Market Data

September 25, 2016

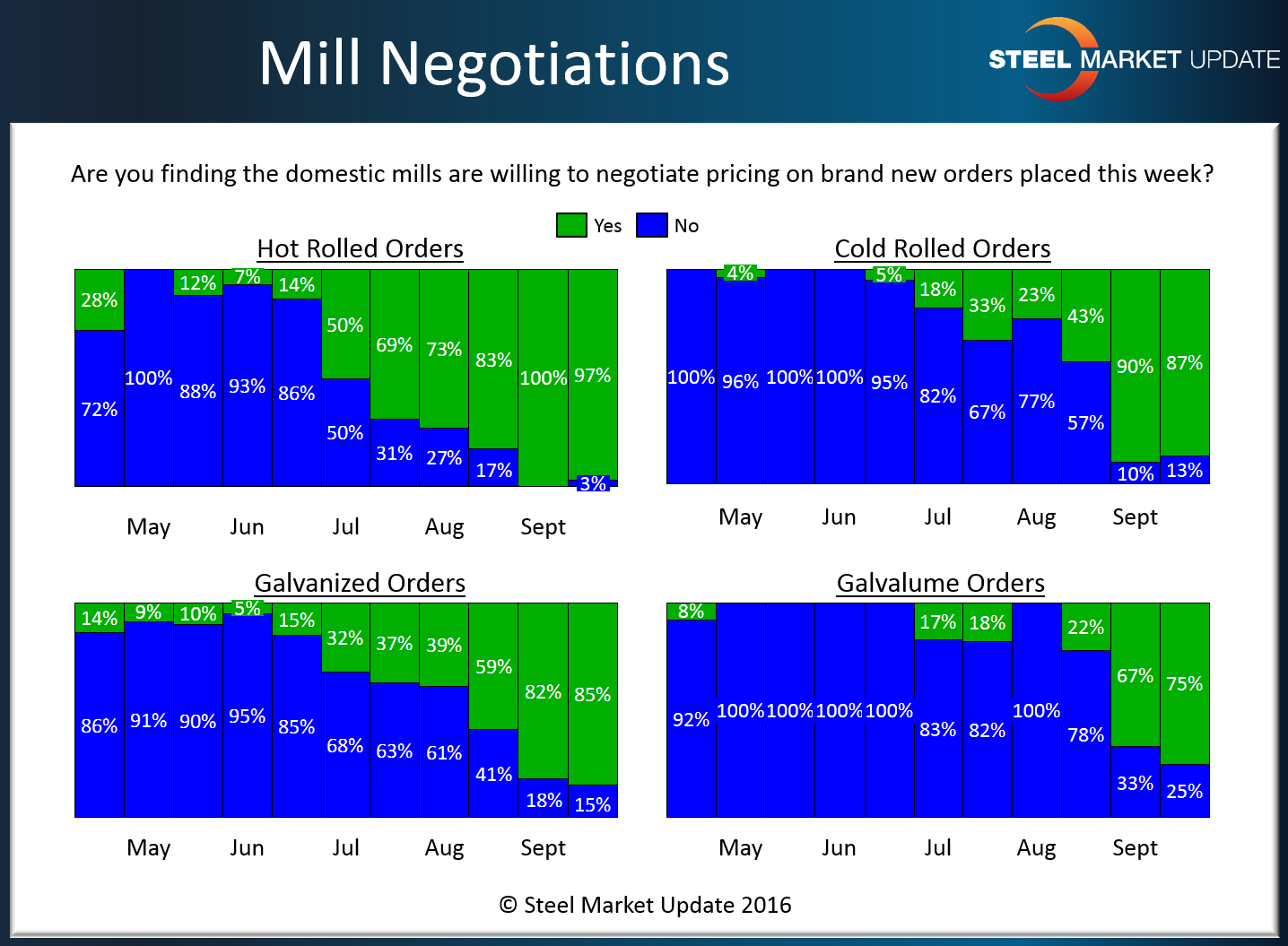

SMU Survey Says: Steel Mills Willing to Negotiate Spot Pricing

Written by John Packard

Spot steel prices are now negotiable on hot rolled, cold rolled, galvanized and Galvalume according to those responding to our mid-September 2016 flat rolled steel market trends survey.

Hot rolled continues to be (almost) unanimous with 97 percent of our respondents reporting spot prices are being negotiated by their mill suppliers. At the beginning of this month we reported 100 percent as saying prices were negotiable. The last time we were at 50 percent or less we have to go back to the beginning of July. As you can see by the graphic we have provided, it appears clear that the late June/early July timeframe was when the market began to change from a seller’s market to one being controlled by buyers.

Eighty-seven percent of those responding to last week’s survey on cold rolled advised that CR spot prices are now negotiable.

SMU is reporting 85 percent of those responding to our flat rolled survey as indicating hot-dipped galvanized spot pricing as being negotiable at the domestic steel mills (USA and Canada).

Galvalume has been the most resilient of the flat rolled products covered by SMU. We did not see a large jump in the responses advising that prices on AZ were negotiable until the beginning of September. We believe this could be due to the much smaller number of market respondents we have on Galvalume than on the other three flat rolled products. This past week 75 percent of those responding reported AZ spot prices as negotiable.

We believe that there is a relationship between lead times (which have been shrinking since early July on most products) and the willingness of the steel mills to negotiate their spot numbers.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.