Market Data

September 25, 2016

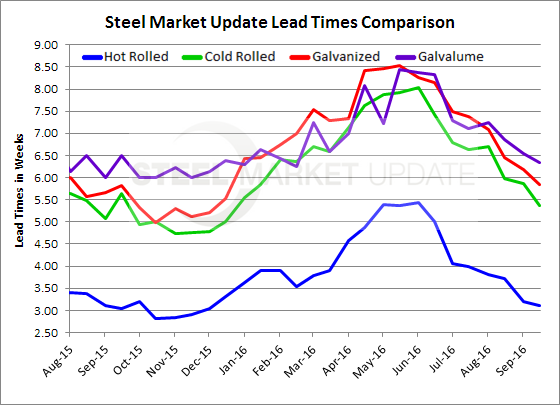

Steel Mill Lead Times Essentially Same as One Year Ago

Written by John Packard

Flat rolled lead times continued to slip, according to those responding to last week’s Steel Market Update flat rolled market trends analysis survey. Lead times are very close to where they were at this time last year when benchmark hot rolled was being reported at $660 per ton (September 16, 2015) and then proceeded to drop to $360 per ton by the first week of December 2015.

Hot rolled lead times are averaging just slightly more than 3 weeks, down from just over 4 weeks at the beginning of July. One year ago HRC lead times averaged 3.04 weeks

Cold rolled lead times are averaging just shy 5.5 weeks (5.38) which is down from 6.79 weeks at the beginning of July and a little lower than the 5.65 weeks reported one year ago.

Galvanized lead times are now essentially exactly what we saw one year ago. Last week’s respondents pegged GI lead times as averaging 5.84 weeks one year ago the average was 5.83 weeks. At the beginning of July GI lead times were 7.50 weeks.

Galvalume, a more seasonal product than the other three, is averaging slightly less than 6.5 weeks (6.33 weeks), down from the 7.29 weeks reported at the beginning of July. One year ago AZ lead times were reported through our survey as being 6.50 weeks.

The shorter the lead times, the more pressure on the domestic mills to fill their order books. At the same time, the shorter the lead times, the less pressure there is on steel buyers to increase orders. We tend to see the domestic steel mills more willing to negotiate flat rolled steel prices as lead times shrink. We will address that issue in our next article in tonight’s newsletter.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents to SMU proprietary flat rolled steel market trends survey which we conduct twice per week. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions. The graphic above does not depict the lead times that may be quoted by any single mill. The data is an average of our respondents only (approximately 100 manufacturing and steel distributors/wholesalers).

To see an interactive history of our Steel Mill Negotiations data, visit our website here.