Analysis

September 22, 2016

US Vehicle Sales and NAFTA Vehicle Production in August 2016

Written by Peter Wright

Vehicles sales in the US are settling in to a more sustainable pace, but a strengthening labor market, low interest rates, low gasoline prices, and rising incentives are still supportive of strong demand.

Moody’s Analytics expects the pace of light vehicle sales to be above a seasonally adjusted annual rate (SAAR) of 17 million units through 2017. Light vehicle sales in August declined from the very strong July result of 17.9 million units (SAAR) to 17.0 million (Figure 1).

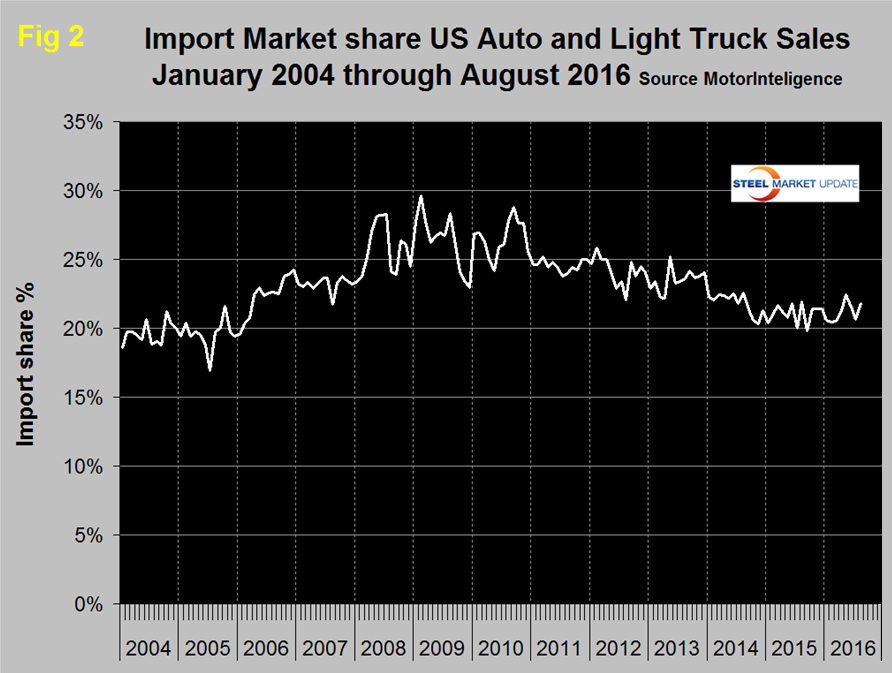

Autos declined from 7.1 to 6.8 million and light trucks declined from 10.8 to 10.2 million. The mix in August was exactly 60:40. Import market share rose from 20.7 in July to 21.8 percent in August. The average import share since January 2014 has been 21.4 percent (Figure 2).

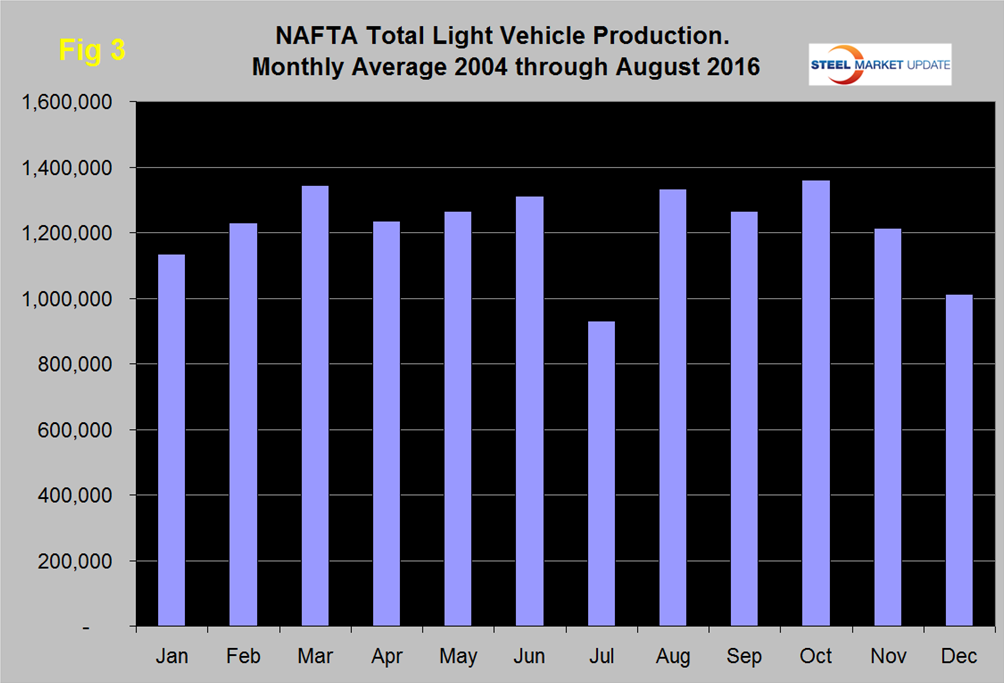

Total light vehicle (LV) production in NAFTA in August was at an annual rate, of 20.252 million units, up from 14.281 million in July. In cases where seasonality is more than a weather effect we like to compare the monthly result with the monthly norm over a number of years. On average since 2004, August’s production has been 43.3 percent higher than July when the auto companies take summer shutdowns for maintenance and re-tooling. This year production rose by 41.8 percent therefore was quite normal in the long term context (Figure 3).

We can expect September through November’s production to be similar to August. Remember that these production numbers are not seasonally adjusted, while the sales data reported above are seasonally adjusted.

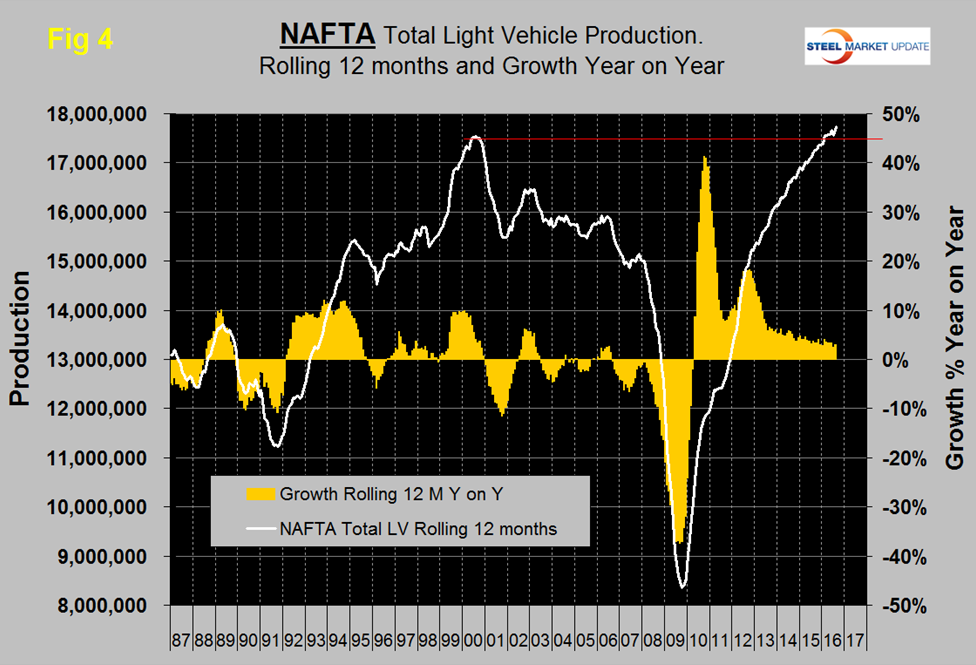

On a rolling 12 months basis y/y through August, LV production in NAFTA increased by 3.0 percent which was up from 2.4 percent in 12 months through July and is still consistent with the growth experienced in the last 12 months as indicated by the brown bars in Figure 4.

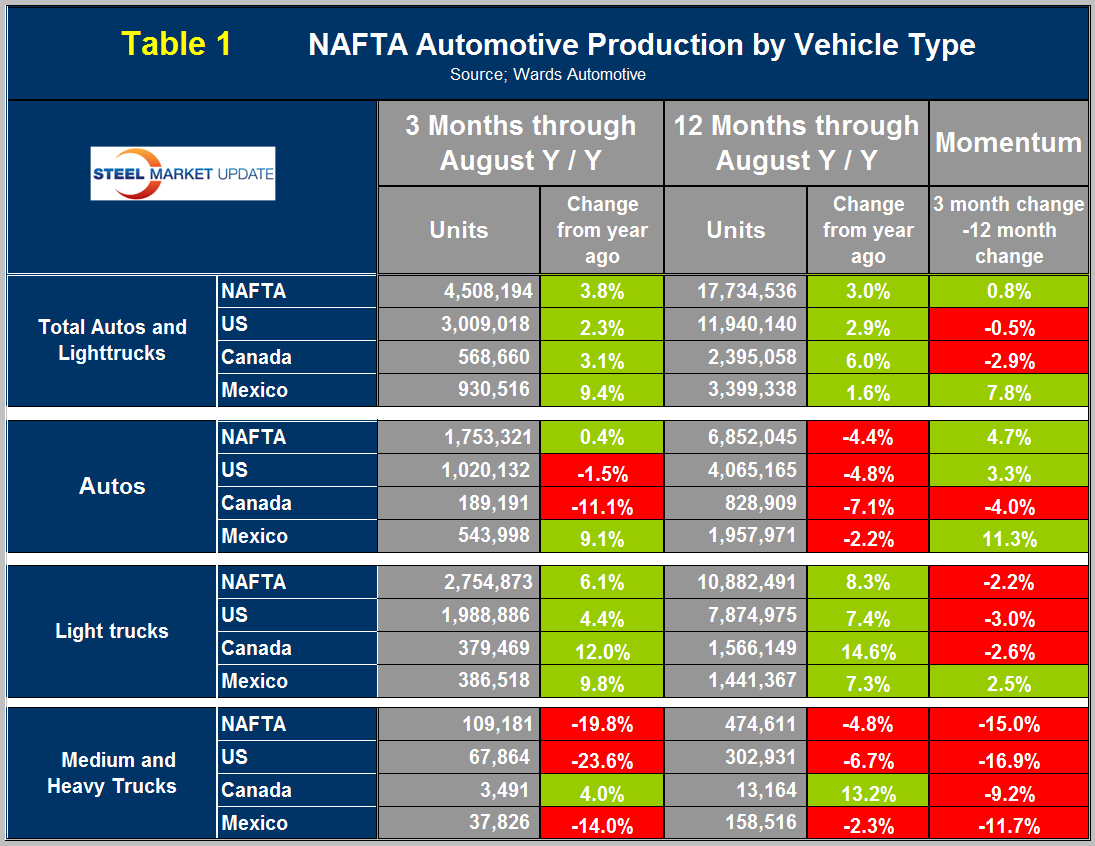

On this basis production has been at an all-time high every month in 2016. On a rolling 12 months basis y/y the US was up by 2.9 percent with negative momentum, Canada was up by 6.0 percent with negative momentum and Mexico was up by 1.6 percent with very positive momentum (Table 1).

July and August were the first months for Mexico to have positive momentum after fourteen straight months of slowdown. Canada experienced negative momentum in July and August following very strong momentum in the previous six months. On a rolling 3 months basis, Mexico has gained production share in the last four months at the expense of both the US and Canada (Figure 5).

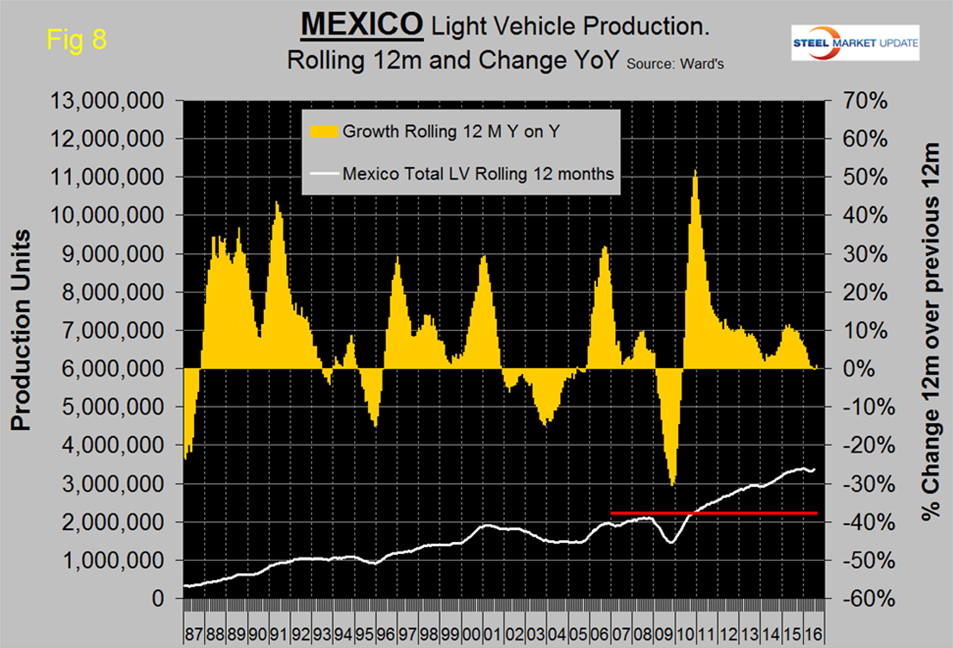

In August on a rolling three month basis, the US production share of total light vehicles was 66.7 percent, down from 69.0 in April, Canada’s was 12.6 percent, down from 14.9 percent in January and Mexico’s was 20.6 percent, up from 17.4 percent in April. July and August were the first months for Mexico to exceed 20 percent since August 2011. Production in Mexico in 2014 was 3.2 million units, in 2015 was 3.4 million units and YTD 2016 through August was 3.417 million units annualized. The Mexican production target for 2020 in 5.0 million units according to Eduardo Solis, president of the Mexican Automotive Industry Association.

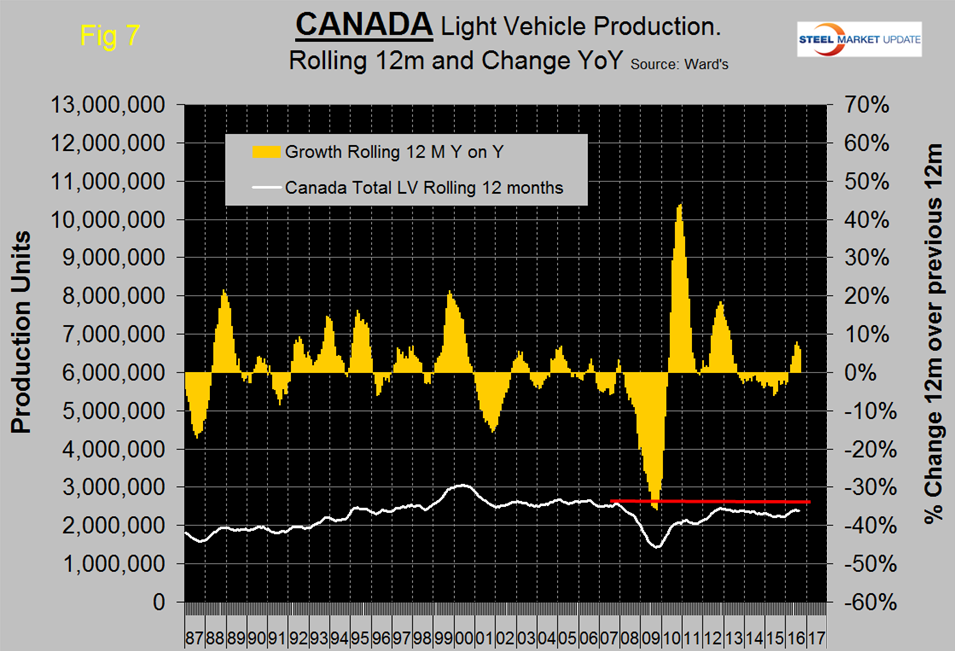

Figures 6, 7 and 8 show total LV production by country with y/y growth rates and on each the red line shows the change in production since Q2 2006.

Note the scales are the same to give true comparability and that Mexican growth has slowed significantly this year and on a rolling 12 months basis is the lowest in NAFTA. This statement seems to contradict what we wrote above about Mexico taking market share in the last four months. To understand this it is necessary to go back to Table 1 which shows that in the last 3 months y/y Mexico has had the highest growth at 9.4 percent whereas in the last 12 months y/y they have had the lowest rate. In other words Mexico is picking up the pace. Canada has had a growth surge in the last five months on a rolling 12 months basis. During the recession Mexico declined by less than the US and bounced back by more during the recovery. This caused Mexico’s production share to surge until Mid-2011 at the expense of the US.

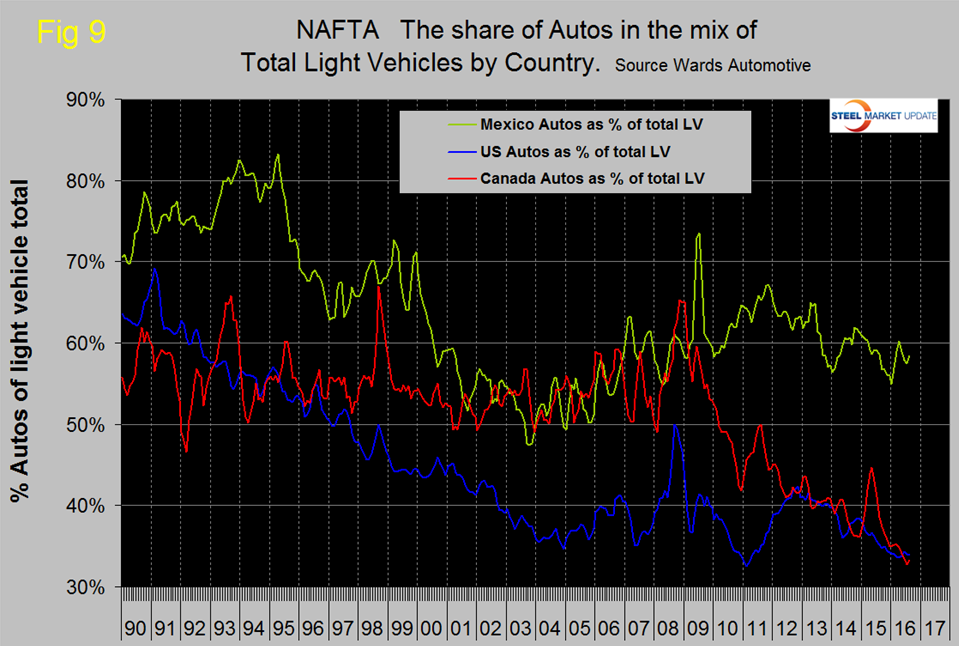

Figure 9 shows the percentage of autos in the light vehicle production of each country.

The percentage of autos in the production mix of all three countries has been declining since 2012, driven by consumer buying preferences which in turn are heavily influenced by gas prices. The change in preference for light trucks tends to favor the US and Canada over Mexico because the mix of light vehicle production capacity is so different by country. The percentage of autos in the Mexican mix in the last three months was 58.5 percent but only 33.9 in the US and 33.3 percent in Canada. This means that Mexico has staked out a higher relative capacity in autos which will serve it well when gas prices eventually rebound. The Detroit Free Press reported at the beginning of August that Fiat Chrysler Automotive will cease production of autos in the US in the first months of 2017. Their US plants will focus entirely on the production of pickup trucks and SUVs for the RAM and Jeep brands. The company will move production of the Dodge Dart and Chrysler 200 to Canada, Mexico and overseas.

Ward’s Automotive reported this week that total light vehicle inventories in the US were unchanged in August at 61 days which was 6 days more than August last year. Month over month FCA (Fiat Chrysler Automotive) was down by 7 days to 74, GM was up by 8 days also to 74 and Ford was down by 5 to 71 days.

The SMU data file contains more detail than be shown here in this condensed report. Readers can obtain copies of additional time based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck and medium and heavy truck production and growth rate and production share by country.