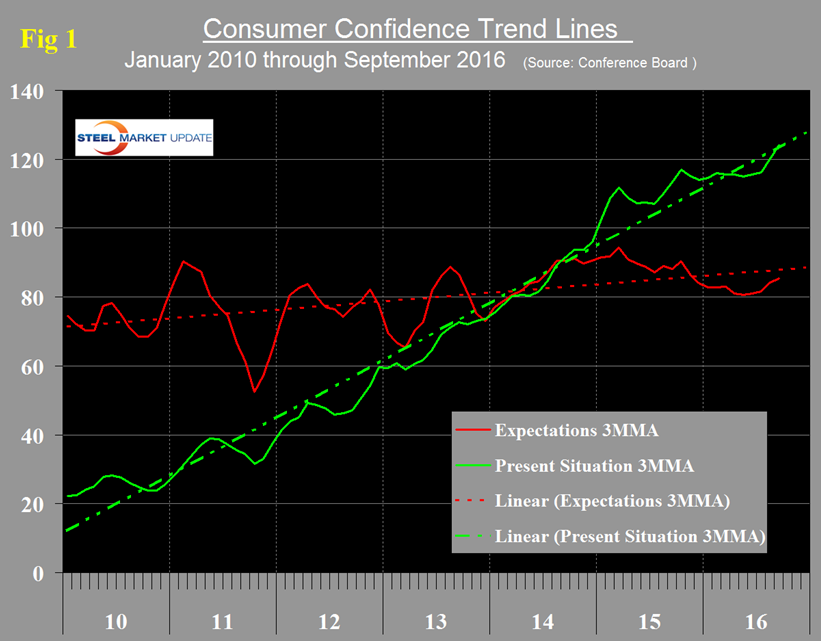

Consumer Confidence jumped from 92.4 in May, its lowest value since July last year, to 101.1 in August, then to 104.1 in September, it’s highest value since August 2007. Included below is the official news release from the Conference Board. The three month moving average (3MMA) has risen from 94.4 in May to 100.9 in September. We prefer to smooth the data in this way because of monthly volatility which in the case of consumer confidence has been quite extreme since the beginning of last year. The composite index is made up of two sub-indexes. These are the consumer’s view of the present situation and his / her expectations for the future. The 3MMA of the present situation is now back to its six year trend and expectations are close and closing (Figure 1).

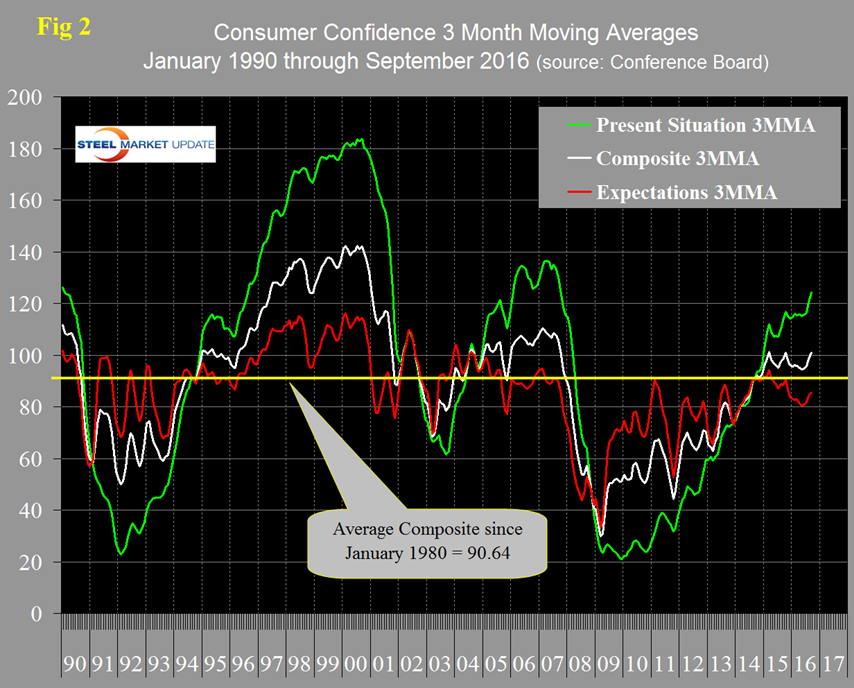

The historical pattern of the 3MMA of the composite, the view of the present situation and expectations are shown in Figure 2.

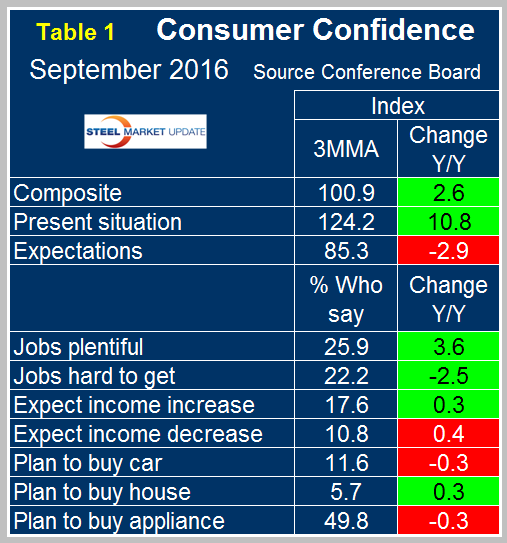

The progression of the 3MMA of the composite was positive throughout 2014 into early 2015 and has been fairly flat since then. Since January last year the improvement in the present situation has been countered by the deterioration in consumer expectations but in this latest result expectations also improved. Comparing September 2016 with September 2015 (y/y) the 3MMA of the composite was up by 2.6, the present situation was up by 10.8 and expectations were down by 2.9 (Table 1).

We have only been tracking the employment components of consumer confidence since August 2011 in which time both of the job availability components have consistently improved. Expectations for wage increases have not been as consistent. August and September were the first months since February that there was an expectation of a wage increase on a 3MMA basis. Plans to buy homes have been positive year-over-year in 14 of the last 16 months. Plans to buy appliances have been negative each month in July through September. Plans to buy a car have been erratic for the last two years and deteriorated slightly in September.

SMU Comment: Consumer confidence is positively correlated with personal consumption which accounts for about 2/3 of GDP. Ultimately the growth of GDP positively drives steel consumption therefore the overall September improvement is welcome.

The official news release from the Conference Board reads as follows and is entirely based on monthly changes. This is a highly regarded indicator which we believe needs to be examined in a longer time context to get the real picture which is why we only consider three month moving averages and focus our comments on year over year results.

The Conference Board Consumer Confidence Index Increased in September

The Conference Board Consumer Confidence Index, which had increased in August, improved further in September. The Index now stands at 104.1 (1985=100), up from 101.8 in August. The Present Situation Index rose from 125.3 to 128.5, while the Expectations Index improved from 86.1 last month to 87.8.

“Consumer confidence increased in September for a second consecutive month and is now at its highest level since the recession,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of present-day conditions improved, primarily the result of a more positive view of the labor market. Looking ahead, consumers are more upbeat about the short-term employment outlook, but somewhat neutral about business conditions and income prospects. Overall, consumers continue to rate current conditions favorably and foresee moderate economic expansion in the months ahead.”

The cutoff date for the preliminary results was September 15.

Consumers’ assessment of current conditions improved in September. Those stating business conditions are “good” decreased from 30.3 percent to 27.4 percent. However, those saying business conditions are “bad” declined from 18.2 percent to 16.2 percent. Consumers’ appraisal of the labor market was more positive than last month. Those stating jobs were “plentiful” increased from 26.8 percent to 27.9 percent, while those claiming jobs are “hard to get” declined from 22.8 percent to 21.6 percent.

Consumers’ optimism regarding the short-term outlook was more favorable in September. The percentage of consumers expecting business conditions to improve over the next six months decreased from 17.6 percent to 16.5 percent. However, those expecting business conditions to worsen also declined from 11.4 percent to 10.2 percent.

Consumers’ outlook for the labor market was more upbeat than in August. The proportion expecting more jobs in the months ahead increased from 14.4 percent to 15.1 percent, while those anticipating fewer jobs declined from 17.5 percent to 17.0 percent. The percentage of consumers expecting their incomes to increase declined from 18.5 percent to 17.1 percent. However, the proportion expecting a decline decreased from 11.0 percent to 10.3 percent.

About The Conference Board

The Conference Board is a global, independent business membership and research association working in the public interest. Our mission is unique: To provide the world’s leading organizations with the practical knowledge they need to improve their performance and better serve society. The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months. The Conference Board is a non-advocacy, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org.