Prices

September 27, 2016

SMU Price Ranges & Indices: Buyers Waiting

Written by John Packard

The number of active steel buyers has definitely slowed over the past few weeks. Buyers are holding back as business has slowed for some, inventory levels are OK (and in some situations rising) and lead times are pulling back making the need to buy less urgent. When taking into consideration lead times, we are also coming up on the end of the year inventory adjustments that need to be made in states where there is a tax due at the end of the year.

One service center steel buyer told us today, “Lead times are short and don’t seem to be any signs of going out. I think that the problem is that with 4th quarter indexed pricing going up (the ones using 3rd quarter CRU Monitor average to set 4Q) – a lot of people will continue to minimize inventory and hold their breath until they can buy 1st quarter contract at much lower numbers…” The bottom line is buyers appear willing to wait, the steel mills are willing to negotiate and the net result is slowly sliding flat rolled steel prices.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $500-$540 per ton ($25.00/cwt- $27.00/cwt) with an average of $520 per ton ($26.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end decreased $10 per ton. Our overall average is down $5 over last week. Our price momentum on hot rolled steel is for prices to trend lower over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $710-$760 per ton ($35.50/cwt- $38.00/cwt) with an average of $735 per ton ($36.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to last week while the upper end decreased $20 per ton. Our overall average is down $25 over one week ago. Our price momentum on cold rolled steel is for prices to trend lower over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU Base Price Range is $35.50/cwt-$37.50/cwt ($710-$750 per ton) with an average of $36.50/cwt ($730 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago while the upper end decreased $30 per ton. Our overall average is down $20 over last week. Our price momentum on galvanized steel is for prices to trend lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $770-$810 per net ton with an average of $790 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 2-8 weeks

Galvalume Coil: SMU Base Price Range is $36.75/cwt-$38.00/cwt ($735-$760 per ton) with an average of $37.375/cwt ($747.50 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end decreased $20 per ton. Our overall average is down $10 over one week ago. Our price momentum on Galvalume steel is for prices to trend lower over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1026-$1051 per net ton with an average of $1038.50 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

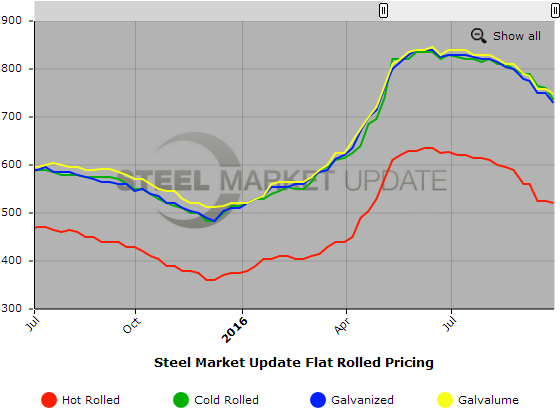

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.