Prices

September 25, 2016

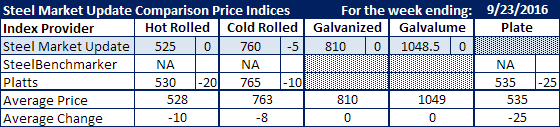

Comparison Price Indices: Catching Up

Written by John Packard

Two of the indexes followed by Steel Market Update (actually one index followed and our own) saw flat rolled steel market prices differently this past week. Our indices were relatively calm this past week having moved dramatically the previous week. Platts indices were all down by double digits and, in the case of hot rolled and cold rolled coil, came closer to parity with our indices.

SteelBenchmarker, another flat rolled price index followed by SMU, only produces prices twice per month and they did not produce prices last week.

Benchmark hot rolled coil was reported to be averaging $525 per ton by SMU and $530 per ton by Platts. In the SMU reporting of prices for the second week we advised of prices as low as $500 per ton ($25.00/cwt) and we have seen reports of prices below $500 per ton for large tonnage buys. Platts reported their average as being down $20 per ton from the prior week and now averages $530 per ton.

The cold rolled average was reported to be lower by both SMU and Platts this past week. SMU had CR down $5 to $760 per ton ($38.00/cwt base) while Platts had it down $10 to $765 per ton.

G90 galvanized (.060″ with a $60 per ton extra for zinc) was reported to be averaging $810 per ton or $37.50/cwt base.

Galvalume was reported by SMU as averaging $1048.50 per ton $52.43/cwt for .0142″ AZ50, Grade 80.

Platts had their plate prices as averaging $25 per ton lower than the week before last week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.